Most Viewed Videos

Looking for an attractive debt consolidation loan option? You might have heard about Best Egg loans. While they offer many benefits, it’s important to be aware of the potential drawbacks and hidden costs. In this video, we’ll explore the risks of Best Egg debt consolidation loans, from high interest rates and hidden fees to the possibility of extending your debt repayment. We’ll also provide a comprehensive overview of the cons associated with Best Egg loans and alternative options for debt consolidation. Furthermore, we’ll equip you with tips for avoiding scams and predatory lenders, so you can make an informed decision about your debt management strategy. By the end of the video, you’ll have a clear understanding of the dangers and cons of Best Egg debt consolidation loans and be better equipped to manage your debt. So, tune in to learn more!

#debtconsolidation #debtsettlement

Ready to Start Your Small Business?

?????????????????Grab the Small Business Blueprint Course Here:

https://solutionistuniversity.thinkific.com/courses/smallbizblueprint

Course Curriculum Includes:

1. What are the best small business ideas?

2. How do I create a business plan?

3. Where can I find financing for my small business?

4. How do I register my small business?

5. How do I choose the right legal structure for my small business?

6. How do I market my small business?

7. What are the tax implications of starting a small business?

8. How do I manage my finances as a small business owner?

9. What are the common pitfalls to avoid when starting a small business?

?Speak with Me Directly

https://mycreditcall.com/

———————————————————

?????????Business & Collaborations

Email Us HERE: info@digidotagency.com

___________________________________

????DIY Credit Repair????

https://fixmyficonow.com/products/

___________________________________

????Credit Builder Card (No Credit Check)????

https://member.myscoreiq.com/get-fico-preferred.aspx?offercode=432121BV

????????Track Your FICO 8 Credit Score

https://member.myscoreiq.com/get-fico-preferred.aspx?offercode=432121BV

___________________________________

??????????????Join Our Free Communities??????????????

????FREE Facebook Group:

?https://www.facebook.com/groups/creditproacademy1/

????INSTAGRAM

Ihttps://www.instagram.com/pxcreditsolutions/

????TIKTOK

https://www.tiktok.com/@UCAjoV7FDgDRHGMEgA__P7Tw

#creditsolutionist #bestegg #personalloans

Best Egg Personal Loan, Best Egg Loan Review, Best Egg Personal Loan Rates, Best Egg Personal Loan Calculator, Best Egg Loan Login, Best Egg Personal Loan Requirements, Best Egg Personal Loan Application, Best Egg Personal Loan Reviews, Best Egg Loan Customer Service, Best Egg Loan Promo Code, Best Egg Personal Loan Approval, Best Egg Loan Interest Rates, Best Egg Personal Loan Terms, Best Egg Loan Payment, Best Egg Loan Fees, Best Egg Loan Payment Calculator, Best Egg Loan Refinance, Best Egg Personal Loan Pros and Cons, Best Egg Loan Requirements.

How Much Money Does a Credit Counselor Make?. Part of the series: Career Salary Information. The money made by a credit counselor averages around $45,000 a year and requires an educational background in accounting, business, economics and math. Help individuals and businesses manage debt as a credit counselor using insight from a guidance counselor in this free video on career information.

I wish I knew this about Debt Counselling before I applied.

Known as debt review or debt counselling, debt relief measures like debt review offers debt relief to borrowers in South Africa who are over-indebted. To prevent consumers from being blacklisted, the National Credit Act (NCA) introduced this process in 2007.

An income-constrained South African can benefit greatly from the process if they are finding it difficult to make ends meet. Especially for those who cannot keep up with monthly debt payments after falling further into debt. Debt review is safer, cheaper, and more effective than consolidation loans, which tend to be short-term and can end up getting consumers deeper into debt.

Are you having difficulty paying your debts on time and in full? Does it take a lot of effort to pay for your basic needs? Then you need a debt review.

A debt counsellor can help you with the legal process if you are over-indebted. To get help with debt, you need a debt counselor registered with the National Credit Regulator (NCR). Get in touch and I will recommend a few for you.

??TIMESTAMP??

00:00 Introduction

00:50 The reasons people seek Debt Review

01:24 Reckless Lending Explained

01:43 The biggest mistake people make with Debt Review.

01:59 Debt counseling: All you should know before applying

02:41 How Debt Counselors exploit poor consumers

03.15 In what ways do Debt Counselors help?

02:38 Don’t lose your Assets

03:46 Authors experience in Debt Review

05:34 Who is eligible for Debt Review

06:02 What is Debt Review

06:31 Significance of Interest and Budget in Debt Review

06:56 Reasons to apply for Debt Review

07:52 The purpose of Debt Review

09:22 Wrong reasons to join Debt Counselling

10:53 Clearance Certificate

11:55 What should you do after this advice?

