Top Rated Videos

Hi! Today’s video is a debt review for June 2020! In this video, I will show you our debt totals for the month and our progress relative to the beginning of the year. ?

Hope you enjoy the video!!

Answers to your burning questions:

What planner do I use for my budget?

• Erin Condren – https://www.erincondren.com/referral/invite/brendacline/1

What pens do I use?

• TUL pens & Pilot G-2 07

What camera do I use to film?

• Samsung Galaxy S7 Edge

What free editing software do I use?

• Olive – https://www.olivevideoeditor.org/

What program do I use for my intro, outro, & thumbnails?

• Canva – https://www.canva.com/join/asking-backdrop-malaga

What color nail polish do I have on?

• Paper Snow by LightsLaquer – https://lightslacquer.com/products/paper-snow

• Who Loves Orange Soda? by LightsLaquer – https://lightslacquer.com/products/who-loves-orange-soda

• Gemini by KL Polish – no longer available

• Aries by KL Polish – no longer available

DISCLAIMER: The links included in this description might be affiliate/referral links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for your support!

As of June this year, our public debt was 6.6 trillion shillings. Each Kenyan citizen, including those born now, owes creditors at least 139,000 shillings due to public debt.

So what does it mean when the government keeps getting loans?

Is Kenya on the verge of a debt distress?

Our latest feature, #KenyasDebtCycle digs deep into these questions seeking answers and highlighting how the appetite for foreign debt to finance infrastructure has devastated various sectors in the country.

Watch, share and engage us on our social media pages:

Twitter: https://twitter.com/AfUncensored

Facebook: https://www.facebook.com/AfUncensored

Instagram: https://www.instagram.com/afuncensored/

Visit our website https://africauncensored.online/ for more.

This is my debt update for December 2020 and a review on my progress in in the year of 2020. I started my first job in March 2020 and started paying off debt in May 2020. Making this video and reflecting on my progress this past year has relit my motivation to pay off debt in 2021.

Please like, leave a comment, and subscribe if you enjoyed this video and would like to follow my debt free journey.

————-

Things I Use:

Highlighters: https://amzn.to/3d63I4V

Pilot G2 (0.38mm): https://amzn.to/2YsAdoq

Tombow white out: https://amzn.to/385X39W

ParKoo Erasable Gel Pens: https://amzn.to/3hsaXHq

Title/End screens: https://amzn.to/37CRoYN, https://amzn.to/2zzlJe8

Camera mount: https://amzn.to/37tCK64

Filming Lamp: https://amzn.to/2NGT4Hj

Filming: iPhone XS Max

Referrals:

Erin Condren – $10 off your first purchase: https://bit.ly/3fRJ3Ut

Rakuten – $10 cash back when you spend $25: https://bit.ly/2LxXRK5

Plum Paper Planner – send an email to avabudgets@gmail.com and I can send a link to save 10% off your first purchase

Life Sciences | Gr12 | Mediation of Life Sciences Examination Guideline | FSDOE | FS IBP Online | 14062021

Un empresario estadounidense se debate entre ayudar a un niño peruano en situación de pobreza y ayudar al director ejecutivo de su empresa a conseguir más tierras.

? Vea más películas completas aquí ? https://www.youtube.com/playlist?list=PLgALNYLXbHkvj3CNPzOz3Yg_1A6BOgLio

?? Síganos en Facebook ? https://www.facebook.com/100558765517601

?? Género : Película en Espanol, Subtitulada en Español y Inglés, Suspenso, Drama

© 2021 – Todos los derechos reservados. #PeliculaCompleta #PeliculaCompletaLATAM

There is a lot of fake news about debt counselling filled with promises of payment holidays and savings.

Don’t believe the hype! If you’re struggling to repay your debts, speak to your bank first before going to a debt counsellor.

Find out more at ncr.org or on our website: http://bit.ly/3v4x1jD

Do you have money worries related to #gambling?

95% of people felt more in control of their finances after working with Gambler’s Help.*

Find out more about our free & confidential financial counselling available in partnership with Latrobe Community Health Service: https://gamblershelp.com.au/get-help/find-support/#financial-counselling

FOLLOW US ON SOCIAL MEDIA:

Twitter – https://twitter.com/vicrgf

Facebook – https://bit.ly/2GSvpT3

LinkedIn – https://www.linkedin.com/company/4858944

Instagram – https://www.instagram.com/vicrgf/

NEED HELP?

