[Paying] Videos

SA government is still paying for international debt from YEARS ago!

Our government steals from us while we spend our lifetimes paying taxes to pay off their DEBT!

????Subscribe for guidance towards your dreams with Mpho Dagada’s wisdom: https://bit.ly/49RiBpB

? Stay Connected With Me.

????Facebook: https://www.facebook.com/mphodagda/?modal=admin_todo_tour

????Instagram: https://bit.ly/3Vj0Fjk

????Tiktok: https://www.tiktok.com/@mpho_dagada

????Twitter: https://bit.ly/3VjSC5R

????Threads: https://www.threads.net/@mphodagada____

????Linkedin: https://bit.ly/3VfpcpC

????Website: https://www.mphodagada.co.za/

? For Business Inquiries: md@mphod.com

=============================

? Recommended Playlists

???? Entrepreneurship

https://bit.ly/3VefF1S

????Mental Health

https://www.youtube.com/watch?v=NSS8lFp4w3c&list=PL7aryAHHUfX3RyBGJ33wOs5ALRbGEpiqX&pp=iAQB

? Other Videos You Might Be Interested In Watching:

???? Arise, South Africa, President Mpho Dagada on SABC News

https://bit.ly/3wRVcpL

???? Arise, South Africa to contest 2024 Elections, with Mpho Dagada as its Leader eNCA

https://www.youtube.com/watch?v=X37sdZGQwPo

???? Mams Radio Interview

https://bit.ly/49OoV13

???? Billions of rands were invested, yet power stations were only 15 years later.

https://www.youtube.com/watch?v=LwNEpqtkRKw

=============================

? About Mpho Dagada.

Mpho Dagada, who is a bestselling author, entrepreneur, and speaker, draws on personal life successes and passions to inspire and rally global agents of change to build a more profitable future for all to ensure that each individual becomes an asset in their organizations, advocates of change in their society and leaders in their world.

Mpho uses this Channel to inspire, educate, and encourage everyone to aspire to achieve their dreams, discover their purpose, and press toward realizing it.

Stay tuned for mindset-altering insights, perception-shifting conversations, laughs, and more “aha” moments than you’ve experienced elsewhere.

For Collaboration and Business inquiries, please use the contact information below:

???? Email: md@mphod.com

???? Transform your thinking and lead the change in your world. Subscribe to Mpho Dagada’s channel for inspiration and actionable insights: https://bit.ly/49RiBpB

=================================

#MphoDagada #AriseSouthAfrica #Taxes #Debt

Disclaimer: I do not accept any liability for any loss or damage incurred from you acting or not acting as a result of watching any of my publications. You acknowledge that you use the information I provide at your own risk. Do your research.

Copyright Notice: This video and my YouTube channel contain dialogue, music, and images that are the property of Mpho Dagada. You are authorized to share the video link and channel and embed this video in your website or others as long as a link back to my YouTube channel is provided.

© Mpho Dagada

In this video I’m taking you through the process of how a debt gets to be a prescribed debt, the Pros and Cons.

To book your credit repair program go to my website

https://thandofinancialeducation.co.za/

#creditrepair #creditreport #creditscore @MapaloMakhu @TalkingMoneyWithNozi@MirandaZulu

In this video, Keith Wright breaks down some tips to help you pay off credit card debt while saving time and money on interest.

SHADED MONEY | IMPROVING YOUR FINANCIAL HEALTH

Find out how you can earn a free stock through the Robinhood app:

https://join.robinhood.com/keithk221?

Receive $10 in Bitcoin when you buy or sell your first $100 of crypto currency on Coinbase:

https://www.coinbase.com/join/kingwr_b

Connect with Shaded Money on Social Media:

https://instagram.com/ShadedMoney??

https://instagram.com/keithxwright??

