[Free] Videos

Getting Your FREE Bonus

Download this book, read it to the end and see “BONUS: Your FREE Gift” chapter after the conclusion.

Motorhome Living for Beginners: (FREE Bonus Included)

50 Best Effective Life Hacks For Full Time RVing

This book runs the gauntlet when it comes to motor home living. Teaching you exactly what you need to know to start your own exciting life of freedom on the road with a motor home! If you enjoy the concept of camping but are not quite ready to just throw a sleeping bag down on the ground in the wild blue yonder, then a motor home is a good choice for you.

Motor Home’s or as they are sometimes called, “Recreational Vehicles” are the perfect combination of comfort and adventure when it comes to life on the road. With a Motor Home the whole world becomes conveniently within your reach for the fraction of the cost of other methods of sight seeing. This book goes to great length to discuss everything that you need to know in order to have a great time on the road!

How to maintain motor homes The rules and regulations of motor homes The best advice during your trip How to maximize storage space How to reduce expenses

Download your E book “Motorhome Living for Beginners: 50 Best Effective Life Hacks For Full Time RVing” by scrolling up and clicking “Buy Now with 1-Click” button!

Debt is a monkey none of us want on our backs. When we have debt we tend to have issues sleeping, eating and doing things in or lives that we want to do or have dreamed of doing for years. When we have debt we limit ourselves and our futures. In this book we will talk about credit and how you can get it. We will then move on to fifteen powerful tips and tricks that are generally overlooked when it comes to cleaning up your debt and building up good strong habits to live debt free. From there we will talk about ways to manage your life so that you don’t have to use credit as much. Learning to live without credit is a powerful way to stay debt free as well as having the ability to use your credit when it is really needed. So if you find yourself in a situation where you are getting deeper and deeper in debt and are looking for a way out or if you are someone young and getting ready to establish credit for the first time and need some advice on how to keep your debt under control before it even begins then this is the book for you. So without delay download this book today and master the art of getting and staying debt free.

Contents of the Book:

Chapter 1 – Understanding Debt and CreditChapter 2 – 15 Credit TipsChapter 3 – Management SkillsAnd much, much more

Getting Your FREE Bonus

Read this book to the end and see “BONUS: Your FREE Gift” chapter after the introduction and conclusion.

Is there a debt cloud looming over your head? Do you feel like you’re drowning?… ** The secret to getting our of debt, creating wealth and retaining it is: Better Money Management ** This Debt Free Forever Guide provides you with the essential knowledge you need to be able to manage you money better to provide you with a wealthy and prosperous future! The problem these days is that our costs keep going up and as hard as we try we just can’t get our income to increase proportionately. Combine that with the happy-to-spend-on-credit culture we live in and things can go from bad to worse as we see our debts mount up and our will-power fade. Debt can be a constant burden on our shoulders causing us severe financial and mental stress. The solution to escaping debt and growing your level of wealth essentially, boils down to three things: 1) Better Money Management Strategies; 2) A Wealthy Mindset; 3) Dedication & Persistence If you combine these three principles you will give yourself the opportunity to escape poverty and say goodbye to your debt burden forever. You will begin to grow your wealth sensibly and with purpose and as a result your life will be less stressful and full of abundance and choice. The Benefits of Reducing your Debts include: More disposable income Better interest rates when applying for credit Less money wasted servicing your debt Less worry & stress You can build you wealth You can create an emergency fund You can invest money for long term wealth creation

This Book is FREE – for Kindle Unlimited Users !

Have you ever flipped out looking at your house bills?

Have you simply longed for a more adventurous life but couldn’t take that first step?

This guide can be that first step for you! Take the leap today, your future self will thank you when you’re living free, low overhead on the open road, enjoying life like it was intended. But don’t just get out there before educating yourself.

RV Living is becoming more and more popular these days and with the economy slashing our backs with living expenses, it’s becoming one of the smartest choices. Not only do you live free and independent, but you get to choose where you live! And it doesn’t have to be in one place either, that’s the benefit of RV & motorhome living.

In this in-depth guide to the art of living in a motorhome, you will find everything you need to know. From making up your mind and choosing the perfect RV, to ways you can and should boondock with your RV.

