[Open] Videos

How to Open a Debt Consolidation Business. Part of the series: Personal Finance & Money Managing. Opening a debt consolidation business requires the appropriate training as a liability specialist, registration with the appropriate reporting agencies and ample advertising to build up a clientele. Star a debt management company from the ground up with money advice from a registered financial consultant in this free video on personal finance.

Opening a debt consolidation business requires the appropriate training as a liability specialist, registration with the appropriate reporting agencies and ample advertising to build up a clientele. Star a debt management company from the ground up with money advice from a registered financial consultant in this free video on personal finance.

Expert: Patrick Munro

Contact: www.northstarnavigator.com

Bio: Patrick Munro is a registered financial consultant (RFC) with outstanding sales volume of progressive financial products and solutions to the senior and boomer marketplace.

Filmmaker: Reel Media LLC

You cannot open a new debt whilst under debt review because,

Jean Varden

The Debt Counselling Centre

032 586 3597

Jean@thedcc.co.za

You cannot open a new debt whilst under debt review because the reason you are under debt review its because you are over-indebted and if you open new debt you will not be able to afford to make those payments then you will be stressed and won’t be able to come out of debts. But after your debt have been paid up you will be able to open a new account and we will issue a clearance certificate.

The Video and Information is the property and copyright of its rightful owner.

Copyright under the Copyright Act 98 of 1978, the Companies Act, 2008 No 71 of 2008 and the Intellectual Property Act.

http://www.cipc.co.za

No allowance is made for “Fair use” for purposes such as criticism, comment, news reporting, teaching, scholarship, or research.

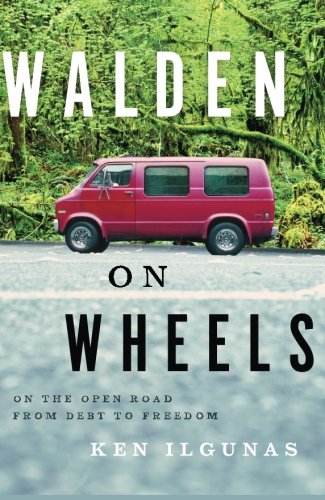

In this frank and witty memoir, Ken Ilgunas lays bare the existential terror of graduating from the University of Buffalo with $32,000 of student debt. Ilgunas set himself an ambitious mission: get out of debt as quickly as possible. Inspired by the frugality and philosophy of Henry David Thoreau, Ilgunas undertook a 3-year transcontinental jour¬ney, working in Alaska as a tour guide, garbage picker, and night cook to pay off his student loans before hitchhiking home to New York.

Debt-free, Ilgunas then enrolled in a master’s program at Duke University, determined not to borrow against his future again. He used the last of his savings to buy himself a used Econoline van and outfitted it as his new dorm. The van, stationed in a campus parking lot, would be more than an adventure—it would be his very own “Walden on Wheels.”

Freezing winters, near-discovery by campus police, and the constant challenge of living in a confined space would test Ilgunas’s limits and resolve in the two years that followed. What had begun as a simple mission would become an enlightening and life-changing social experiment. Walden on Wheels offers a spirited and pointed perspective on the dilemma faced by those who seek an education but who also want to, as Thoreau wrote, “live deep and suck out all the marrow of life.”