Chapters

0:00 – Intro

0:32 – What is debt consolidation/Credit card interest rates

1:22 – #5 Payday Loan

1:57 – #4 Personal Loan

2:34 – #3 Personal Line of Credit

3:09 – #2 Balance Transfer

3:48 – #1 Employer Sponsored Retirement Plan Loan

4:34 – Outro

Intro Music: KY

Background Music: T-Reg

In Loving Memory of Maurice Dwayne McIntosh II

All Rights Reserved. K. Wright Holdings, LLC. 2022

SUPPORT THESE VIDEOS:

? Patreon – https://www.patreon.com/NextLevelLife

START INVESTING FOR FREE:

? M1 Finance – https://m1finance.8bxp97.net/NextLevelLife

GET YOUR FREE AUDIOBOOKS:

? Audible FREE Trial (Includes FREE Audiobook) – https://amzn.to/2zEFqhT

? My Favorite Books – https://thefinancialghost.com/books/

START YOUR OWN SIDE HUSTLE:

? Bluehost (Start Your Own Website) – https://www.bluehost.com/track/nextlevellife/

? ConvertKit (Build Your Business) – https://convertkit.com?lmref=cdSVnQ

? TubeBuddy (Grow Your Own YouTube Channel) – https://www.tubebuddy.com/NextLevelLife

? VidIQ (Alternative to TubeBuddy) – https://vidiq.com/#_l_1ra

You’re Wrong… Paying Debt Off Early Works (4 Reasons):

Conventional wisdom suggests that paying off debt early at the expense of some of your investment money in the short term is a bad trade unless the debt you’re carrying is high interest debt like credit cards. The thinking is why would anyone want to pay off debts with 5% or 6% interest rates when they could instead invest that extra payment money into the markets and earn 7%-10%. And, to be fair, there are certainly instances where that logic makes a lot of sense. I know the title of the video is pretty black and white, but that’s mainly because in my experience the discussion surrounding this topic presents it as a very clear cut decision and I feel that there’s a bit more nuance to it that often gets lost in translation. Today I’m going to be going over 4 reasons why I feel that, in certain situations, paying off even lower interest debts can be the better approach, even if it means giving up some investment returns in the short-term.

SUBSCRIBE FOR WEEKLY FINANCE VIDEOS: https://www.youtube.com/channel/UCbsDR27rGCFdDKQVRl_tgEQ?sub_confirmation=1

WANT TO LEARN MORE ABOUT MONEY?

All of my Personal Finance videos: https://goo.gl/3qMbXW

All of my Financial Independence & (Early) Retirement Videos: https://goo.gl/R5JU8E

All of my Stock Market & Investing Videos: https://goo.gl/swSUQN

All of my Debt-Related Videos: https://goo.gl/9HkrtF

All of my Budgeting Videos: https://goo.gl/D3iiSn

All of my Side Hustles/How to Make More Money Videos: https://goo.gl/oQui48

All of my Book Summaries: goo.gl/xmWeaD

SUPPORT THIS CHANNEL:

? Patreon (Exclusive Content From Me) – https://www.patreon.com/NextLevelLife

? M1 Finance (Start Investing Today) – https://m1finance.8bxp97.net/NextLevelLife

? You Need A Budget (Excellent Budgeting Software) – https://www.youneedabudget.com/

BOOKS & EDUCATIONAL RESOURCES:

? Audible FREE Trial (Includes FREE Audiobook) – https://amzn.to/2zEFqhT

? My Favorite Books – https://thefinancialghost.com/books/

? Skillshare (Affordable Online Video Classes) – skillshare.eqcm.net/NextLevelLife

START YOUR OWN SIDE HUSTLE:

? Bluehost (Start Your Own Website) – https://www.bluehost.com/track/nextlevellife/

? Wix (Alternative to Bluehost) – https://wixstats.com/?a=30171&c=2611&s1=

? ConvertKit (Build Your Business) – https://convertkit.com?lmref=cdSVnQ

? TubeBuddy (Grow Your Own YouTube Channel) – https://www.tubebuddy.com/NextLevelLife

? VidIQ (Alternative to TubeBuddy) – https://vidiq.com/#_l_1ra

???? NordVPN (Protect Yourself & Your Business Online) – https://go.nordvpn.net/aff_c?offer_id=15&aff_id=30988&url_id=902

???? Fiverr (Hire Freelancers to Help Scale Your Business) – https://track.fiverr.com/visit/?bta=51908&brand=fiverrcpa

? Grammarly (Free online Grammar Checker) – https://grammarly.go2cloud.org/aff_c?offer_id=182&aff_id=45298

OTHER RECOMMENDATIONS:

? Check Out My Merchandise (Shirts) – https://teespring.com/stores/next-level-life?aid=marketplace&tsmac=marketplace&tsmic=campaign

#PersonalFinance #Wealth #Money

Disclaimers: All opinions are my own, sponsors are acknowledged. Links in the description are typically affiliate links that let you help support the channel at no extra cost to you.

