[clients] Videos

Qualified Insolvency Counsellor Bethany Cann of Sands & Associates answers: “How are clients changed by financial counselling?”

To book a free, confidential consultation in an office near you, visit www.sands-trustee.com

In this 5-minute tutorial, I will show you exactly what your clients will see in their portal. To start and scale your own credit repair agency, go to app.credithealing.org.

Contact us at credithealing@gmail.com

Phone: 225-733-6429

Facebook: https://www.facebook.com/credithealing/

Monitor your credit with our trusted partner below:

https://member.identityiq.com/creditpreferred.aspx?offercode=431271X2

Report your rent payments on your credit report using our trusted partner below:

https://rentalkharma.com/credit-healing/?CODE=CREDITHEALING25

credit repair, credit repair business, credit repair secrets, credit repair cloud, credit repair companies, credit repair cloud review, credit repair software, credit repair services, credit repair scams, credit repair business startup

credit report, credit report dot com baby, credit report song, credit reports, credit report commercials, credit report dispute letter, credit report dot com baby anime, credit report dispute, credit report dot com baby remix, credit reporting agencies, derogatory items on credit report remove, delete derogatory items credit report, dispute derogatory Items credit report, how to delete derogatory accounts

rental history on credit report, rental history, rental history tradeline, adding rental history to credit report, repair my credit, repair my credit myself, repair my credit quickly, fix my credit myself, fix my credit in 30 days, repair your credit like the pros, fix my credit for free, fixing my credit to buy a house, fix my credit fast and free,

fix my credit now

credit counseling, credit counseling services, credit counselor, credit counseling vs debt settlement,

consumer credit, certified credit counselor, credit counselling near me, credit repair company near me, Best credit company near me

Credit (Industry), how to fix credit, free report, free score, score free, fix credit, credit, credit cards, good credit, excellent credit, how to make money, credit expert, student loans, FICO, consumer credit, credit bureau reports, debt solutions, bad credit apply, business credit, Charge-off, repair, letters, help, how i fixed credit fast, remove, adverse, negative, 609 credit repair, free, credit repair letters, fix my credit, bad credit, fix my credit fast, debt, trick

Kindly Like, Share, and Subscribe for more educative credit repair videos.

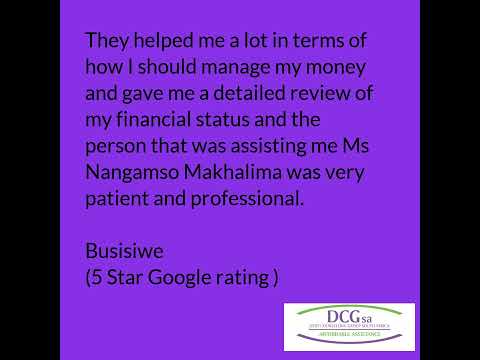

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

Have you ever asked yourself the question: What do I do when I receive threatening phone calls from debt collectors while being under the debt review program?

National Debt Advisors is the #1 debt counselling company in South Africa. We offer you debt counselling, debt solutions and expert advice. If you are struggling with your debt or need financial assistance, contact us today!

CALL US on 021 003 8733 or visit our website: https://nationaldebtadvisors.co.za/

With debt absolutely consuming her life, Nicole turned to Freedom Debt Relief to help relieve her financial stress and find a clear path towards a debt free life.

In this Freedom Debt Relief debt settlement review, you’ll learn how breaking free of the cycle of crippling credit card debt and finding a clear path toward debt freedom helped Nicole become a better mom for her children.

Debt relief client testimonials as well as US debt relief reviews such as this one explain firsthand why Freedom Debt Relief is the best company of its kind in America.

To learn more about Freedom Debt Relief, please visit:

https://www.freedomdebtrelief.com/what-we-do/

Join us on:

Facebook: https://www.facebook.com/freedomdebtrelief/

Twitter: https://twitter.com/FreedomDebt

Instagram: https://www.instagram.com/freedomdebtrelief/

See our reviews on Trustpilot:

https://www.trustpilot.com/review/freedomdebtrelief.com

When a consumer (client) realizes that he/she is over indebted and that some arrangements

have to be made to make sure all monthly repayments are met.

2. The consumer contacts a registered Debt Counsellor who supplies a regulated form 16 and

assists with the completion thereof. As soon as this form is completed the consumer will have

formally applied for debt review in terms of the Act.

3. All requested documentation as on the application form is supplied by the consumer within 5

days of signing the form 16.

4. With the information and supporting documents supplied by the consumer the debt counsellor

now informs all the known creditors of the consumer that the said consumer has applied for

debt review. This is done with the regulated form 17.1 as well as 17.2

5. A formal analysis is done by the Debt counsellor to determine if the consumer is indeed over

indebted. This is a very simple calculation once all information has been taken into account. A

consumer can only apply for debt counselling if his/her monthly disbursable amount (Nett

income minus living expenses) is LESS than the amount required to service all obligations.

AS EXAMPLE ONLY. If the consumer only has R5000 to pay his/her debt after the living

expenses have been accounted for, and the total monthly debt repayments are R6000 the

application would be a success.

6. If the consumer is indeed over indebted according to the above method all creditors would be

informed of this for their record.

7. The restructuring process can now begin. The Debt counsellor will now restructure and

renegotiate all credit agreements and present these proposed terms to all creditors. This new

proposal will then restructure the consumer’s monthly commitments to be more affordable

and ensure that all credit agreements get something every month.

8. The new proposal will now be sent out to all the creditors after it has been approved by the

consumer. Should all creditors agree to a consent order that new arrangement will be made

an order of court. If there are some creditors who don’t agree to the restructuring a court date

will be allocated for the matter to be heard. At this hearing the magistrate will have no choice

to grant the order if the debt counsellor acted in terms of the Act and subsequently

restructured the debt accordingly.

9. A Very important consideration when applying for debt counselling will be who handles your

money! Debt counsellors are not allowed to handle any money from consumers except for the

application fee along with the retainer for early cancellation.

10. All disbursements of contributions will be handled by a registered Payment Distribution

Agency (PDA). The PDA is regulated and governed by the Act. As soon as a restructuring

proposal is agreed on by the consumer payments of the distribution amount will be paid over

from the consumer directly to the PDA. The PDA in turn will disburse with the funds as per the

restructuring proposals.

11. The Fee structure:

Debt counsellors are entitled to a maximum of R 6000 plus VAT for single applications and R

6000 plus VAT for a joint application.

The Act allows for the following payment of Debt counsellor fees as well as Legal fees.

The first payment made by the PDA will pay the debt counsellors fee

The second payment will pay the legal fees

The third payment will be the first payment that creditors receive. This is done so that

consumers don’t have to pay any money that they might not have up front, and to make the

process affordable.

12. When the payments are being made to the creditors by the PDA there will be some

agreements that will be paid up before others. As soon as this happens the Debt counsellor

must restructure the payments again to make sure any creditor is not paid more than he must

receive and to disburse the surplus equally between the other to ensure that the process runs

smoothly. For this the Debt counsellor is entitled to a 5% after care fee not exceeding R300.

13. As soon as all debt has been cleared the debt counsellor will release the consumer from debt

review and issue him/her with a clearance certificate. All records will also be removed from

the credit bureaus

14. Should a consumer’s situation change for the better and they are in a position to repay all

monthly obligations as they were before the restructuring they will be allowed to be release

from debt counselling. Although nothing is binding, any consumer can leave the process at

any time for any reason