Recently Added Videos

Do you know the difference between debt review and debt consolidation? Watch our video and phone a consultant to find out more on 0861 043 627 https://www.iemasfinancialservices.co.za/ #IemasFinancialWellness #IemasCares

For information about our new Fast Track membership and beating the debt collectors, go here: https://yourlegallegup.com/blog/fast-track-to-victory-over-debt-collectors/.

There’s a rule of pretrial procedure that debt defendants need to know. If the other side submits exhibits before trial, you probably have to object to them – before trial and within a specified amount of time – or the exhibits will come in automatically.

Animated Video created using Animaker – https://www.animaker.com Assisting South Africans who are struggling to pay their monthly credit obligations. Get a free assessment done to see if you qualify to reduce your monthly debt by up to 60%. Clear your credit score today.

In need of debt help? Should You Get A Debt Consolidation Loan? That will likely depend on your situation. So how do you know for sure what your best option is? Doug Hoyes, a Licensed Insolvency Trustee, with Hoyes, Michalos and Associates talks about the pros and cons of debt consolidation and what you can do if your consolidation options are not very favorable due to bad credit or if you’re already maxed out on monthly payments.

To learn more about debt relief options, have a watch, scroll through our playlists, or visit us at:

If you’ve ever been caught in cash crunch you know how hard it can be to dig yourself out of trouble. Debts take over your life, bills pile up and then the phone starts to ring as collection agencies circle overhead. No one wants to be in this position, but there is a way out with the help of non-profit credit cousellors. They can really make a difference. They will teach you how to budget, provide basic credit counselling and talk you through your options in terms of negotiating with your creditors.

Basic services like counselling and debt management workshops are low cost—or in some cases no cost—and the money they can save you is more than worth your time. The hardest part is asking for help. Bruce Sellery walks you through the different services available and explains how they work.

Links to some non-profit credit counseling agencies

Credit Counselling Society — www.nomoredebts.org

Credit Canada — www.creditcanada.com

Consolidated Credit — www.consolidatedcredit.ca

Money Mentors — www.moneymentors.ca

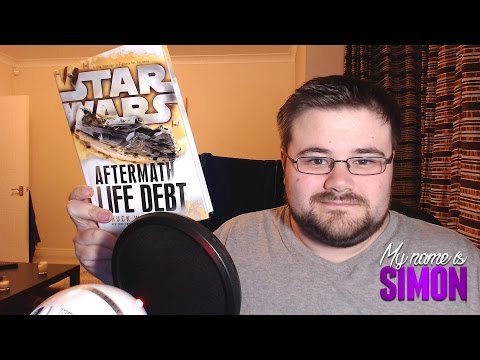

Reviewing the Star Wars novel – Aftermath Life Debt

Like, comment, share & subscribe!!

Twitter – https://twitter.com/MyNameIsSimon88

Facebook – https://www.facebook.com/MyNameIsSimon88

Twitch – https://www.twitch.tv/mynameissimontwitch

Join our Discord community – https://discord.gg/c4XYNZb

Support me on Patreon and gain access to rewards! – https://www.patreon.com/mynameissimon – only donate if you can afford to!!

A special thanks to my Patreon supporters:

Lost&Found

Gaddocks (Erl)

Vanquish

Jonathon Morgan

—————————————-—————————————-———–

Copyright Disclaimer Under Section 107 of the

Copyright Act 1976, allowance is made for

“fair use” for purposes such as criticism,

comment, news reporting, teaching, scholarship,

and research. Fair use is a use permitted by

copyright statute that might otherwise be

infringing.

Banks wanting to foreclose on farmers will be forced to head to mediation first, under proposed new law. Agriculture Minister Damien O’Connor discussed the Farm Debt Mediation Bill with Lisa Owen.

Mohau Debt Counselling a division of Mohau holdings was founded in 2012 by Mohau Petrus Motaung. We have highly trained professionals who are committed to providing life changing assistance to over indebted individuals.

Q. I have a bad credit score. Can I get a debt consolidation loan?

A. Your credit score is a reflection of how you handle credit and debt. A bad credit score shows that you haven’t handled your credit accounts responsibly so a new creditor is unlikely to offer you a debt consolidation loan with a low interest rate.

Even though you may not qualify for a debt consolidation loan there is a way you can reduce your debt and save some money in the process.

It’s called debt negotiation also known as debt settlement. You can negotiate with the creditor or debt collector to settle your debt for less than what you owe. Of course, your lender will need to accept the settlement and agree to cancel the remainder of your debt. Most of them will agree to settle since they would get nothing if you decided to file for bankruptcy.

Plus, debt negotiation is not as severe a hit to your credit score as a bankruptcy filing.

If you don’t want to hassle negotiating with your creditors, you can hire a BBB accredited debt negotiation company to do it for you. Visit https://www.nationaldebtrelief.com to learn how to consolidate your credit card debt without bankruptcy.

Credit Counselling Services of Atlantic Canada, Inc. (CCSAC) offers help with credit card debt, budget counselling, debt repayment plans, financial education and more to help you on your way to financial freedom. If you’re looking for debt relief, we can help.