[House] Videos

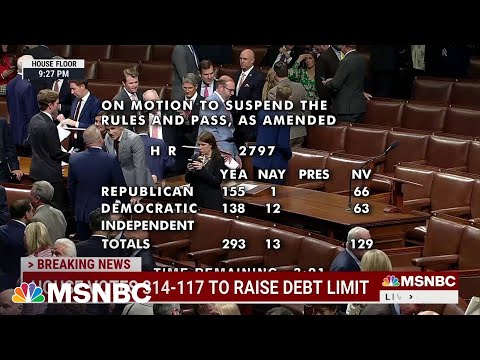

Jen Psaki, former White House press secretary, and Peter Baker, chief White House correspondent for The New York Times, talk with Alex Wagner about what was accomplished by both parties as the House passes the debt ceiling bill, sending it to the Senate, and what President Biden might do to avoid having to deal with a Republican debt ceiling stunt in a potential second term.

» Subscribe to MSNBC: http://on.msnbc.com/SubscribeTomsnbc

Follow MSNBC Show Blogs

MaddowBlog: https://www.msnbc.com/maddowblog

ReidOut Blog: https://www.msnbc.com/reidoutblog

MSNBC delivers breaking news, in-depth analysis of politics headlines, as well as commentary and informed perspectives. Find video clips and segments from The Rachel Maddow Show, Morning Joe, The Beat with Ari Melber, Deadline: White House, The ReidOut, All In, Last Word, 11th Hour, and Alex Wagner who brings her breadth of reporting experience to MSNBC primetime. Watch “Alex Wagner Tonight” Tuesday through Friday at 9pm Eastern.

Connect with MSNBC Online

Visit msnbc.com: http://on.msnbc.com/Readmsnbc

Subscribe to the MSNBC Daily Newsletter: MSNBC.com/NewslettersYouTube

Find MSNBC on Facebook: http://on.msnbc.com/Likemsnbc

Follow MSNBC on Twitter: http://on.msnbc.com/Followmsnbc

Follow MSNBC on Instagram: http://on.msnbc.com/Instamsnbc

#msnbc #debtceiling #republicans

President Joe Biden and US congressional leaders are planning to meet on Tuesday to resume debt limit negotiations as the clock ticks down to the crunch point when the US will be forced to default. Kathleen Hays reports on Bloomberg Television.

——–

Follow Bloomberg for business news & analysis, up-to-the-minute market data, features, profiles and more: http://www.bloomberg.com

Connect with us on…

Twitter: https://twitter.com/business

Facebook: https://www.facebook.com/bloombergbusiness

Instagram: https://www.instagram.com/bloombergbusiness/

Grow house movie ? Starring Malcolm McDowell · Dr. Doobie ; Snoop Dogg · Self ; DeRay Davis · Pat ; Lil Duval · Darius ; Faizon Love · Rollin’ Reg.

The Biden administration released a new student loan payment plan that would lower monthly payments for millions of borrowers and pause them completely for some. There’s been a freeze on loan repayments throughout the pandemic, but that’s coming to an end in June. The new proposal comes while plans to cancel some of the debt are held up in court. Cory Turner of NPR joined Geoff Bennett to discuss.

\Stream your PBS favorites with the PBS app: https://to.pbs.org/2Jb8twG

Find more from PBS NewsHour at https://www.pbs.org/newshour

Subscribe to our YouTube channel: https://bit.ly/2HfsCD6

Follow us:

TikTok: https://www.tiktok.com/@pbsnews

Twitter: http://www.twitter.com/newshour

Instagram: http://www.instagram.com/newshour

Facebook: http://www.pbs.org/newshour

Subscribe:

PBS NewsHour podcasts: https://www.pbs.org/newshour/podcasts

Newsletters: https://www.pbs.org/newshour/subscribe

Dental hygienist Liz and truck driver Will are engaged in a destructive spending game. Control freak Liz handles all the finances while keeping Will on a tight leash, yet still spends a lavish amount on clothes for herself, their baby and their dog. In retaliation, Will takes out costly cash advances. They’ve refinanced their home several times to hide debt in their mortgage to the point they now owe more than the house is worth. Getting this couple back on track means reigning in the spending, finding ways to re-build equity in their home and getting rid of the resentment between them. Gail finds way to get them fighting their debt rather than each other. –

–

Watch more from Weddings and Beyond – https://youtube.com/c/WeddingsAndBeyondTV/videos

Explore our family of YouTube channels with Free movies, tv series and documentaries.