If you feel uneasy about your own or someone else’s gambling, you can find free and confidential support at https://gamblershelp.com.au

Contact us – Click here for free advice

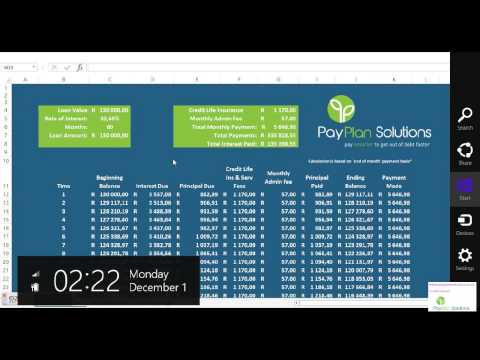

www.payplansolutions.co.za

If you’ve ever been caught in cash crunch you know how hard it can be to dig yourself out of trouble. Debts take over your life, bills pile up and then the phone starts to ring as collection agencies circle overhead. No one wants to be in this position, but there is a way out with the help of non-profit credit cousellors. They can really make a difference. They will teach you how to budget, provide basic credit counselling and talk you through your options in terms of negotiating with your creditors.

Basic services like counselling and debt management workshops are low cost—or in some cases no cost—and the money they can save you is more than worth your time. The hardest part is asking for help. Bruce Sellery walks you through the different services available and explains how they work.

Links to some non-profit credit counseling agencies

Credit Counselling Society — www.nomoredebts.org

Credit Canada — www.creditcanada.com

Consolidated Credit — www.consolidatedcredit.ca

Money Mentors — www.moneymentors.ca

Farm Debt Mediation in NSW — A few problems

by ALEX ELLIOTT on 05/05/2012 · LEAVE A COMMENT · in MEDIATION

The object of the NSW Farm Debt Mediation Act 1994 is to provide for the efficient and equitable resolution of farm debt disputes. Mediation is required before a bank or financial institution can take possession of the farm or other farm property.

Section 10 of the Act provides that once a farmer gives notification that mediation is required, the bank or financial institution cannot take any enforcement action unless a certificate is in force under section 11.

Section 11 of the Act stipulates that a certificate will be issued by the Authority (NSW Rural Assistance Authority), if the Authority is satisfied that a satisfactory mediation has taken place in respect of the farm debt involved.

Mediation is a structured process in which the mediator, who must be a neutral and independent person, assists the farmer and the bank or financial institution to reach an agreement. That agreement may mean the capitalisation of interest, the extension of repayments, additional advances or increasing an overdraft limit. It may also mean the sale of certain assets over time. There are many possible settlement outcomes available to the parties.

The High Court of Australia in its decision in Waller v Hargraves Secured Investments Limited [2012] HCA 4 has added a substantial complication to the mediation process and any possible settlement.

In August 2003, Hargraves Secured Investment Limited advanced $450,000 to Ms Waller under a loan agreement. The advance was secured by a mortgage over Ms Waller’s farm. She defaulted on the loan.

Mediation was held under the provisions of the Farm Debt Mediation Act 1994. The parties entered into terms of settlement under which there was a second loan agreement for $640,000. This enabled the first loan to be paid out, along with past and future interest.

Ms Waller defaulted on the second loan.

Hargraves Secured Investment Limited commenced action in court for possession of the farm and judgment against Ms Waller.

Ms Waller appealed to the High Court from a decision of the NSW Court Appeal. The argument which was accepted by the High Court was that the enforcement proceedings were not in relation to the farm debt the subject of the mediation. There was now a new and different debt, which was distinct from the first loan. Hargraves Secured Investment Limited had not complied with the Act because the mediation only dealt with the first loan, not the new one.

So it seems that even if a section 11 certificate has been obtained in respect of a farm mortgage, a bank or financial institution must be careful that the farm debt it relates to is the same and has not been discharged in anyway prior to enforcement action. If in doubt it seems that a new notice to the farmer may have to be given.

The High Court’s decision may discourage future lending to farmers because of the uncertainty surrounding this decision. The bank or financial institution may play it safe and only offer in mediation the option of refinancing with another institution, selling the asset or agreeing to surrender the asset to the bank or financial institution. Anything else may complicate future enforcement proceedings.

This is clearly not in the interests of the rural community and the Act needs to be amended as a matter of urgency. A full range of options should be available to comply with the spirit of the legislation.

Alex Elliott