[Their] Videos

#film #movie #filmcommentary #featurefilm

?Updated daily, welcome to subscribe!?

Summary:

We hope you can subscribe my channel: https://bit.ly/pandaatv

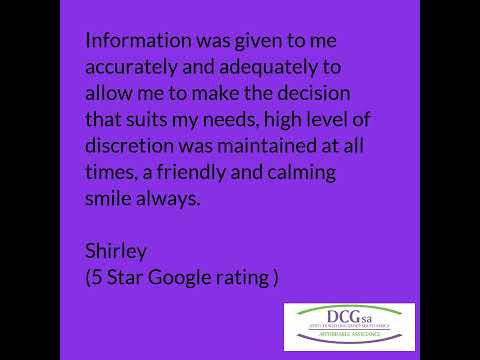

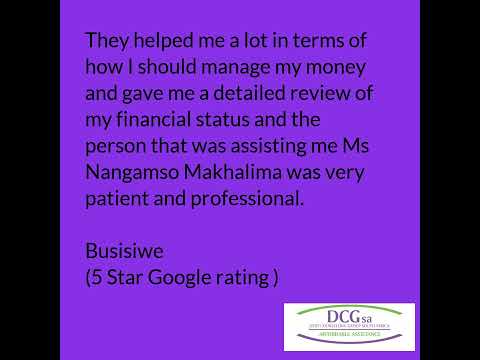

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

The National Consumer Regulator says it has received complaints from consumers who have been placed under debt review without their knowledge.

And it has blamed this on false advertising on the part of debt counsellors and credit providers.

The NCR has called on consumers to know what they are getting themselves into when applying for debt consolidation and restructuring.

For more news, visit sabcnews.com and also #SABCNews #Coronavirus #COVID19News #Covid-19Vaccination #Vaccine on Social Media.

The National Credit Amendment Bill aims to provide relief to low-income earners, by erasing part or all of their debt.

For more on this, we’re joined by Norton Rose Fulbright Attorney’s Riccardo Petersen.

Courtesy #Dstv403

? HOW TO MAKE MONEY ON AMAZON – FREE eCOURSE: ?

? http://TheAmazonGPS.com ?

—————————————————————————————————

LOOK THROUGH MY BOOKS! http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

OTHER: http://themoneygps.com/donate

—————————————————————————————————

AUDIOBOOK: http://themoneygps.com/store

T-SHIRTS: http://merch.themoneygps.com

MY FAVORITE BOOKS: http://themoneygps.com/books

—————————————————————————————————

Sources Used in This Video:

https://goo.gl/YpU9nm

—————————————————————————————————

David Quintieri, author of The Money GPS book series, is here on the most active, most informative channel in the financial world. Day after day, breaking down the data and making it easy to understand.

#money #debt #invest

Each one of us have at least two things in common. Money and dreams! What separates one person from another is when one person’s money or problems with money keeps them from their dreams. Those that are able to get control of their finances are the ones who are able to do what they love! If you have found yourself having more month than money or you are just trying to save more money then this is the book for you! Ja’Net speaks all over the country about the steps she took to pay off $50,000 of debt in 2 1/2 years and she shares those exact steps in this book! “Debt Sucks! Everyone’s Guide To Winning With Money So They Can Live Their Dreams!” will show you how to: Determine what your dreams and how to make those dreams reality. Create a “spending plan” that will allow you to still have fun while also getting out of debt! Build an “In Case You Are Breathing Fund” to have money for all emergencies. Turn your hobby into a business that makes you money! Find a better paying career in the “new economy.” AND SO MUCH MORE!

