[Professional] Videos

?? ?? ? Using Arbitration: https://arbitrationagreement.com/

Education to Level Up Your Business:

Libraries for awesome help and direction:

??? Arbitration: https://arbitrationagreements.org/

??? Services: https://arbitrationagreements.org/arbitration-agreement/

Recommended Videos:

??????? Meaning of Arbitration (Tutorial):

https://youtu.be/UE5UiLki950

?Timestams

00:00 Intro Professional Debt Mediation.

00:16 Before we get started, please give this video,

00:28 You know, debt disputes can be,

00:44 Arguing about who should pay for its,

01:04 Middle ground where a neutral third party,

01:23 Over seventy percent of mediated debt disputes,

01:38 Time is of the essence. Mediation is swift,

01:57 Aiming to reduce tensions. Litigation,

02:11 And lets not forget flexibility. Parties have,

Professional Debt Mediation.

Hey there. I see you are curious about Professional Debt Mediation. Well, you have come to the right place. Grab a comfy chair, because we are about to dive deep into this fascinating world.

Before we get started, please give this video a thumbs up, press the subscribe button, and hit the notification bell so you can stay up to date about important alternative dispute resolution topics, which can help you keep costs low.

You know, debt disputes can be daunting. The looming shadow of litigation is often time consuming, not to mention costly and stressful. Enter the hero of our story. Professional Debt Mediation.

Imagine two neighbors with a shared fence. They could spend days, maybe even months, arguing about who should pay for its repair. Or, they could have a chat, understand each others perspectives, and reach a friendly agreement. That chat, my friend, is mediation. But what we are focusing on today is specifically about debt.

Professional Debt Mediation is an alternative dispute resolution process. Think of it as a middle ground where a neutral third party, the mediator, assists two disputing parties in resolving their financial disagreements. The mediators role. Not to decide, but to facilitate a dialogue, guide the conversation, and help find a solution that both parties can live with.

Now, lets sprinkle in some stats, shall we. Did you know that in recent years, over seventy percent of mediated debt disputes reached an agreement outside of court. Yes, seventy percent. Another fun fact. mediation can be up to ten times faster than traditional litigation. I know, its impressive.

So why is mediation so much better than heading straight to court. Well.

Time is of the essence. Mediation is swift, while court cases can drag on for months, if not years.

Your wallet will thank you. Mediation is cost effective. Court proceedings, with all the associated fees and unpredictable outcomes. Not so much.

Say goodbye to stress. Mediation is a calm, structured process, aiming to reduce tensions. Litigation. It can be a roller coaster of emotions.

But wait, there is more. One of the hidden gems of mediation is confidentiality. Unlike public court proceedings, whats discussed in mediation stays in mediation.

And lets not forget flexibility. Parties have the autonomy to craft their own solutions, tailored to their unique needs. Its not a one size fits all resolution. Its a tailored suit, custom made just for you.

Remember, if you find yourself tangled in a debt dispute, consider giving Professional Debt Mediation a shot. Its swift, cost effective, and stress reducing.

If you want to learn more information about mediation, please visit.

arbitrationagreements.org

That is where you can purchase what you need to start the dispute resolution process in the correct fashion to handle issues online.

Also, what do you think about mediation.

Which advantage of it is your favorite.

Drop a comment below and let us know your opinion.

Please do not forget to give this video a thumbs up, subscribe to our channel, and hit the notification bell so you can receive the latest updates about dispute resolution that can help you keep your costs low and spirits high.

#conciliation #law #dullb #judiciary #internationalarbitration #lawmemers #corporatelawyer #advocate #lawmemes #lawyerlife #lawlife #judiciaryexams #llb #nlu #crpc #lawislife #highcourt #pcsjudiciary #lawstudent #districtcourt #arbitration #partnerships #arbitration #legal #law #mediation #litigation #adr #disputeresolution #familylaw #attorney #lawstudent #business #usa #justice #realestate #advocate #employment #legalservices #lawstudents #supremecourt #property #negotiation #alternativedisputeresolution #labor

Your Professional Debt Mediators

Contact us now for personalized credit mediation services tailored to suit your financial needs.We do assist with services such as Debt Review Removal and ITC Clearance.