12:53 Payment Distribution Agency (PDA)

15:50 Contact Details.

Subscribe to: Austin Kalajila Channel

?Make sure to enable ALL push notifications?

If you like the video don’t forget to share it with others and You all are requested to please watch videos on our channel and also subscribe to our channel & Click the bell ? (next to the subscribe button) to receive updates and notifications.

——————————————————————————————————————————

?? keywords??

?Debt Counselling South Africa? Debt Review South Africa ? The Debt in South Africa ? Debt Rehabilitation in South Africa?

?Debt Consolidation in South Africa ?South Africans Overwhelmed by Debt?

?? watch our latest videos: Follow Austin Kalajila

? Phone: (+27) 67 290 7668

? Whatsapp (+27) 81 748 2150

? Email: akcolors947@gmail.com

? Facebook: Follow Austin Kalajila

————————————————————————-

? Production Credits

?? Edited by: @Austin Kalajila

? Produced by: @Austin Kalajila

? Logo by: https://logomakr.com/

?Editing apps: Power Director; Canva

?? Video Title: I wish I knew this about Debt Review Before I Applied.

?? Other Channel Content

Your Own Thoughts and Feelings determine your mental health.

https://youtu.be/cAE24P0xVEE

The bible when how and for whom it was written.

https://youtu.be/Ld94DBPaHzY

It is because of this reason that people are lousy at love.

https://youtu.be/LzDZRO1sFo8

LET THEM GO | When life throws lemons at you make lemonade.

https://youtu.be/Y4ae3rdjkjQ

THE MOST BEAUTIFUL GIRL| How to spoil your beautiful girl.

https://youtu.be/BaeVYWvM8Mw

Fight Against Child ABUSE, Emotional, and all forms of ABUSE

https://youtu.be/NPWSaFMskak

As my father’s daughter | I am proud to be my Father’s girl.

https://youtu.be/28jSPrI2laE

? About Austin Kalajila

I am a person who is positive about every aspect of life. There are many things I like to do, to see, and to experience. I like to read, I like to write; I like to think, I like to dream; I like to talk, I like to listen. I like to see the sunrise in the morning, I like to see the moonlight at night; I like to feel the music flowing on my face, I like to smell the wind coming from the ocean. I like to look at the clouds in the sky with a blank mind, I like to do thought experiments when I cannot sleep in the middle of the night. I like flowers in spring, rain in summer, leaves in autumn, and snow in winter. I like to sleep early, I like to get up late; I like to be alone, I like to be surrounded by people. I like country’s peace, I like metropolis noise; I like delicious food and comfortable shoes; I like good books and romantic movies. I like the land and nature, I like people. And, I like to laugh.

Channel Link: https://youtu.be/_AJjkoYvBCQ

??It is because of this reason that people are lousy at love.

??LET THEM GO | When life throws lemons at you make lemonade.

??Your Own Thoughts and Feelings determine your mental health.

??As my father’s daughter | I am proud to be my Father’s girl.

??Fight Against Child ABUSE, Emotional, and all forms of ABUSE

??A Special Dedication To All Mother’s. Mama I Am SORRY.

????TAGS????

#DebtCounsellingSA #DebtReviewSA #DebtReliefSA

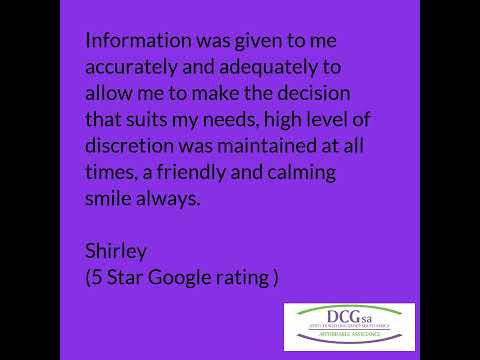

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

There isn’t one way to just obtain a debt consolidation loan or to pay off all of these debts. In fact, there are numerous amounts of ways you can get them. What we’re going to talk about here are the most common ways United States citizens consolidate debt.

Read our full article:

https://infoforinvestors.com/methods-to-consolidate-debt

Why Debt Consolidation is better than a Consolidation Loan.

Attorney Phil Creel teams up with Kabrina Bass, Executive Director of Midlands Mediation Center, to outline how mediation works and why it works. Many of your questions about mediation are answered in this episode of Level Up Law.

Hi Planner Friends,

Join me for a February 2023 Budget Review. In this video I am recapping the month and sharing how I use the Budget Mom workbook. I am covering goals, income, expenses, debt, savings, cash envelopes, sinking funds and savings challenges. For this budget, I use the Erin Condren Monthly Planner and the Budget Mom Workbook in the boxed set. I hope that you gain some budget and planning ideas from this video.