How Do I Change Jobs While Paying Off Debt?

Say goodbye to debt forever. Start Ramsey+ for free: https://bit.ly/35ufR1q

Visit the Dave Ramsey store today for resources to help you take control of your money! https://goo.gl/gEv6Tj

Did you miss the latest Ramsey Show episode? Don’t worry—we’ve got you covered! Get all the highlights you missed plus some of the best moments from the show. Watch debt-free screams, Dave Rants, guest interviews, and more!

Want to watch FULL episodes of The Ramsey Show? Make sure to go to The Ramsey Show (Full Episodes) at: https://www.youtube.com/c/TheRamseyShowEpisodes?sub_confirmation=1

Check out the show at 4pm EST Monday-Friday or anytime on demand. Dave Ramsey and his co-hosts talking about money, careers, relationships, and how they impact your life. Tune in to The Ramsey Show and experience one of the most popular talk radio shows in the country!

Ramsey Network (Subscribe Now!)

• The Ramsey Show (Highlights):

https://www.youtube.com/c/TheRamseyShow?sub_confirmation=1

• The Ramsey Show (Full Episodes): https://www.youtube.com/c/TheRamseyShowEpisodes?sub_confirmation=1

• The Dr. John Delony Show: https://www.youtube.com/c/JohnDelony?sub_confirmation=1

• The Rachel Cruze Show: https://www.youtube.com/user/RachelCruze?sub_confirmation=1

• The Table with Anthony ONeal: https://www.youtube.com/user/aonealministries?sub_confirmation=1

• The Ken Coleman Show: https://www.youtube.com/c/TheKenColemanShow?sub_confirmation=1

• The Christy Wright Show: https://www.youtube.com/c/ChristyWright?sub_confirmation=1

• EntreLeadership: https://www.youtube.com/c/entreleadership?sub_confirmation=1

ABC News’ Faith Abubey reports on individuals who have paid off mountains of debt in the midst of the pandemic.

ABC News Live Prime, Weekdays at 7EST & 9EST

WATCH the ABC News Live Stream Here: https://www.youtube.com/watch?v=w_Ma8oQLmSM

SUBSCRIBE to ABC NEWS: https://bit.ly/2vZb6yP

Watch More on http://abcnews.go.com/

LIKE ABC News on FACEBOOK https://www.facebook.com/abcnews

FOLLOW ABC News on TWITTER: https://twitter.com/abc

Deciding between a balance transfer credit card and a debt consolidation loan depends on the terms you get, the repayment plan, and your comfort with risk. A balance transfer credit card is a great option if you can get a 0% introductory APR, AND you can pay off the balance before the period expires. A debt consolidation loan might be better if you need a more extended period to pay off the debt.

So, when thinking about debt consolidation, you need to think about these things:

1. Are you just kicking debt down the road? Meaning ae you paying off debt by taking out more debt? You have to lower your spending and be committed to not accruing more debt as you work on paying off

your debt.

2. If you have a low credit score, you probably won't be able to get a lower interest rate on the balance transfer or debt consolidation loan. So, first focus on making on-time payments, paying off debt, and increasing your credit score.

3. make sure you have a budget and have found a way for that budget to work successfully in your life.

Now, of course, I always recommend paying off your debt by buckling down, controlling your spending, and learning about why you are debt in the first place. Addressing and understanding why you go into

debt is critical if you want to make changes to stay out of debt in the future.

That said, when you are facing financial hardship, sometimes debt consolidation can help when you have high-interest debt that is not manageable.

CHAPTERS

Intro: 00:00

What is debt consolidation: 00:54

The benefits: 01:45

How to consolidate your debt: 03:23

Things to consider: 09:55

?? SHOULD YOU CONSOLIDATE YOUR DEBT: https://bit.ly/3e69JAv

?? SHOULD YOU CONSOLIDATE STUDENT LOANS: https://bit.ly/3oy9xPw

?? FINDING YOUR WHY: https://bit.ly/3aJUryj

?? THE BUDGET MOM’S FINANCIAL FREEDOM STEPS: https://bit.ly/3cfJXsp

?? HOW TO GET STARTED WITH THE CASH ENVELOPE METHOD: https://bit.ly/2vQJaO5

?? HOW TO CREATE A PLAN OF ATTACK TO PAY OFF DEBT: https://bit.ly/2wDETxF

ABOUT ME

I’m the blogger behind https://www.thebudgetmom.com. I have a rambunctious 6-year-old son, live in Washington, and I’m passionate about helping people with money management and personal finance. Let me know what you like to learn more about! Leave me comments and suggestions on my video and let me know!