Communication strategies, financial crisis management, negotiation techniques, and litigation and bankruptcy tactics told through the stories of a loan workout and financial restructuring consultant. How do you protect yourself, or your clients, or your family and friends from aggressive creditors, lawsuits, and bureaucracy? When do you need protection from the advice of your own advisors and friends? Debt & Circuses is a true story of seven years of loan workouts, lawsuits, and bankruptcies during the Great Recession (2009-2015) and beyond. Debt & Circuses explains real-world negotiation strategy and courtroom tactics through the true stories of finance and accounting advisors, lawyers, and courageous entrepreneurs who followed the counter-intuitive, asymmetrical, and risky advice of a few creative consultants. Debt & Circuses demonstrates, through first-hand experiences, effective methods of: Preparing the mind (and your assets) for conflict. Coping with emotional pressure tactics. Responding to unreasonable demands constructively. Understanding why victory or defeat in court can be irrelevant. Preventing the two things that produce an unfavorable outcome. Negotiating with inferior bargaining power. Going on offense against an opponent with unlimited resources. Capitalizing on bureaucratic failures. Avoiding the big mistake made by all companies in financial distress. Clay Westbrook is an attorney and consultant who spent six years involved with over 100 loan workout cases, dozens of lawsuits and business bankruptcies, and $100s of millions of bad debts. He advises clients on business breakups, litigation and bankruptcy strategy, and negotiating with taxing authorities and governmental entities. He saw many spectacular wins in unlikely circumstances, learned valuable lessons from a few disappointing losses, and drew inspiration to tell the story from one woman’s experiences with debt collectors that destroyed her family and her future. “‘The mortgage company told us that we weren’t allowed to file for bankruptcy. They said it wasn’t an option,’ Maria explained. She didn’t realize what this meant. The mortgage company didn’t just lie to them; they violated state and federal laws in doing so. We might have had a case, or at least an issue to run with, which is usually enough. But it was too late.” The consultants quickly learn that to save their clients, they have to forget about “doing the right thing,”forget about the legal merits of the case, and forget about logic. The solutions come from psychology and math, human nature, and realizing neither side understands (nor cares) what the other side is saying. “After witnessing it firsthand many times, accomplishing the impossible takes specific knowledge, character, and action. As simple as it sounds, you rarely see all three when the cards are down. If they don’t have all three, they lose.” Achieving success against long odds is more than “when to stop paying,” or “if the bank files a lawsuit,cut your settlement offer,” or remembering to stash the Ferrari at a covered garage in Reno if the bank gets a judgment. Debt & Circuses shows: How to know and have the confidence to trust your instincts under pressure. How human nature affects the strategies and results conflicts are never “just business” and are always personal. Ways to identify and avoid traps lawyers, advisors, and others miss. The one principle that explains the entire process. Through the experiences of business owners and advisors, and the entertaining, if not ridiculous,stranger-than- fiction situations in which these people found themselves, Debt & Circuses provides essential knowledge and skills for surviving financial distress, and serving clients whose future depends upon your advice. “You are not alone. Don’t be frightened, and don’t feel hopeless. We will never, ever give up.”

Do you know that millions of dollars of debt are collected illegally every year? Do you know that it may be possible for you to receive a payment from a debt collector or creditor for legal damages? The Secret World of Debt Collection shows readers how they can reduce their personal debt and possibly win thousands in legal compensation. I wrote this book because it’s only fair that you find out what you’re really up against when it comes to consumer credit, finance, and collections.

Attorney and former debt collections CEO, Mike Cardoza wants you to know that what you might think is an impossible situation is not. Mike Cardoza is the most senior executive from the consumer credit and finance industry to publish such a comprehensive account on the vulnerabilities and shortcomings of American consumer credit and debt collection companies. A former CEO and Executive Vice President in debt collections, he lays bare the economic realities of the U.S. credit and collections system that virtually ensures that millions of dollars of debt are collected illegally every year.

College students are facing many issues today and the main one being student loan debt! Student loan debt is at $1.2 trillion and growing! Debt Sucks! is for the college student who is looking to win with money so they can pursue their dreams! Ja’Net Adams shows the reader step by step how she paid off nearly $50,000 of debt in 2 1/2 years! In Debt Sucks! there are tips on how pay off student loans and other debt quickly while in college and after. The book also encourages college students to stand out from the crowd so that they can land internships while they are in school and valuable careers once they graduate.