? TOP BOX is where you’ll find an eclectic mix of mind-bending documentaries, cult classic films and investigative television documentaries. https://youtube.com/topboxtv

?? I Love Docs for documentaries: https://youtube.com/ILOVEDOCS

?? North of Main for Independent movies: https://youtube.com/NORTHOFMAIN

#weddings #gettingmarried #realitytv

Visit the Dave Ramsey store today for resources to help you take control of your money! https://goo.gl/gEv6Tj

Become a Channel Member today: https://www.youtube.com/channel/UC7eBNeDW1GQf2NJQ6G6gAxw/join

Welcome to The Dave Ramsey Show like you’ve never seen it before. The show live streams on YouTube M-F 2-5pm ET! Watch Dave live in studio every day and see behind-the-scenes action from Dave’s producers. Watch video profiles of debt-free callers and see them call in live from Ramsey Solutions. During breaks, you’ll see exclusive content from people like Rachel Cruze, Chris Hogan, and Christy Wright —as well as all kinds of other video pieces that we’ll unveil every day.

The Dave Ramsey Show channel will change the way you experience one of the most popular radio shows in the country!

In this video I go over when to use the equity in your home to refinance and pay off your credit card debt

The Great American Recession resulted in the loss of eight million jobs between 2007 and 2009. More than four million homes were lost to foreclosures. Is it a coincidence that the United States witnessed a dramatic rise in household debt in the years before the recession?that the total amount of debt for American households doubled between 2000 and 2007 to $14 trillion? Definitely not. Armed with clear and powerful evidence, Atif Mian and Amir Sufi reveal in House of Debt how the Great Recession and Great Depression, as well as the current economic malaise in Europe, were caused by a large run-up in household debt followed by a significantly large drop in household spending.

Though the banking crisis captured the public’s attention, Mian and Sufi argue strongly with actual data that current policy is too heavily biased toward protecting banks and creditors. Increasing the flow of credit, they show, is disastrously counterproductive when the fundamental problem is too much debt. As their research shows, excessive household debt leads to foreclosures, causing individuals to spend less and save more. Less spending means less demand for goods, followed by declines in production and huge job losses. How do we end such a cycle? With a direct attack on debt, say Mian and Sufi. More aggressive debt forgiveness after the crash helps, but as they illustrate, we can be rid of painful bubble-and-bust episodes only if the financial system moves away from its reliance on inflexible debt contracts. As an example, they propose new mortgage contracts that are built on the principle of risk-sharing, a concept that would have prevented the housing bubble from emerging in the first place.

Thoroughly grounded in compelling economic evidence, House of Debt offers convincing answers to some of the most important questions facing the modern economy today: Why do severe recessions happen? Could we have prevented the Great Recession and its consequences? And what actions are needed to prevent such crises going forward?

The Great American Recession resulted in the loss of eight million jobs between 2007 and 2009. More than four million homes were lost to foreclosures. Is it a coincidence that the United States witnessed a dramatic rise in household debt in the years before the recession?that the total amount of debt for American households doubled between 2000 and 2007 to $14 trillion? Definitely not. Armed with clear and powerful evidence, Atif Mian and Amir Sufi reveal in House of Debt how the Great Recession and Great Depression, as well as the current economic malaise in Europe, were caused by a large run-up in household debt followed by a significantly large drop in household spending.

Though the banking crisis captured the public’s attention, Mian and Sufi argue strongly with actual data that current policy is too heavily biased toward protecting banks and creditors. Increasing the flow of credit, they show, is disastrously counterproductive when the fundamental problem is too much debt. As their research shows, excessive household debt leads to foreclosures, causing individuals to spend less and save more. Less spending means less demand for goods, followed by declines in production and huge job losses. How do we end such a cycle? With a direct attack on debt, say Mian and Sufi. More aggressive debt forgiveness after the crash helps, but as they illustrate, we can be rid of painful bubble-and-bust episodes only if the financial system moves away from its reliance on inflexible debt contracts. As an example, they propose new mortgage contracts that are built on the principle of risk-sharing, a concept that would have prevented the housing bubble from emerging in the first place.

Thoroughly grounded in compelling economic evidence, House of Debt offers convincing answers to some of the most important questions facing the modern economy today: Why do severe recessions happen? Could we have prevented the Great Recession and its consequences? And what actions are needed to prevent such crises going forward?

From the authors of the national bestseller 13 Bankers, a chilling account of America’s unprecedented debt crisis: how it came to pass, why it threatens to topple the nation as a superpower, and what needs to be done about it.

With bracing clarity, White House Burning explains why the national debt matters to your everyday life. Simon Johnson and James Kwak describe how the government has been able to pay off its debt in the past, even after the massive deficits incurred as a result of World War II, and analyze why this is near-impossible today. They closely examine, among other factors, macroeconomic shifts of the 1970s, Reaganism and the rise of conservatism, and demographic changes that led to the growth of major—and extremely popular—social insurance programs. What is unquestionably clear is how recent financial turmoil exacerbated the debt crisis while creating a political climate in which it is even more difficult to solve.