[Faster] Videos

The benefits of mediation. What to consider if making a cross border move. Ways to pay off debt faster. Investing post retirement.

Debt consolidation can help you pay off debt faster and help you save money by lowering your interest rate, if you do it the right way. If you don’t do it the right way it can cost you more money and take you longer to pay off. Learn how to use debt consolidation the right way. #debtconsolidation #financialseeds

JOIN EMAIL LIST:

https://financialseeds.net/

FREE DEVOTIONAL “DONE WITH DEBT”:

https://financialseeds.net/done-with-debt/

FREE VIDEO SERIES “BIBLE MONEY MAKEOVER”: https://financialseeds.net/bible-money-makeover-4/

FREE MASTERCLASS “$5, 5-MINUTE INVESTING PLAN”:

https://financialseeds.net/5-dollar-5-minute/

LEARN ABOUT MY SERVICES:

https://greenfinancialsolutions.net/

LEARN TO PICK THE BEST STOCKS:

https://greenfinancialsolutions.net/stock-picker/

SUBSCRIBE TO THIS CHANNEL FOR:

Investing and getting out of debt

LET’S CONNECT

Instagram | instagram.com/craigbaileyfinancialseeds

Facebook | facebook.com/financialseeds

Twitter | twitter.com/financialseeds

Website | financialseeds.net

Music Credit:

? Music Credit: LAKEY INSPIRED

Track Name:”Days Like These”

Music By: LAKEY INSPIRED @ https://soundcloud.com/lakeyinspired

Content by Craig Bailey, licensed financial advisor, creator of Financialseeds.net Bible-based financial advice for millennial couples.

In this video, I share with you how you can avoid debt forever and pay off debt faster using the Debt Avalanche Method!

If you liked this video, you will also enjoy:

? How To Be Rich and Successful At A Young Age: https://www.youtube.com/watch?v=py0qufx9phk

? How To Make $100/Day With No Money: https://www.youtube.com/watch?v=Mdgt7yoCKeQ

Music Credit: Bensound – Dreams

If you have any amount of debt to pay off, you’re probably wondering what debt elimination strategy will get you back in the positive in the fastest time frame possible. In the United States, debt has been skyrocketing year after year with personal consumer debt surpassing $4 trillion dollars in 2019 which means that Americans could be doing a much better job when it comes to paying down their debts. In this video, I am going to share with you one of the quickest methods of paying down your debt: The Debt Avalanche Method. And if you’re new to the channel, hit the subscribe button below for more informative content!

You’re probably asking yourself, what is the debt avalanche method? Do I need to be able to ski? Will it be cold? The Debt avalanche is a strategy of paying off what you owe by prioritizing loans and credit card balances with the highest interest rates. You see, while it sucks to have to look at a huge debt balance every time you check your bank balance, what’s worse is paying annoying interest charges. At least when you accumulated debt by buying goods and services you get value out of those things but interest charges are zero value-added expenses. Therefore, the goal of the debt avalanche is to minimize the amount of interest you pay, allowing you to put more money towards paying off the principle which in turn will allow you to be debt-free much sooner than if you were to use other strategies like the debt snowball.

Step #1: List out all of your debts

On a piece of paper or an excel spreadsheet, list out each one of your debts from the highest interest rate to the lowest. This could include anything from money you owe your brother, to credit card debt and even your car loan just to name a few. An important point to note is that you are arranging your debts from the ones with the highest interest rate and not the highest interest charge. While a large balance with a smaller interest rate may be costing you more money every month than the one with the highest interest rate, in principle, having the loan with the highest interest rate still outstanding is still the most costly.

Step #2: Make all your minimum payments

After you’ve listed out all of your debts from the highest to lowest interest rates it’s now time to write down each of their respective minimum payments. Every month, it is critical that you make the minimum payments on each one of your debts as missing payments will not only increase your debt but will also affect your credit score. In fact, being just 30 days late on a payment can reduce your credit score by up to 100 points making getting a future mortgage or even a job that much tougher. As a best practice, set up a reminder in your phone to make each one of your payments because often times life can get busy and having a reminder means one less you have to think about.

