[Experience] Videos

Contact us now for personalized credit mediation services tailored to your suit financial needs.We do assist with services such as Debt Review Removal and ITC Clearance.

Give us a call today to regain control of your finances and your credit profile

Contact Us:

Whatsapp: 069 523 6184

Call Us :087 163 6359

Email :mediator1@nitc.co.za

Hear the story of Ashley and Chantal, a married South African couple who overcame financial struggles through the power of debt counselling. In this video, we share their journey from relationship strain caused by finances to a harmonious and debt-free life.

#Debtcounselling #marriageadvice #relationshipstruggles #financialtransformation #debtmanagement #loveandfinance #debt-freejourney #relationshipcounselling #financialsuccess #overcomingdebt #couplegoals #counsellingimpact #debtrelief #buildingastrongermarriage #debtcounsellingbenefits #marriedinCOP #marriedincommunityofproperty

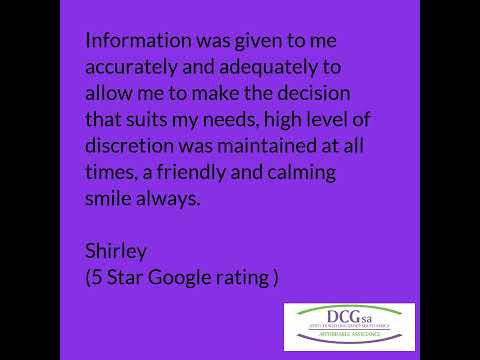

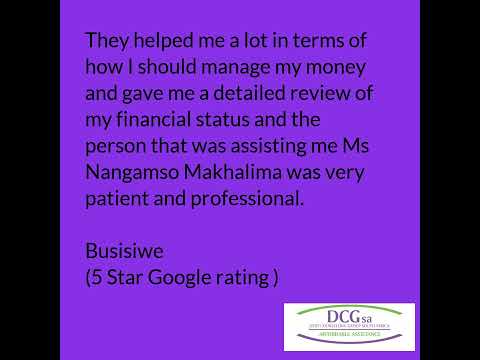

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

‘Back to the Black – How to become debt-free and stay that way’, is for those worried about debt and wanting to know how to manage the situation. By viewing the problem as a coach or a counsellor would, you’ll learn strategies for handling stress and formulating a plan. You’ll find out how to fix a repayment schedule that’ll shorten the time until you are debt-free; and discover some simple ways to track your spending while still enjoying life. After reading this book you will feel more confident of your ability to handle your debt situation…and you’ll have a plan for doing so. You’ll soon discover how to evaluate your current circumstances; how to set realistic goals for reducing your debt; how to develop a list of options; and how to calculate your discretionary income. This book also provides a comprehensive ‘Resources’ section, that outlines what further support is available to help ensure that a debt-free life is maintained after reading ‘Back to the Black’.

As their children grow up parents face increasing need to develop and guide their wise formal use of money. In the teen years, acquiring a credit card is a first foray. Then purchasing a first auto comes along. As post-secondary education nears, student loans arise. Graduation moves a better auto and a first condo or home purchase to the horizon. Increasing complexity and monetary magnitude of loan needs can be a scary challenge for people relatively new to debt.

Debt is a 4-Letter Word, but it need not be! is a book series that helps parents and young people to effectively maneuver through first-time debt worries. In The College Experience the reader walks along as a fictionalized Dad and daughter go through her independent need for a credit card for ongoing college expenses, financing her college dreams, considering graduate school, and planning for post-graduation repayment of student loans. One observes Dad’s caring teaching path; taken atop informed, strategic borrowing strategies he shares and uses as they make important decisions and take vital steps together. You see a parent become less and less overseeing and a daughter more and more self-reliant.

Debt is a 4-Letter Word, but it need not be! The College Experience volume includes:

• 20 LESSONS about typical college-related debt needs young families face

• 42 detailed hypothetical SITUATIONS numerically covering borrowing circumstances commonly encountered in real life college experiences

• Step-by-step explanation of needed calculation techniques

• 39 easy-to-do EXERCISES for the reader to try the illustrated calculation methods

• Table-based aids to simplify/expedite applying the detailed calculations procedures

While pragmatic and detailed, the book is written in a fun, narrative style so the reader will enjoy learning what otherwise might be unexciting financial matters.

If you are one of the millions of people who have hundreds or even thousands of dollars of credit card debt and want to seriously get out of debt and live debt free, then this simple, step-by-step, easy to follow plan is for you. In this book, you will have all the tools you need to get out of debt and stay out of debt. You will discover how to get control of your finances, how to create a monthly cash budget, how to eliminate credit card debt quickly, and have the skills you need to master your money. Start today and get serious about getting out of debt and saying goodbye to credit card debt for good. You CAN experience true financial freedom.