Give us a call today to regain control of your finances and your credit profile.

We specialize in :

Debt Review Removal

ITC Clearance

Debt Mediation

Contact Us:

WhatsApp: 069 523 6184

Call Us :087 163 6359

www.wedodebtrescue.co.za

#film #movie #filmcommentary #featurefilm

?Updated daily, welcome to subscribe!?

Summary:

We hope you can subscribe my channel: https://bit.ly/pandaatv

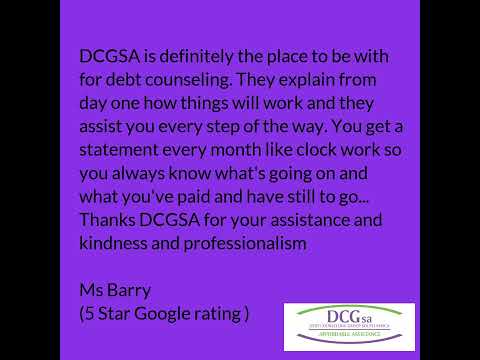

If you visit our Google reviews you can read our current and past clients reviews and make an informed choice about who you want on your side through the process of debt review.

Choosing the right company to get you out of debt is a big choice that should be done with as much information as possible.

If you would like a free and obligation free assessment you can call us on 086 100 1047 or visit www.dcgsa.coza

Creditline, Wesley Mission aims to provide a professional and comprehensive, sufficiently funded, specialist financial counselling service for individuals and their families who are suffering financial difficulties.

We offer face-to face counselling and support to those dealing with the emotional trauma and distress caused by financial crises. Our aim is to enhance financial independence and assist clients to self-manage their own financial situations.

FInd out more about Creditline services:

http://www.wesleymission.org.au/centres/creditline/

or

Call the Credit and Debt Hotline at 1800 808 488,

If you’ve been harassed by Professional Debt Mediation, we can help. We can turn the tables on debt collectors and make them pay you. Call us today at 844-685-9100 for a free, no obligation case evaluation, or visit http://www.hatecalls.com

******

Attorney Advertising – This is Not Legal Advice

Sergei Lemberg, Esq. is the Connecticut Attorney responsible for this advertisement.

Consumers should not assume that they are entitled to any compensation as a result of bringing a claim. Any compensation and any results obtained would depend upon specific factual and legal circumstances of each case.

Professional Debt Mediation HARASSING YOU? Professional Debt Mediation DEBT COLLECTOR CALLS?

https://www.lemberglaw.com/professional-debt-mediation-pdm-collections-complaints-calls

If Professional Debt Mediation is harassing you, making unwanted calls to you, or treating you or your family unfairly, the Fair Debt Collection Practices Act and the Telephone Consumers Protection Act offer you protection against Professional Debt Mediation harassment. You may be able to recover up to $1000.00 for unwanted or harassing debt calls from Professional Debt Mediation.

Common debt collection law violation by Professional Debt Mediation could be:

* Professional Debt Mediation could be misleading you or saying something that’s not true

* Professional Debt Mediation could be collecting more than is owed

* Professional Debt Mediation could be calling you at work

* Professional Debt Mediation could be calling many times per day or week

* Professional Debt Mediation could be calling your friends or family

* Professional Debt Mediation making unwanted calls to you before 8:00 a.m. or after 9:00 p.m.

* Professional Debt Mediation could be calling you after you’ve asked them to stop

* Professional Debt Mediation could be informing other people of your debt

* Professional Debt Mediation could be using abusive language

* Professional Debt Mediation could be falsely threatening to garnish your wages or lien your property

You can recover money for debt harassment. When you sue a debt collection agency and win, you can recover up to $1,000 in damages, plus court costs and attorney fees. Lemberg Law has a wealth of experience and stellar reputation in collection agency laws, and can help you stop harassment from Professional Debt Mediation. If you’ve experienced Professional Debt Mediation harassment, call us now 855-301-5100.

Professional Debt Mediation Unwanted or Harassing Calls? Recover $500-$1500 per call!