Budget Kit designed by me and available at Studio Bliss Co www.StudioBlissCo.com

Shop With Me for Stickers and Cash Envelopes on Etsy at Studio Bliss Co.

https://www.etsy.com/shop/StudioBlissCo

Join the Studio Bliss Co FaceBook Group here:

https://www.facebook.com/groups/2867631376833746/

Connect with me on Instagram:

@lifewithniabudgetandplan

@studioblissco

Save $10 on your first Erin Condren order:

http://bit.ly/2R1EPQv

Save $5 off your first $15 or more order with Simply Gilded http://bit.ly/2PvOUnw

Check out my Amazon Favorites:

Sharpie S-Gel Pens. https://amzn.to/3pm025b

Sharpie S-Gel Gunmetal Barrel https://amzn.to/320NyXd

Sharpie S-Gel Gunmetal Barrel (12 Pack) https://amzn.to/3uT3cjV

Sharpie S-Gel Champagne Barrel. https://amzn.to/3qZTbzV

Sharpie S-Gel Frost Blue Barrel. https://amzn.to/2OHVaei

Sharpie S-Gel White Barrel https://amzn.to/3sqvel1

Sharpie Paint Marker Extra Fine Point https://amzn.to/3dOwSJw

Uni-Ball Gel Impact UM-153 White Ink 1.0mm Rollerball. https://amzn.to/32IBt9r

Locking Curved Craft Tweezers https://amzn.to/3wG8UqV

Clean Color Dot Dual Tip Set. https://amzn.to/3u0PL1M

Clean Color Dots Metallics. https://amzn.to/3bfYENo

Clean Color Dots Basic Colors. https://amzn.to/30iqa6w

Ring Light. https://amzn.to/2UkqWgw

Waterpik. https://amzn.to/3nZzRSm

Ring Doorbell. https://amzn.to/31esCMi

Solar Lights. https://amzn.to/3dw16yK

Infrared Thermometer https://amzn.to/3513s4V

Personal Agenda https://amzn.to/2PgKpfI

Personal Agenda Blue. https://amzn.to/2HluYSv

? PO BOX ?

Nia Brown

PO BOX 2463

Elk Grove, CA 95759

What happens when you enter into a debt consolidation program?

Debt consolidation companies often promise to consolidate your debts and negotiate settlements with your creditors. These companies frequently advise people to stop paying their debts and to make monthly payments to the debt consolidation company instead. This is done with the hope that the company will be able to use those funds to settle certain debts.

Will a debt consolidation program stop creditors from reporting negative information to the credit bureaus?

Unfortunately not. If you fall behind or stop paying on a debt, the creditor is permitted to report the late or missed payments to the credit bureaus.

So, even if a person is current on the monthly payments to the debt consolidation company, they can still be delinquent on payments to their creditors.

Entering into a debt consolidation program does not automatically change the terms of a person’s agreement with a creditor. Unless your creditor agrees to change the repayment terms, you will remain bound by the payment terms of your agreement with the creditor.

The creditor is also permitted to take action to collect the debt, such as collection calls, lawsuits, and garnishing a person’s wages or a bank account, and the creditor can report delinquencies to the credit bureaus. Reports of missed payments to the credit bureau can hurt your credit score and impact your future borrowing capabilities.

How will your credit be impacted if the debt is settled?

If your creditor agrees to accept a balance less than the full balance that you owe to settle a debt, the account will still remain on your credit report.

Additionally, any missed or late payments prior to the settlement being reached will remain reported as well. Your credit report should reflect that there is no longer a balance owed. However, it is likely to also reflect that the debt was settled and not paid in full.

Should someone who is considering a debt consolidation program also consider bankruptcy?

Yes. It is common for people to believe that a debt consolidation program is a better option than bankruptcy due to concerns about the credit impact. However, the negative credit consequences associated with debt consolidation programs are less commonly understood.

There are actions that people are able to take to overcome credit challenges and accomplish their financial goals. In many instances, eliminating or restructuring debts through bankruptcy may put an individual in a better position to be able to rebuild credit quickly.

At Financial Freedom Legal, we offer free bankruptcy consultations that can be completed via telephone, Zoom, or in-person in Richmond, VA. We also offer flexible scheduling and are happy to meet with you on evenings and weekends.

Generally, an appointment takes approximately 1 ½ hours to complete. At this appointment, you are able to explore your options with an experienced debt relief attorney. There is no obligation to file. If you are considering debt consolidation, we strongly recommend also taking the time to learn about your options under bankruptcy.

www.fflegalva.com

Getting into debt is an ugly and often unexpected experience. One day you’re coasting along, managing fine with your finances, and then one unexpected expense puts you over the edge. To avoid this problem, look at your spending patterns. If you see any signs that you’re walking a financial tightrope, consider tightening your belt a little.

If you find that you’re already over the brink, consider getting credit counselling services from experienced specialists: www.4pillarsvi.ca/