[Payments] Videos

Consolidate all those MCAs and short-term loans requiring a weekly or daily payment into ONE MANAGEBLE PAYMENT, saving 50-75%!

To get started, visit http://www.BusinessDebtConsolidationLoans.com

This program provides IMMEDIATE FINANCIAL RELIEF to small businesses IN ALL INDUSTRIES! To qualify, your company must:

–Be headquartered in the United States

–Be a currently operating company

–Have AT LEAST 2 current short-term (MCA) loans with DAILY or WEEKLY payments

#businessloan #businesstips #hardmoneyloan #hardmoney #hardmoneylender #debtconsolidation #smallbusinesstips #entrepreneur #refinance #refinancing #businessbanker #businesshelp #mca #merchantcashadvance #businessfunding #boss #blackbusiness #reverseconsolidation #businesstips #businesshelp #loan #lowerpayments #ppp #consolidate #mcaconsolidation #ertc #erc #buyout #ertcbuyout #ercbuyout #bridgeloan

Grab Credit Repair Course (DIY Recession Repair Remedy) for ONLY $27 VS $297 TODAY (90% OFF): https://catcredit.samcart.com/products/diy-recession-repair-remedy

To apply for mentorship: https://api.leadconnectorhq.com/widget/booking/Arj8ncGPep4NP3qiJnm9

If you need done-for-you credit repair services:

https://api.leadconnectorhq.com/widget/booking/onYJLLKmCMcabCKhKCwi

Invest in my 2-hour Fair Credit Reporting Act Consumer Law COURSE to get access to the SPECIFIC SECRET LAWS you need for DELETIONS!

https://catcredit.samcart.com/products/consumer-law-fcra-masterclass-replay/

Watch my FREE Credit Workshop to learn how to fix your credit yourself: www.webinar.catactics.com

Join my FREE Credit Repair Support Group: https://www.facebook.com/groups/1128458291282021/

Sep.21 — China Evergrande Group is one step closer to default after a missed interest payment due on Monday. Bloomberg Economics says a systemic meltdown is unlikely. Bloomberg’s John Liu reports on “Bloomberg Daybreak: Asia.”

South Africa’s leading debt review administration system

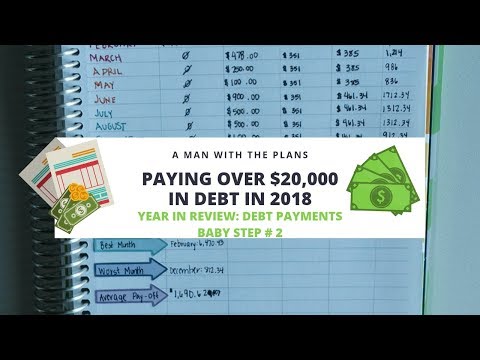

As I’m closing out my 2018 Year in Review, I wanted to take a look at home much money I put to debt this entire year. I went through each of my current debts from 2018 (4 in total: 1 credit card, 2 student loans and 1 car loan) and looked at how much I paid. These payments are both principal and interest, but it’s crazy how much I did this year and how much room for improvement I still have on my debt free journey. What are you doing in 2019 to tighten your budget to hit your financial goals?

Links for products used down below! (Note: some may be affiliate links!)

Connect with me!

AManWithThePlans on Instagram

A Man with the Plans on Facebook

www.amanwiththeplans.com

Looking to make your first EC purchase? Use my code below to get a $10 coupon code emailed to you! Lucky for me, I’ll also get a $10 off coupon code (at no cost to you), so that I can keep sharing all of my favorite goodies! Thanks!

Erin Condren Colorful Hourly Life Planner:

https://www.erincondren.com/referral/invite/ryanselock0323/1

Dave Ramseys: Total Money Makeover:

https://amzn.to/2J78Nwr

Capital One 360 (Interest Bearing Checking Accounts!):

https://capital.one/2KRdg7b

The Miracle Morning by Hal Elrod

https://amzn.to/2xpmUYk

Papermate Flair

https://amzn.to/2NmJoUV

Camera I use: Canon G7X:

https://amzn.to/2Pc2U7j

SWAG Bucks (Take Surveys to Earn Gift Cards):

http://www.swagbucks.com/p/register?rb=47837497

Strategies and tools to live debt free

The world of borrowing and debt management has changed dramatically, leaving people confused about how best to secure their financial future. This book is the only guide with detailed advice to help you become debt free or master the debt you have, based on the latest laws and new government programs and policies implemented under the Obama administration.

Is the information and advice on debt management different than in years past? Definitely. In this savvy, engaging guide, bestselling financial expert Jordan Goodman will tell you how to

Win the mortgage game: avoid foreclosure, obtain the best refi, and modify your mortgage even if it is “under water” Clean up your credit report and dramatically boost your credit score Negotiate new terms and payments for burdensome medical bills, student loans, and credit cards Protect yourself from the devastation of identity theft Master the new credit card rules, and avoid the rate and fee traps Learn a revolutionary strategy that will help you become mortgage free in 5 to 7 years, change the way you pay all your bills, and save hundreds of thousands of dollars

Master Your Debt recommends many pioneering strategies as it lays out an innovative plan for achieving the elusive goal of financial success. The book is filled with helpful web sites, toll free numbers, associations and government agencies, and vetted companies and services to help you implement this advice. In today’s volatile economy, getting out of debt is the key to surviving and thriving, and author Jordan Goodman provides you with the strategies and tools to live debt free.