YOU CAN FIND ME AT:

? BLOG: https://www.thebudgetmom.com

? FACEBOOK: https://www.facebook.com/thebudgetmom/

? INSTAGRAM: https://www.instagram.com/thebudgetmom/

? PINTEREST: https://www.pinterest.com/thebudgetmom/

GET STARTED

??Start Here: https://www.thebudgetmom.com/start-here/

??Free Email Course: https://bit.ly/2UYgNFf

??Free Resources: https://bit.ly/2PDmTHz

??GET 10% OFF my popular Budget-by-Paycheck Workbook – Coupon Code TBMYOUTUBE https://bit.ly/2CR7U9n

I’m Aja Dang and here are the 7 things I wish I knew about paying off debt while I was paying off my credit card, car and student loan debts. Just remember, you are so brave for wanting to tackle your debt. I feel like now there is this huge momentum for people in our generation to want to get out of debt – we are stick of feeling broke and tired of watching our paychecks go to someone else. No more! This is an exhausting journey but hopefully these 7 things will remind you that you are not alone in your experience. Here are the lessons I learned about paying off debt.

• THUMBNAIL •

Elaine Zhao: http://bit.ly/394T78L

• VIDEO EDIT •

Michelle Choi: https://bit.ly/31P9OVc

• END CARD •

Chrisline Raymundo: https://bit.ly/38SKvD6

•SUBSCRIBE TO MY CHANNEL•

http://bit.ly/SubAjaDang

•STAY CONNECTED•

Website: http://www.ajadang.com

Instagram: http://bit.ly/IGAjaDang

Twitter: http://bit.ly/TweetAjaDang

Facebook: http://bit.ly/FBAjaDang

Podcast: http://bit.ly/2Yyj9fJ

Tiktok: ajadang

Are you looking for debt solutions? Are you disorganized? Do you have trouble paying your bills? There is help. Youre not alone in this. We are a Canadian non-profit service, and we can help.

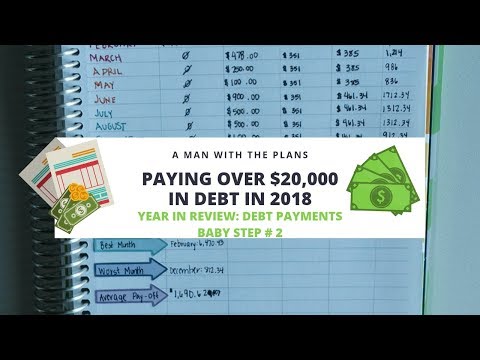

As I’m closing out my 2018 Year in Review, I wanted to take a look at home much money I put to debt this entire year. I went through each of my current debts from 2018 (4 in total: 1 credit card, 2 student loans and 1 car loan) and looked at how much I paid. These payments are both principal and interest, but it’s crazy how much I did this year and how much room for improvement I still have on my debt free journey. What are you doing in 2019 to tighten your budget to hit your financial goals?

Links for products used down below! (Note: some may be affiliate links!)

Connect with me!

AManWithThePlans on Instagram

A Man with the Plans on Facebook

www.amanwiththeplans.com

Looking to make your first EC purchase? Use my code below to get a $10 coupon code emailed to you! Lucky for me, I’ll also get a $10 off coupon code (at no cost to you), so that I can keep sharing all of my favorite goodies! Thanks!

Erin Condren Colorful Hourly Life Planner:

https://www.erincondren.com/referral/invite/ryanselock0323/1

Dave Ramseys: Total Money Makeover:

https://amzn.to/2J78Nwr

Capital One 360 (Interest Bearing Checking Accounts!):

https://capital.one/2KRdg7b

The Miracle Morning by Hal Elrod

https://amzn.to/2xpmUYk

Papermate Flair

https://amzn.to/2NmJoUV

Camera I use: Canon G7X:

https://amzn.to/2Pc2U7j

SWAG Bucks (Take Surveys to Earn Gift Cards):

http://www.swagbucks.com/p/register?rb=47837497