[Solve] Videos

DebtBusters, one of South Africa’s most prestigious debt management companies, helps’ consumers to solve debt problems by offering debt consolidation and other quality debt management services. Through DebtBusters sister company BondBusters, debt consolidation is a debt solution provided to meet your individual needs. The process involves taking all your debts and consolidating them into one large debt amount. Debt consolidation reduces the hassle of having to pay off various debt accounts of a monthly basis, and provides the convenience of only having to make one monthly debt repayment.

Most commonly, debt consolidation involves taking an additional homeloan in order to secure a lower interest rate. At DebtBusters, we have the client’s best interest at heart, and also offer unsecured debt consolidation as another option. DebtBusters financial consultants will make sure you are able to choose from a variety of credit providers, in order for you to get the best possible debt consolidation solution to meet your needs.

DebtBusters have helped many families and individuals escape the debt trap through the quality debt counselling and debt consolidation solutions. DebtBusters primary aim is to enable South African consumers to gain a second chance to build a brighter future and eventually contribute to the economic growth of South African countries.

In order for DebtBusters to help these South African consumers gain a better financial position, they will advise debt consolidation or more likely, the debt solution debt counselling, as it more beneficial to the consumer. DebtBusters will conduct a full analysis of your financial situation, draw up a monthly budget and find ways in which you can save money and pay off your debt faster. A new debt repayment plan will be structured, consisting of extended debt repayment terms and reduced interest rates. DebtBusters has mandates with 95% of credit providers and will provide the best debt solution for you.

Visit DebtBusters website today www.debtbusters.co.za to find out more about our debt consolidation options or to speak to one of our friendly financial consultants. From debt counselling to debt consolidation, DebtBusters will pick the right debt solution for your particular financial needs.

Looking for credit counselling services in Ontario to settle your debt? Here’s when this option works and when it doesn’t. For more information about debt help services in Ontario, please call 519-310-JOHN (5646) or contact us via:

Website: https://www.adamsontrustee.com/

Facebook: https://www.facebook.com/adamsontrustee

Twitter: https://twitter.com/310johnadamson

Instagram: https://www.instagram.com/adamsontrustee/

Adamson & Associates offer bankruptcy, consumer proposal, credit counselling, and other debt help services in London, St. Thomas, Windsor, Kitchener / Waterloo and Chatham, Ontario.

Find out if credit counselling is the best way to put an end to your financial woes. Learn more: https://debthelpbc.ca/2018/03/credit-counselling-services-solve-debt-problems/

Follow us:

Website: https://debthelpbc.ca

Twitter: https://twitter.com/TrusteeSlocombe

Facebook: https://www.facebook.com/TrusteeSlocombe

Google+: https://plus.google.com/u/4/+Slocombetrusteebankruptcy

#Justice #Disputes #Mediation

Don’t forget to like, share and subscribe.

The Public Broadcasting Corporation of Jamaica or PBCJ carries as part of its programming:

Coverage of events of National and Regional Interest

Dissemination of Balanced News, Current Affairs, Information and Ideas on matters of general public interest.

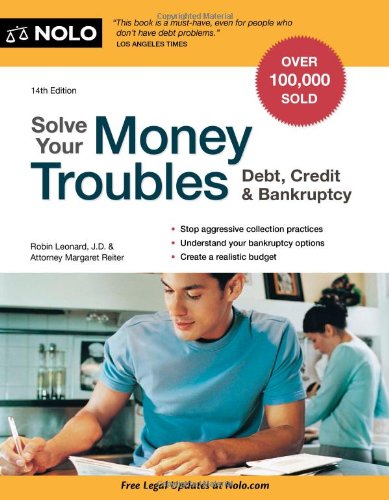

Are you overwhelmed by your debts? Feeling squeezed by the housing bust? Or simply want to get smarter about managing your money? If you’re ready to regain your financial freedom, you’ll find everything you need in this comprehensive guide. Solve Your Money Troubles shows you how to:

prioritize debts & create a budget

negotiate with creditors

stop harassment by debt collectors

deal with wage garnishment, car repossession, and foreclosure

reduce student loan payments

know what to expect if a creditor sues

rebuild your credit

decide if bankruptcy is the right option for you

To make the process easier, Solve Your Money Troubles includes sample letters to negotiate with creditors, as well as worksheets and charts to calculate your debts and expenses and help you create a repayment plan.

Feeling overwhelmed by your debts? If you’re ready to regain your financial freedom, feeling the squeeze of the housing bust or simply get smarter about managing your money, you’ll find everything you need in this complete guide. Solve Your Money Troubles shows you how to:

. prioritize debts

. create a budget

. negotiate with creditors

. stop collector harassment

. challenge wage attachments

. contend with repossessions

. respond to creditor lawsuits

. qualify for a mortgage

. rebuild credit

. decide if bankruptcy is the right option for you

To make the process easier, Solve Your Money Troubles includes sample letters to creditors, as well as worksheets and charts to calculate your debts and expenses.