If Professional Debt Mediation has been making unwanted robocalls to your cell phone without your permission, or after you told them to stop calling, you could be entitled to between $500 and $1500 in damages for each and every call. How do you know it’s a computer call? When you answer, you hear a pre-recorded voice, or maybe silence, delay, clicks, or music, before you’re connected to a real person. Do you have Professional Debt Mediation complaints? If so, you should know your rights under the Telephone Consumer Protection Act. If you’ve experienced Professional Debt Mediation harassment, call us now 855-301-5100.

The FDCPA protects you from Professional Debt Mediation harassment.

Consumer Law, Class Actions, Personal Injury & Overtime Pay Lawyers

Do you have Professional Debt Mediation complaints? If so, you should know your rights under the Fair Debt Collection Practices Act and Telephone Consumer Protection Act.

Professional Debt Mediation is headquartered in Jacksonville, FL. It was founded in 1998, and does primary, secondary, and older account collections. It collects on behalf of apartments, rental homes, homeowners associations, credit cards, payday loans, healthcare, telecom, small business, student loans.

In order to increase your chances of prevailing in a Professional Debt Mediation harassment case, keep records of all phone calls and correspondence, such as the dates and times of contact, with whom you spoke, and what the debt collector said.

Professional Debt Mediation

Professional Debt Mediation complaints

Professional Debt Mediation harassment

What is Professional Debt Mediation

Professional Debt Mediation debt collections

Professional Debt Mediation collection agency

Attorney Advertising – This is Not Legal Advice

Sergei Lemberg, Esq. is the Connecticut Attorney responsible for this advertisement.

Consumers should not assume that they are entitled to any compensation as a result of bringing a claim. Any compensation and any results obtained would depend upon specific factual and legal circumstances of each case.

Presenting twelve breakthrough practices for bringing creativity into all human endeavors, The Art of Possibility is the dynamic product of an extraordinary partnership. The Art of Possibility combines Benjamin Zander’s experience as conductor of the Boston Philharmonic and his talent as a teacher and communicator with psychotherapist Rosamund Stone Zander’s genius for designing innovative paradigms for personal and professional fulfillment. The authors’ harmoniously interwoven perspectives provide a deep sense of the powerful role that the notion of possibility can play in every aspect of life. Through uplifting stories, parables, and personal anecdotes, the Zanders invite us to become passionate communicators, leaders, and performers whose lives radiate possibility into the worldThe lure of this book’s promise starts with the assumption in its title. Possibility–that big, all-encompassing, wide-open-door concept–is an art? Well, who doesn’t want to be a skilled artist, whether in the director’s chair, the boardroom, on the factory floor, or even just in dealing with life’s everyday situations? Becoming an artist, however, requires discipline, and what the authors of The Art of Possibility offer is a set of practices designed to “initiate a new approach to current conditions, based on uncommon assumptions about the nature of the world.”

If that sounds a little too airy-fairy for you, don’t be put off; this is no mere self-improvement book, with a wimpy mandate to transform its readers into “nicer” people. Instead, it’s a collection of illustrations and advice that suggests a way to change your entire outlook on life and, in the process, open up a new realm of possibility. Consider, for example, the practice of “Giving an A,” whether to yourself or to others. Not intended as a way to measure someone’s performance against standards, this practice instead recognizes that “the player who looks least engaged may be the most committed member of the group,” and speaks to their passion rather than their cynicism. It creates possibility in an interaction and does away with power disparities to unite a team in its efforts. Or consider “Being the Board,” where instead of defining yourself as a playing piece, or even as the strategist, you see yourself as the framework for the entire game. In this scenario, assigning blame or gaining control becomes futile, while seeking to become an instrument for effective partnerships becomes possible.

Packed with such examples of personal and professional interactions, the book presents complex ideas on perception and recognition in a readable, useable style. The authors’ combined, eclectic experience in music and painting (as well as family therapy and executive workshops) infuses their examples with vibrant color and sound. The relevance to corporate situations and relationships is well developed, and they don’t rely on dry case studies to do it. Indeed, this book assumes the emotional intelligence and desire to engage of its reader, promising access to the rewards of that door-opening notion–possibility–in return. –S. Ketchum