Top Rated Videos

Debt consolidation means taking multiple debts such as credit cards, store cards or other loans and consolidating these debts into a single loan. But make sure you do your research first to make sure debt consolidation is right for you.

Learn more about debt consolidation here: http://nab.co/UUWBDr.

In this podcast Morris Fischer discusses the mediation process, what you expect at the mediation. He goes the biggest mistakes people make mediation. Are you prepared for mediation?

Contact Morris E. Fischer, LLC for a consultation at 800-209-2608 or contact us on the web at www.morrisfischerlaw.com. Morris practices in the Washington DC Metro Area and New York. His office handles federal cases nationwide.

Considering debt consolidation? Here are five things you need to check to determine whether you should get a debt consolidation loan.

Check out Credible to easily compare loans:

https://bit.ly/consolidate-dfm

——–

?CHECK OUT THE HOW TO CONTROL YOUR SPENDING WORKBOOK

http://bit.ly/DFMworkbook

——–

? READY TO BUDGET?

Sign up for the Debt Free Millennials FREE budget toolkit: https://www.debtfreemillennials.com/toolkit

——–

? SIGN UP FOR BUDGET BOOTCAMP

https://www.debtfreemillennials.com/budget-bootcampl

——–

? My favorite money-saving app: FETCH REWARDS

USE CODE WR367 TO RECEIVE FREE POINTS! https://fetchrewards.onelink.me/vvv3/referraltext?code=WR367

——–

My favorite investing app: ? ROBINHOOD

Sign up with my link and get one free stock like Apple, Ford, or Microsoft! https://robinhood.c3me6x.net/5OkXo

——–

Kyle’s favorite investing app: WEBULL

Sign up and get FREE stocks with WeBull: https://act.webull.com/te/yt2IdCaLHpVl/vks/inviteUs/main

——–

My favorite FREE car insurance quote comparison tool:

GABI® NOW EXPERIAN®, FOR AUTO INSURANCE

https://www.dpbolvw.net/click-100603519-15223028

——–

? Facebook Group: https://www.facebook.com/groups/debtfreemillennials

? Instagram: https://www.instagram.com/debtfreemillennials_

? Site: https://www.debtfreemillennials.com

Music by: Lakey Inspired – https://soundcloud.com/LAKEYINSPIRED

Disclosure: Links contain affiliates. When you buy through one of my links, I will receive a commission. This is at no cost to you and helps support my channel!

In this video we will discuss: What is debt consolidation?

How will this financial alternative affect my credit?

How can I leverage debt consolidation?

Will this affect my home buying process?

Top five consolidation lenders you can apply for NOW with bad credit!

Click this Link to read the full Article : https://medium.com/@Superior.Shelbie/debt-consolidation-in-2023-2f6c0fc0789d

Book a consultation now if you need help applying for Grants!

https://calendly.com/expandmywallet/30min

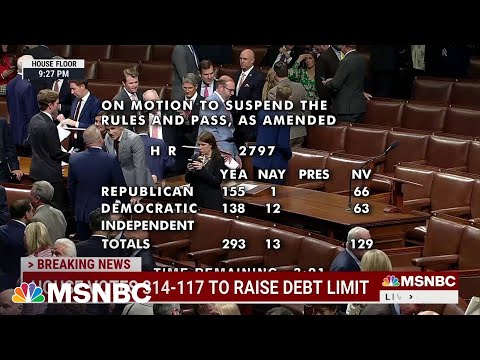

Jen Psaki, former White House press secretary, and Peter Baker, chief White House correspondent for The New York Times, talk with Alex Wagner about what was accomplished by both parties as the House passes the debt ceiling bill, sending it to the Senate, and what President Biden might do to avoid having to deal with a Republican debt ceiling stunt in a potential second term.

» Subscribe to MSNBC: http://on.msnbc.com/SubscribeTomsnbc

Follow MSNBC Show Blogs

MaddowBlog: https://www.msnbc.com/maddowblog

ReidOut Blog: https://www.msnbc.com/reidoutblog

MSNBC delivers breaking news, in-depth analysis of politics headlines, as well as commentary and informed perspectives. Find video clips and segments from The Rachel Maddow Show, Morning Joe, The Beat with Ari Melber, Deadline: White House, The ReidOut, All In, Last Word, 11th Hour, and Alex Wagner who brings her breadth of reporting experience to MSNBC primetime. Watch “Alex Wagner Tonight” Tuesday through Friday at 9pm Eastern.

