Recently Added Videos

Reviewing the Star Wars novel – Aftermath Life Debt

Like, comment, share & subscribe!!

Twitter – https://twitter.com/MyNameIsSimon88

Facebook – https://www.facebook.com/MyNameIsSimon88

Twitch – https://www.twitch.tv/mynameissimontwitch

Join our Discord community – https://discord.gg/c4XYNZb

Support me on Patreon and gain access to rewards! – https://www.patreon.com/mynameissimon – only donate if you can afford to!!

A special thanks to my Patreon supporters:

Lost&Found

Gaddocks (Erl)

Vanquish

Jonathon Morgan

—————————————-—————————————-———–

Copyright Disclaimer Under Section 107 of the

Copyright Act 1976, allowance is made for

“fair use” for purposes such as criticism,

comment, news reporting, teaching, scholarship,

and research. Fair use is a use permitted by

copyright statute that might otherwise be

infringing.

Banks wanting to foreclose on farmers will be forced to head to mediation first, under proposed new law. Agriculture Minister Damien O’Connor discussed the Farm Debt Mediation Bill with Lisa Owen.

Mohau Debt Counselling a division of Mohau holdings was founded in 2012 by Mohau Petrus Motaung. We have highly trained professionals who are committed to providing life changing assistance to over indebted individuals.

Q. I have a bad credit score. Can I get a debt consolidation loan?

A. Your credit score is a reflection of how you handle credit and debt. A bad credit score shows that you haven’t handled your credit accounts responsibly so a new creditor is unlikely to offer you a debt consolidation loan with a low interest rate.

Even though you may not qualify for a debt consolidation loan there is a way you can reduce your debt and save some money in the process.

It’s called debt negotiation also known as debt settlement. You can negotiate with the creditor or debt collector to settle your debt for less than what you owe. Of course, your lender will need to accept the settlement and agree to cancel the remainder of your debt. Most of them will agree to settle since they would get nothing if you decided to file for bankruptcy.

Plus, debt negotiation is not as severe a hit to your credit score as a bankruptcy filing.

If you don’t want to hassle negotiating with your creditors, you can hire a BBB accredited debt negotiation company to do it for you. Visit https://www.nationaldebtrelief.com to learn how to consolidate your credit card debt without bankruptcy.

Credit Counselling Services of Atlantic Canada, Inc. (CCSAC) offers help with credit card debt, budget counselling, debt repayment plans, financial education and more to help you on your way to financial freedom. If you’re looking for debt relief, we can help.

LOOK THROUGH MY BOOKS! http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

OTHER: http://themoneygps.com/donate

—————————————————————————————————

MY FAVORITE BOOKS: http://themoneygps.com/books

—————————————————————————————————

AUDIOBOOK: http://themoneygps.com/store

STEEMIT: https://steemit.com/@themoneygps

T-SHIRTS: http://merch.themoneygps.com

—————————————————————————————————

Sources Used in This Video:

https://goo.gl/YpU9nm

—————————————————————————————————

#money #economy #debt

http://www.alabamaconsumer.com/2014/09/5-options-sued-debt-collector-alabama/

This is the video discussing the second option — fighting the lawsuit on your own — when you have been sued by a debt collector or debt buyer in Alabama.

The five options you have are:

1. Bankruptcy

2. Fight the case on your own

3. Settle the case on your own

4. Hire a lawyer to fight the case

5. Hire a lawyer to settle the case

Each option has advantages and disadvantages (particularly bankruptcy which we rarely recommend).

When looking at fighting the case on your own (also called being “pro se”), the main advantage is there is no lawyer fee.

The main disadvantage is you don’t have a lawyer.

Typically if you have been sued in Circuit Court you don’t want to choose this option as the level of complexity can be too much to handle on your own.

But if you are sued in District or Small Claims court, and you are willing to spend time instead of spending money, then this may be a good choice for you.

We’ll be glad to help you think through your options.

If you have questions about your options when sued in Alabama, please feel free to get in touch with us by calling us at 205-879-2447 or contacting us through our website AlabamaConsumer.com.

John G. Watts

Watts & Herring, LLC

Birmingham, Alabama

No representation is made that the quality of legal services to be performed is greater than the quality of legal services performed by other lawyers.

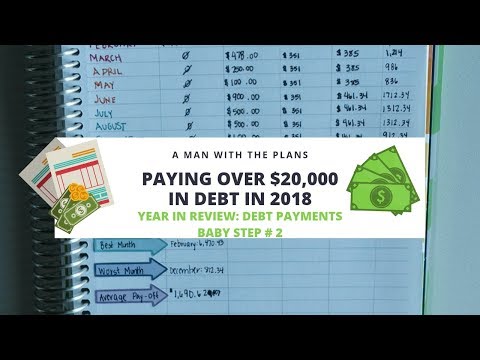

As I’m closing out my 2018 Year in Review, I wanted to take a look at home much money I put to debt this entire year. I went through each of my current debts from 2018 (4 in total: 1 credit card, 2 student loans and 1 car loan) and looked at how much I paid. These payments are both principal and interest, but it’s crazy how much I did this year and how much room for improvement I still have on my debt free journey. What are you doing in 2019 to tighten your budget to hit your financial goals?