Here’s a preview of what’s inside…

The Lifestyle Choice

RV Selection

Plan for an RV Resident

Financial Management on the road

Living with Family, Friends or Pets in limited space

Boondocking

Safety & Security

Legal

Family Affairs and Roles in the RV

Trip Itinerary

and MUCH MORE!

With an RV, you are never restricted to a single place. When someone asks you where you live, wouldn’t it feel great for you to reply with “ everywhere! “ ?

This guide is literally the all-in-one package to starting your RV Adventure! Grab a copy and make the decision your life has been waiting for!

So hurry up and scroll up to get your own copy of Living Off The Grid: A Step-By-Step Guide to a More Self Sufficient, Self-Reliant, Sustainable Life NOW!

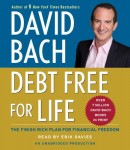

GOODBYE DEBT—HELLO FREEDOM!

Most of us grew up with the idea that there is good debt and there is bad debt. Good debts are generally considered to be debts you incur to buy things that can go up in value—like a home or college education. Bad debts are things like credit card balances, where you borrowed money to buy things that depreciate or go down in value, like most consumer goods.

But as America’s favorite financial coach, David Bach, points out, in difficult times there is no such thing as good debt. There is only debt. And all debt is too expensive—if what you desire is FREEDOM! In fact, Bach believes the best investment you can make today is to pay down your debt, faster and smarter than you have ever attempted before—starting today!

In Debt Free for Life, #1 New York Times bestselling author David Bach has written his most groundbreaking and important book since The Automatic Millionaire, giving us the knowledge, the tools, and the mindset we need to get out of debt and achieve financial freedom— forever! Offering a revolutionary approach to personal finance that teaches you how to pay down your debt and adopt a whole new way of living – debt free. Bach unveils the Debt Wise program that empowers you to pare down your debt automatically. You’ll learn how to calculate your Debt Freedom Day – the actual date you will be completely free of debt. And you’ll discover that when you are debt free, you need a lot less money to live on. You can retire, even with a smaller nest egg — perhaps earlier than you expected.

David Bach has coached millions to pay off their debt and now he can guide you. Whether you have home loans, student loans, car loans, credit card debt—paying down your debt is truly a game you can win, if you know the rules. Debt Free For Life will teach you the rules and give you the tools to buy back your freedom.

Product Features

- Used Book in Good Condition

Strategies and tools to live debt free

The world of borrowing and debt management has changed dramatically, leaving people confused about how best to secure their financial future. This book is the only guide with detailed advice to help you become debt free or master the debt you have, based on the latest laws and new government programs and policies implemented under the Obama administration.

Is the information and advice on debt management different than in years past? Definitely. In this savvy, engaging guide, bestselling financial expert Jordan Goodman will tell you how to

Win the mortgage game: avoid foreclosure, obtain the best refi, and modify your mortgage even if it is “under water” Clean up your credit report and dramatically boost your credit score Negotiate new terms and payments for burdensome medical bills, student loans, and credit cards Protect yourself from the devastation of identity theft Master the new credit card rules, and avoid the rate and fee traps Learn a revolutionary strategy that will help you become mortgage free in 5 to 7 years, change the way you pay all your bills, and save hundreds of thousands of dollars

Master Your Debt recommends many pioneering strategies as it lays out an innovative plan for achieving the elusive goal of financial success. The book is filled with helpful web sites, toll free numbers, associations and government agencies, and vetted companies and services to help you implement this advice. In today’s volatile economy, getting out of debt is the key to surviving and thriving, and author Jordan Goodman provides you with the strategies and tools to live debt free.

Debt Free

Sale price. You will save 33% with this offer. Please hurry up!

Find you financial freedom and Learn how to make a budget

Is living a debt-free life really possible or just simply a dream, a fantasy or a total impossibility? No, it’s not. We have all grown up with the expectations of a successful life: college, possibly marriage and a family, car, boat, home and all the other great toys that most people want. But none of this comes without a cost and it is often that cost that causes problems. There is that college tuition to repay, raising a family is far from cheap, cars and boats cost as much as a house did 25 years ago and to own a home is a near impossibility for many. Today, the average person is totally bombarded with debt if left uncontrolled. In this book, we will take a look at some of these costs and how they can get out of hand then offer some possible solutions that individuals can do to regain financial order to their life.