Connect with MSNBC Online

Visit msnbc.com: http://on.msnbc.com/Readmsnbc

Subscribe to the MSNBC Daily Newsletter: MSNBC.com/NewslettersYouTube

Find MSNBC on Facebook: http://on.msnbc.com/Likemsnbc

Follow MSNBC on Twitter: http://on.msnbc.com/Followmsnbc

Follow MSNBC on Instagram: http://on.msnbc.com/Instamsnbc

#msnbc #debtceiling #republicans

DCM Group Marketing Director Anjela da Silva gives advice on what to look out for so that a consumer can identify a reputable debt counselor

You should choose a local, trusted and accredited credit counselling partner to help you find debt relief. At Credit Counselling Services of Atlantic Canada, we will work with you to find a solution that works.

Visit us at www.solveyourdebts.com

Get started with our Free Credit Repair Program at ecredithero.com

Summons from creditors is one of the expected outcomes of a bankruptcy. Your creditors will file a case against you when you fail to pay. When this happens, you need to seek debt mediation. This kind of arrangement is also known as debt settlement. Usually, the creditor you owe money will hire a credit collection agency to represent them in the case.

For more information, check out their website: http://www.debtmediators.com.au

I PAID OFF $10,000 IN CREDIT CARD DEBT IN SIX MONTHS GJFREKJGHRJFEGK I’m too excited WOW. Here’s a very detailed video of my debt payoff process!! #personalfinance #debtpayoff #creditcarddebt

TIME STAMPS:

0:00 – intro

2:01 – how I got into 10k of credit card debt

5:30 – get serious and commit to a debt payoff plan

6:30 – balance transfers

7:23 – track your income and expenses & create a budget

7:59 – pay more than minimum payments (debt snowball vs debt avalanche)

9:04 – find extra money to use toward debt (cut your spending and/or make more money!)

11:18 – I have definitely increased my income (+ my estimated total income for 2019)

12:50 – what percentage of my income goes toward debt?

14:35 – how much did I pay each month?

16:40 – my debt payoff hype song lmfao

17:36 – how do you resist lifestyle inflation / spending more as you earn more?

18:43 – how do you stay motivated during debt payoff?

19:57 – what was the most helpful way to think about the process of paying off debt?

20:33 – are you saving while paying off debt?

21:13 – what’s next? Pay off my student loans! + my current total loan balance

22:49 – how has your credit score changed?

23:24 – did you still use credit cards while paying them down?

24:46 – what do you recommend for young people regarding credit cards and student loans?

SOURCES & REFERENCES:

Opening Up About My Student Loans and Credit Card Debt – https://youtu.be/tku2C-DgA6s

Finances of a Full-Time YouTuber (taxes, budgeting, etc) – https://youtu.be/3NMQyrvp7o8

Debt Snowball Vs Debt Avalanche | Which is the Best Debt Payoff Strategy? – https://youtu.be/jtgnRJKSJlw

What is a balance transfer? – https://www.creditkarma.com/credit-cards/i/what-is-balance-transfer/

The Financial Diet – https://www.youtube.com/channel/UCSPYNpQ2fHv9HJ-q6MIMaPw

Aja Dang – https://www.youtube.com/user/ajabdang

Sarah Nourse – https://www.youtube.com/channel/UCDbGw5fdxTLjRsNnD7_Jwvw

? Instagram: https://www.instagram.com/tferg__/

? Twitter: https://twitter.com/tiffanytheprez

? My Podcast, Previously Gifted: http://bit.ly/previouslygifted

? Vlog Channel: http://bit.ly/tfergvlogs

? Political Channel: http://bit.ly/sociallyunacceptable

??? Use my affiliate links to support my channel 🙂 ???

* My go-to eyeshadow palette (vegan and cruelty free!) https://amzn.to/2WnU5tX

* 10% off Glossier (for first time customers). I use the Perfecting Skin Tint, “Cake” and “Zip” Generation Z lipstick

– https://re.glossier.com/72ff5ffa

*Sign up for my fav travel site, Airbnb, for a $40 credit! http://www.airbnb.com/c/tferguson42

*Here’s an Amazon list with all of the equipment I use to film my videos, including my camera, mic, ring light, and more! http://bit.ly/filmingequipment

Hello my dudes! My name is Tiffany Ferguson. I’m a 24 year old sharing my thoughts and life experiences. Here on Tiffanyferg, recently I’ve been working on my Internet Analysis series, where I research and discuss topics related to social issues and media. I also occasionally talk about my experiences with college, traveling, study abroad, veganism, and more.

Business Inquiries: tiffanyferguson@select.co

FTC: This video is not sponsored. Links with * are affiliate, meaning I am compensated monetarily if you join or make a purchase.