Step #3: Pay down extra on your highest rate debt

You’ve now set up your debt listing and have made all of your minimum payments, it’s now time to really get the debt avalanche rolling. In order to do this, what you’ll want to do is put any extra disposable income you have towards your highest interest debt. And if you’re thinking to yourself, I wish I had extra disposable income then it’s time to roll up your sleeves and get to work. Most people have more free time than they think and one of the best ways to use this time to make more money. This could be in the form of taking on more shifts at work or picking up side projects. No matter what this extra work looks like, the key is to funnel all that extra income towards your highest interest debt allowing you to pay it off as fast as possible.

Step #4: Keep the avalanche rolling

At this point, you are making solid progress at paying down your debts by prioritizing them and earning extra cash to put towards them. Within no time, you’ll be able to stroke off the first debt on your list allowing you to begin to focus your attention on the second one. In order to keep the avalanche rolling, you will need to do three things: continue to make the minimum payments on each debt, earn extra income and finally add all previous debts’ minimum payments to your new monthly debt contribution. So for instance, if the debt you just paid off had a $200 minimum payment, you will add that amount to the minimum payment contribution on your next highest debt creating an avalanche effect of a much greater payment. And this larger payment, when compounded with extra income you’re earning, will make your debt load evaporate in no time!

Debt consolidation loans are all over the place and they all promise lower interest rates, lower monthly payments and a better overall option to paying off debt.

With debt consolidation you can combine your various credit card debts, store credit cards like a sears credit card, medical bills, or gas credit cards like a bp credit card – into just one monthly payment. It typically does come with a lower interest rate, but is it actually going to save you money over just paying your minimum monthly payments?

Matthew Pillmore digs into consolidation and shows which gets you debt free faster and which ends up costing you less in the long run.

Don’t forget to sign up TODAY for your exclusive one on one consultation at:

http://www.FreeCoachingCalendar.com

Our coaching costs can change with demand. To see our current pricing please watch this video:

https://www.youtube.com/watch?v=HbVLmCvFjoI

Keep in mind – we have an ongoing contest for the next 5 months! We’ll be giving away a $25 Amazon Gift Card every week, Video Coaching Sessions and a Grand Prize trip to Denver! Check out the rules and prizes in more detail below:

CONTEST RULES:

In order to be eligible for the ongoing contests you must:

A) Be Subscribed

B) Comment on this video

(We’d love to hear what you’ve learned from our channel and how it is impacting you!)

Each time you comment on a new video your name will be entered into the contest drawing, so the more you comment on the videos, the better your chances of winning! You can also gain additional entries by sharing our video on your social media accounts or by commenting on our Instagram or Facebook accounts.

CONTEST PRIZES:

1: $25 Amazon Gift Cards

a) 1 winner selected each week for next 24 weeks.

2: 2 Hour Skype Coaching Session

a) 1 winner selected each month for next 5 months.

b) To be considered:

– Must have a MINIMUM of $500 average cash flow each month. No exceptions.

3: GRAND PRIZE – 2 Night Trip For Two to Denver and an Afternoon With Mr. Pillmore

a) 1 winner selected first week of October.

b) To be considered:

– Must have a MINIMUM of $500 average cash flow each month. No exceptions.

– Win a 2 hour Skype session with Mr. Pillmore.

Current coaching members are also eligible for the contest!

Want more actionable financial tips and tricks like this one? Check out our YouTube channel here https://www.youtube.com/channel/UC45hHuqWfdi7TIZg0RDG9_g

Make sure to check out our social channels for more insight and industry news!