Links for products used down below! (Note: some may be affiliate links!)

Connect with me!

AManWithThePlans on Instagram

A Man with the Plans on Facebook

www.amanwiththeplans.com

Looking to make your first EC purchase? Use my code below to get a $10 coupon code emailed to you! Lucky for me, I’ll also get a $10 off coupon code (at no cost to you), so that I can keep sharing all of my favorite goodies! Thanks!

Erin Condren Colorful Hourly Life Planner:

https://www.erincondren.com/referral/invite/ryanselock0323/1

Dave Ramseys: Total Money Makeover:

https://amzn.to/2J78Nwr

Capital One 360 (Interest Bearing Checking Accounts!):

https://capital.one/2KRdg7b

The Miracle Morning by Hal Elrod

https://amzn.to/2xpmUYk

Papermate Flair

https://amzn.to/2NmJoUV

Camera I use: Canon G7X:

https://amzn.to/2Pc2U7j

SWAG Bucks (Take Surveys to Earn Gift Cards):

http://www.swagbucks.com/p/register?rb=47837497

2018-05-16 – Farm Debt Mediation Bill – First Reading – Video 9

Kieran McAnulty

Help us caption & translate this video!

https://amara.org/v/i4xU/

When a consumer (client) realizes that he/she is over indebted and that some arrangements

have to be made to make sure all monthly repayments are met.

2. The consumer contacts a registered Debt Counsellor who supplies a regulated form 16 and

assists with the completion thereof. As soon as this form is completed the consumer will have

formally applied for debt review in terms of the Act.

3. All requested documentation as on the application form is supplied by the consumer within 5

days of signing the form 16.

4. With the information and supporting documents supplied by the consumer the debt counsellor

now informs all the known creditors of the consumer that the said consumer has applied for

debt review. This is done with the regulated form 17.1 as well as 17.2

5. A formal analysis is done by the Debt counsellor to determine if the consumer is indeed over

indebted. This is a very simple calculation once all information has been taken into account. A

consumer can only apply for debt counselling if his/her monthly disbursable amount (Nett

income minus living expenses) is LESS than the amount required to service all obligations.

AS EXAMPLE ONLY. If the consumer only has R5000 to pay his/her debt after the living

expenses have been accounted for, and the total monthly debt repayments are R6000 the

application would be a success.

6. If the consumer is indeed over indebted according to the above method all creditors would be

informed of this for their record.

7. The restructuring process can now begin. The Debt counsellor will now restructure and

renegotiate all credit agreements and present these proposed terms to all creditors. This new

proposal will then restructure the consumer’s monthly commitments to be more affordable

and ensure that all credit agreements get something every month.

8. The new proposal will now be sent out to all the creditors after it has been approved by the

consumer. Should all creditors agree to a consent order that new arrangement will be made

an order of court. If there are some creditors who don’t agree to the restructuring a court date

will be allocated for the matter to be heard. At this hearing the magistrate will have no choice

to grant the order if the debt counsellor acted in terms of the Act and subsequently

restructured the debt accordingly.

9. A Very important consideration when applying for debt counselling will be who handles your

money! Debt counsellors are not allowed to handle any money from consumers except for the

application fee along with the retainer for early cancellation.

10. All disbursements of contributions will be handled by a registered Payment Distribution

Agency (PDA). The PDA is regulated and governed by the Act. As soon as a restructuring

proposal is agreed on by the consumer payments of the distribution amount will be paid over

from the consumer directly to the PDA. The PDA in turn will disburse with the funds as per the

restructuring proposals.

11. The Fee structure:

Debt counsellors are entitled to a maximum of R 6000 plus VAT for single applications and R

6000 plus VAT for a joint application.

The Act allows for the following payment of Debt counsellor fees as well as Legal fees.

The first payment made by the PDA will pay the debt counsellors fee

The second payment will pay the legal fees

The third payment will be the first payment that creditors receive. This is done so that

consumers don’t have to pay any money that they might not have up front, and to make the

process affordable.

12. When the payments are being made to the creditors by the PDA there will be some

agreements that will be paid up before others. As soon as this happens the Debt counsellor

must restructure the payments again to make sure any creditor is not paid more than he must

receive and to disburse the surplus equally between the other to ensure that the process runs

smoothly. For this the Debt counsellor is entitled to a 5% after care fee not exceeding R300.

13. As soon as all debt has been cleared the debt counsellor will release the consumer from debt

review and issue him/her with a clearance certificate. All records will also be removed from

the credit bureaus

14. Should a consumer’s situation change for the better and they are in a position to repay all

monthly obligations as they were before the restructuring they will be allowed to be release

from debt counselling. Although nothing is binding, any consumer can leave the process at

any time for any reason