[Review] Videos

In this video I review “Big Debt Crises” by Ray Dalio. Ray is a legendary investor and former Chief Investment Officer at Bridgewater and Associates (the largest hedge fund in the United States). With years of investment experience and expertise, Ray has recently embarked on the “3rd stage of his life” in which he hopes to teach others what it is he has learned over the course of his life and career.

The book, “big Debt Crises” offers us an archetype and framework for thinking about debt crises, in particular, inflationary and deflationary debt crises.

I discuss in this video my major take aways from the book.

CuraDebt Review – http://bit.ly/complimentarydebtanalysis

Watch my CuraDebt Review video to learn more

Why You Should Choose CuraDebt As Your Debt Relief Solution

Since 2000 CuraDebt has helped tens of thousands of people resolve their financial problems bringing peace of mind.

Expert debt counselors offering solutions

Live your life stress free and fun

Free no obligation debt analysis

For your free debt analysis go to:

http://bit.ly/complimentarydebtanalysis

Thank you for watching my CuraDebt Review

If you enjoyed this video please subscribe to my YouTube Channel for more!

My Product Review Channel https://www.youtube.com/channel/UChe40xJKWIDNqKEmWh1nZ-w

Like and Share this video

Reviews for Busy People

DISCLAIMER: Some of the links mentioned in the video and in the description might be affiliate links where I’m paid a small referral fee. Those commissions help support this channel and allow me to continue to record more videos.

For More Detailed Information Please Click Here: http://bit.ly/2xoSCp7

Visit us online by going to https://www.debtreview-sa.co.za/

English:

Debt Review is a process in terms of the National Credit Act for over indebted consumers. The purpose of the act is to protect the over indebted consumer against Credit providers.

The first step in the process is to get the help from a debt counsellor and we do recommend that you do work with a company that has a NCR number and thus is registered with the NCR.

Afrikaans:

Skuldberading is basies die afrikaanse terme vir”debt review” of “debt counselling” en ons gaan onder net n oorsig gee en voel asb vry om ons te kontak met enige vrae of vir meer inligting. Ons afrikaans sprekende konsultante sal met graagte help.

Skuldberading is die proses in terme van die Nasionale Krediet Reguleerder (NKR) vir verbruikers wat in die skuld is. Die rede vir die proses is vir beskerming van die verbruikers, teen krediet verskaffers.

Do you know the difference between debt review and debt consolidation? Watch our video and phone a consultant to find out more on 0861 043 627 https://www.iemasfinancialservices.co.za/ #IemasFinancialWellness #IemasCares

Reviewing the Star Wars novel – Aftermath Life Debt

Like, comment, share & subscribe!!

Twitter – https://twitter.com/MyNameIsSimon88

Facebook – https://www.facebook.com/MyNameIsSimon88

Twitch – https://www.twitch.tv/mynameissimontwitch

Join our Discord community – https://discord.gg/c4XYNZb

Support me on Patreon and gain access to rewards! – https://www.patreon.com/mynameissimon – only donate if you can afford to!!

A special thanks to my Patreon supporters:

Lost&Found

Gaddocks (Erl)

Vanquish

Jonathon Morgan

—————————————-—————————————-———–

Copyright Disclaimer Under Section 107 of the

Copyright Act 1976, allowance is made for

“fair use” for purposes such as criticism,

comment, news reporting, teaching, scholarship,

and research. Fair use is a use permitted by

copyright statute that might otherwise be

infringing.

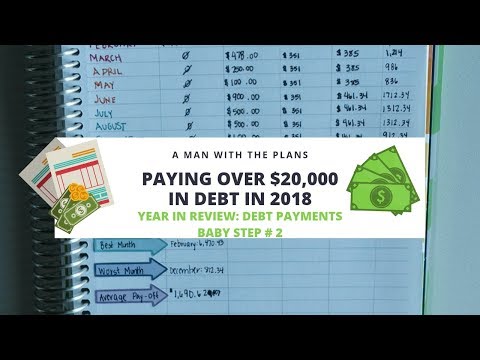

As I’m closing out my 2018 Year in Review, I wanted to take a look at home much money I put to debt this entire year. I went through each of my current debts from 2018 (4 in total: 1 credit card, 2 student loans and 1 car loan) and looked at how much I paid. These payments are both principal and interest, but it’s crazy how much I did this year and how much room for improvement I still have on my debt free journey. What are you doing in 2019 to tighten your budget to hit your financial goals?

Links for products used down below! (Note: some may be affiliate links!)

Connect with me!