Facebook – https://www.facebook.com/VIPFinancialEducation/

Instagram – https://www.instagram.com/vipfinancialed/

Instagram (Lifestyle) – https://www.instagram.com/vipfinancialedlifestyle/

Twitter – https://twitter.com/VIPFinancialEd

LinkedIn – https://www.linkedin.com/in/vipfinancialed/

BBB A+ Rating – https://www.bbb.org/denver/business-reviews/financial-services/vip-enterprises-llc-in-westminster-co-90024254/

Complimentary services and products mentioned in our videos are available for a limited time only and are not guaranteed at the viewing of this video. VIP Financial Education provides resources for educational purposes only. Our education is not a substitute for legal, tax, or financial advice and results vary. VIP Financial Education encourages viewers to do their homework before taking any financial action. VIP Enterprises, LLC may from time to time earn commissions by recommending various products, services, and programs.

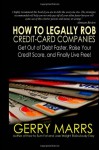

THIS IS THE BOOK THAT THE CREDIT-CARD COMPANIES DON’T WANT YOU TO READ!!!

So, you may be looking for a book on such a subject because you amassed a certain amount of debt, perhaps fallen behind in some payments, or even considered bankruptcy. Sometimes debt isn’t even a result of overspending but just bad life circumstances such as a death or divorce of someone that helped us live to a certain standard. There is nothing to be ashamed of or even worried about.

Using the strategies in this book, you can pay off your debts in the least amount of time and live free again.

Imagine instead of paying everything off in five to seven years, you’re able to do this in two. Can you wait that long to be completely debt free?

The strategies used in this book are based on time-tested equations that will significantly reduce the time it will take to pay off your credit debt, saving you thousands of dollars. Additionally, Gerry Marrs will teach you some guerrilla tactics that will literally cut your credit card balances in half, and free you from the chains of debt bondage. The plan in this book is simple to implement, and flexible according to your lifestyle needs.

This book will show you some quick-payoff principles as well as how to save more, spend less, and perhaps even make some money. Gerry Marrs calls this principle the three pillars of financial success; save, budget, and earn. When you can balance all three of these functions of personal finance, you can achieve great wealth and prosperity.

Here are some of the things you will find in this book:

* Understanding Debt and Credit

* Types of Debt

* Debt-to-Income Ratio: What is it?

* Median Ranges of Debt-to-Income

* The REAL Cost of Credit Debt

* How banks calculate home loans

* The real cost of credit card debts and how they are calculated

* Getting a better deal

* Practical Money Skills For Life

* Setting Serious Goals

* Why should I set goals?

* Visualize your goals and write them down

* Personal Goals Vs Financial Goals

* Create a Solid Timeline

* 3 Tiered Plan Of Saving

* Short Term and Long Term Financial Goals

* Prepare to do Battle!

* Finding Additional Resources

* Making a Budget You Can Live With

* Health Insurance

* Grocery Bills

* Utility Costs

* Banking and/or Check Cashing Fees

* Additional Income Opportunities

* Yard Sales

* Odd Jobs around Your Community

* Freelance Writing Gigs

* The Light at the End of the Tunnel

* Laying Out Your Debts

* Prioritize Your Debts

* Map Out Other Bills

* Decrease Your Expenses

* Credit Scores and Credit Reports: A Primer

* What Is a Credit Score?

* The Credit Score Model

* Credit Worthiness

* Credit Reporting Companies

* Credit reporting Scams

* Demystification of the credit reporting systems in the United States of America

* The Effect on Interest

* The Get out of Debt Early (GOODE) System

* Choosing which Debts to Pay Early

* Calculating pay-offs

* Online debt repayment calculators

* Right to the Source

* Yet even more calculators

* Manually Calculating Payments for More Control

* Calculating Monthly Credit Card Interest, the Easy Way

* Calculating Monthly Credit Card Payments, the Easy Way (or MAYBE NOT)

* Determining the Amount of Time to Pay Something Off

* Setting up your payment strategy

* What happens when you can no longer make a payment?

* What happens when you miss one single payment?

* What happens when you are unable to pay a second month?

* What happens when you cannot make payments beyond six months?

* What happens when you cannot make payments for years?

* Working with Creditors, Some Useful Scripts

* Proactive Approach

* Reactive Approach

* Sample Scripts

* How To Legally Rob Credit Card Companies

* Debt held by credit card company

* Debt held by collection agency

Don’t delay! Order your copy today!