A few of the topics we’ll discuss will cover:

How you got in debt and your financial outlook How to redirect your steps Future financial planning Life without debt: how glorious! Download your copy of ” Debt Free ” by scrolling up and clicking “Buy Now With 1-Click” button.

Tags: financial freedom, how to get out of debt, financial freedom, credit score, retirement planning, how to travel the world, investing for beginners, how to make a budget , credit scores and credit reports, raise credit score, free credit score, improve credit score, retirement income planning, retirement planning for dummies, financial retirement planning, debt free, get out of debt, get rid of debt, how to get out of debt, financial freedom, debt free spending plan, debt free forever, debt free for life, debt free for good, debt free hacks, debt free book, retirement planning for dummies, financial retirement planning, debt free living, budgeting money

When you want to change your lifestyle entirely, you need to have enough motivation but you also need to have knowledge about the lifestyle that you are adopting. Many people who want to live in an RV full-time fail to find a balance in their lives which make that living pleasurable, while others can live the dream and learn to compromise on comforts for the sake of freedom. They wake up in the mornings to feel that they have breathed fresh air. They see different scenery every morning if they so wish. What you need to know before joining them is whether you’re cut out for the lifestyle and what differences there are between living in a conventional home and living in an RV. This book bridges that gap in your knowledge, and although you may choose to save a fortune by staying at home, you may also choose the lesser travelled road and discover the benefits of living in an RV. Both lifestyles, either in an RV or a home, have their pros and cons. Many who choose the RV lifestyle find that adapting their lives comes naturally. It takes a unique and free spirited person to compromise on the luxuries of home living in favor of the adventurous lifestyle offered by RV living, though many do. Once you weigh the pros and cons, you can make the choice wisely, and that’s what this book is all about. The book will appeal to the free spirited who seek something more than merely surviving month to month oppressed by mortgage payments and housing taxes. Both have benefits, though those who live the life they choose, rather than the life chosen for them by responsibility, find that RV life tests their personal boundaries and skills freeing up their lives to live beyond the grid. Journey with us and learn if living in an RV will suit you, and be prepared for the journey of your life.

This book is specifically designed for 8th through 10th graders who want to have a successful high school experience that leads to success in college and ultimately getting a job. It can be equally helpful for older high school students and college freshman, although they will have some catching up to do. Are you struggling with high school or confused and wondering how you should approach and pay for college? This book guides you through high school strategies to prepare for college. It leads you through the right way to survive college without borrowing money while getting prepared for a real-world career and actually getting a job in your field once you graduate. The advice in this book is based on 30 years of business experience and experiences teaching and coaching over 2,000 high school students. The advice is real world… what’s going to happen when someone is paying you rather than when you are paying them. Let the ideas in this book help you to focus your efforts and make decisions that will lead to an exciting career that makes sense for you. All of this all without incurring massive college debts that control your life decisions and restrict your choices!

For anyone who wants to get out of debt…

Do your money problems keep you up at night worrying? Do you stress about not having any money left to pay your bills after buying basic necessities? Does it seem like no matter how much you pay off, your debt only increases? More and more people are finding themselves struggling with debt, whether it is from their massive student loans, the mortgage on their home, car loans, or credit card debt. Even those who have great paying jobs often will end up living from paycheck to paycheck.

Stop making choices that are driving you further into debt…

For the first time, two bestselling money management books have been collected into a single volume, Debt Free Forever. This definitive collection tackles some of the most serious problems those who are in debt suffer from, namely a poor credit rating and living well beyond their means. With Debt Free Forever, you will learn techniques that will help you repair your credit as well as strategies that will help you live much more frugally.

Debt Free Forever – The Definitive Collection on Living Frugally and Credit Repair contains the following two books:

Easy Credit Repair – Effective Strategies to Fix Even the Worst Credit Problems by Warren R. Sullivan Frugal Living – Learn Proven Techniques to Help You Live Within Your Means by Nicole Harrington

Take control of your life and finances today! Debt Free Forever is your first step to a better tomorrow!