AManWithThePlans on Instagram

A Man with the Plans on Facebook

www.amanwiththeplans.com

Looking to make your first EC purchase? Use my code below to get a $10 coupon code emailed to you! Lucky for me, I’ll also get a $10 off coupon code (at no cost to you), so that I can keep sharing all of my favorite goodies! Thanks!

Erin Condren Colorful Hourly Life Planner:

https://www.erincondren.com/referral/invite/ryanselock0323/1

Dave Ramseys: Total Money Makeover:

https://amzn.to/2J78Nwr

Capital One 360 (Interest Bearing Checking Accounts!):

https://capital.one/2KRdg7b

The Miracle Morning by Hal Elrod

https://amzn.to/2xpmUYk

Papermate Flair

https://amzn.to/2NmJoUV

Camera I use: Canon G7X:

https://amzn.to/2Pc2U7j

SWAG Bucks (Take Surveys to Earn Gift Cards):

http://www.swagbucks.com/p/register?rb=47837497

When a consumer (client) realizes that he/she is over indebted and that some arrangements

have to be made to make sure all monthly repayments are met.

2. The consumer contacts a registered Debt Counsellor who supplies a regulated form 16 and

assists with the completion thereof. As soon as this form is completed the consumer will have

formally applied for debt review in terms of the Act.

3. All requested documentation as on the application form is supplied by the consumer within 5

days of signing the form 16.

4. With the information and supporting documents supplied by the consumer the debt counsellor

now informs all the known creditors of the consumer that the said consumer has applied for

debt review. This is done with the regulated form 17.1 as well as 17.2

5. A formal analysis is done by the Debt counsellor to determine if the consumer is indeed over

indebted. This is a very simple calculation once all information has been taken into account. A

consumer can only apply for debt counselling if his/her monthly disbursable amount (Nett

income minus living expenses) is LESS than the amount required to service all obligations.

AS EXAMPLE ONLY. If the consumer only has R5000 to pay his/her debt after the living

expenses have been accounted for, and the total monthly debt repayments are R6000 the

application would be a success.

6. If the consumer is indeed over indebted according to the above method all creditors would be

informed of this for their record.

7. The restructuring process can now begin. The Debt counsellor will now restructure and

renegotiate all credit agreements and present these proposed terms to all creditors. This new

proposal will then restructure the consumer’s monthly commitments to be more affordable

and ensure that all credit agreements get something every month.

8. The new proposal will now be sent out to all the creditors after it has been approved by the

consumer. Should all creditors agree to a consent order that new arrangement will be made

an order of court. If there are some creditors who don’t agree to the restructuring a court date

will be allocated for the matter to be heard. At this hearing the magistrate will have no choice

to grant the order if the debt counsellor acted in terms of the Act and subsequently

restructured the debt accordingly.

9. A Very important consideration when applying for debt counselling will be who handles your

money! Debt counsellors are not allowed to handle any money from consumers except for the

application fee along with the retainer for early cancellation.

10. All disbursements of contributions will be handled by a registered Payment Distribution

Agency (PDA). The PDA is regulated and governed by the Act. As soon as a restructuring

proposal is agreed on by the consumer payments of the distribution amount will be paid over

from the consumer directly to the PDA. The PDA in turn will disburse with the funds as per the

restructuring proposals.

11. The Fee structure:

Debt counsellors are entitled to a maximum of R 6000 plus VAT for single applications and R

6000 plus VAT for a joint application.

The Act allows for the following payment of Debt counsellor fees as well as Legal fees.

The first payment made by the PDA will pay the debt counsellors fee

The second payment will pay the legal fees

The third payment will be the first payment that creditors receive. This is done so that

consumers don’t have to pay any money that they might not have up front, and to make the

process affordable.

12. When the payments are being made to the creditors by the PDA there will be some

agreements that will be paid up before others. As soon as this happens the Debt counsellor

must restructure the payments again to make sure any creditor is not paid more than he must

receive and to disburse the surplus equally between the other to ensure that the process runs

smoothly. For this the Debt counsellor is entitled to a 5% after care fee not exceeding R300.

13. As soon as all debt has been cleared the debt counsellor will release the consumer from debt

review and issue him/her with a clearance certificate. All records will also be removed from

the credit bureaus

14. Should a consumer’s situation change for the better and they are in a position to repay all

monthly obligations as they were before the restructuring they will be allowed to be release

from debt counselling. Although nothing is binding, any consumer can leave the process at

any time for any reason

NDMA Acting Case Mediation Manager Santie Schindehutte offers consumers help when debt review fails them