Debt Counselling

Is debt taking control of your life? Do you have trouble paying your bills? Well help you reduce your monthly payments, lower or eliminate interest charges and stop those stressful collection calls. We are a Canadian non-profit service, and we can help.

https://www.g.page/richard-killen-georgetown This video provides a short overview of debt counselling found in Georgetown & Brampton and bordering areas regarding what debt counselling is including your choices to credit and debt counselling in Ontario.

Personal Debt Counselling in Georgetown & Brampton.

Plenty of people today are experiencing difficulty repaying their credit debt, whether it is charge cards or almost any other types of debt.

Are you one of them?

Are you likewise having difficulties getting rid of your personal debts for a few months or perhaps years?

Are you among the list of individuals that disregard the issue or delay and let it build up, or perhaps stubbornly hang on in dread of filing for bankruptcy?

The easiest way to get the most effective option would be getting assistance through a financial debt professional, but not all of them can provide all the alternatives that may be the most beneficial solution for you.

Financial debt counselling is an excellent option to personal bankruptcy, wherein plenty of people who usually do not desire bankruptcy as a remedy to their debt difficulties.

Speaking with a Licensed Insolvency Trustee will guide you through every one of the alternatives which might be appropriate for you personally so that you can make the most suitable choice for your circumstance.

Consulting a trustee doesn’t suggest you are filing for bankruptcy, instead, they’ll review your situation and provide you all of your options to obtain the appropriate choice to your debt issues, such as credit and debt management, a consolidation loan, a consumer proposal and personal bankruptcy.

Richard Killen and Associates have been offering financial debt and credit counselling for over 25 years. We work with a variety of tools to ensure you get out of debt but not only that, we provide basic credit education with regards to budgeting and money management skills that will help you to reach your financial goals.

“This Could Be The Most Stress Relieving Phone call You’ll Ever Make!”

Call +1 647-492-2219

We have offices over the GTA. Visit https://rkillen.ca/debt-counselling-toronto-an-alternative-debt-relief/ for more information.

Richard Killen & Associates Ltd. Georgetown & Brampton

348 Guelph St,

Georgetown, ON L7G 4B5, Canada

Tel: +1 647-492-2219

Follow us on Social Media:

https://www.instagram.com/killen_trustee/

https://twitter.com/Killen_Trustee

https://www.facebook.com/rkillenassociates

https://www.linkedin.com/company/richard-killen-&-associates/

https://www.linkedin.com/in/richard-killen-020aaaba/

Follow our Podcast at https://rkillen.ca/podcasts/

What are the telltale signs that you are falling further and further into debt. What are the signs to watch out for that signals you need to re-look your finances and remedy your lifestyle before its to late. In this video, we explain the four most critical signs that you are falling further into debt.

If you have overwhelming debt, then you know the stress it puts on you and those around you. Speaking with a debt counselor can be like debt therapy.

You didn’t get into debt overnight, and you won’t get out of that way either. But you can trade the sleeplessness nights and anxiety over your debt for the comfort that you are getting help. But like therapy, you need to make the call.

A certified debt counselor from Clearpoint Credit Counseling Solutions can work with you to understand your debt issues, and help work out a plan to get you out of debt. To learn more about their free debt counseling services, please visit the Clearpoint Credit Counseling Solutions website:

http://www.clearpointcreditcounselingsolutions.org/credit-debt/

ClearPoint is one of the largest, most-respected credit counseling agencies in the nation – a 501(c)(3) nonprofit organization whose mission is to promote consumer health through financial education.

Clearpoint Credit Counseling Solutions

8000 Franklin Farms Drive

Richmond, VA 23229

(800) 750-2227

Updated video:

DISCLAIMER:

I am NOT a financial expert, accountant, or anything of the sort. I am in no way qualified or certified to give financial advice. However, I am here to share my love of planning and also share what my family is doing to get out of debt and be better with money. If you are looking for financial advice, I would recommend seeking advice from an expert.

#SnowballMethod #DaveRamsey #PayingOffDebt

How to exit debt review

A consumer can apply for debt review if they are unable to meet their debt commitments. However, in some cases, a consumer’s finances may improve and they wish to exit. Whether or not you are able to exit will be determined by where you are in the process.

When you apply for debt review, a debt counsellor issues form 17.1(b) which protects you from further legal action by your creditors. Creditors must provide a certificate of balance and the debt counsellor then assesses whether you are overindebted.

Once this assessment is completed, the debt counsellor issues form 17.2 (b). This includes a repayment plan which could include interest rate concessions from your creditors. Although this agreement still requires court approval, the consumer can start the new repayment schedule. All credit bureaus are notified, and you are effectively under debt review.

The next step is to apply to the Magistrates Court and the magistrate declares the consumer overindebted.

If you have applied for debt review and the debt counsellor has issued form 17.1(b), you can still cancel the process. Be aware that creditors can immediately act against you, if you are in arrears with repayments, as you are no longer protected.

Once form 17.2(b) has been issued, you are under debt review, but a magistrate has not yet issued a court order. If your financial circumstances have changed, then you can provide this information in the court application. If the magistrate agrees that you are no longer over-indebted, this terminates the debt review.

Once a magistrate has issued a court order placing you under debt review, you cannot exit until all your debts, apart from your mortgage, are settled as per the court order. This means even if your financial circumstances change you will not be able to exit debt review.

The only way to exit in this case is to accelerate all your debt repayments and settle as quickly as possible. If you received an interest-rate concession in the debt review agreement as you would settle your debts sooner than if you were not under debt review.

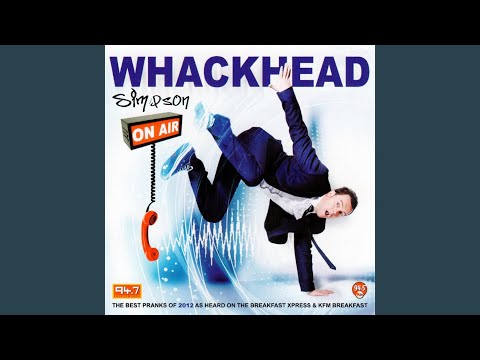

Provided to YouTube by Ingrooves

The Debt Counsellor · Whackhead Simpson

On Air

? 2012 94.7 Highveld Stereo and Darren Simpson

Released on: 2012-11-01

Writer, Composer: Darren Simpson

Auto-generated by YouTube.

Are you struggling in debt?

Allow us to assist you by reducing your monthly installments by up to 60%

Call us today to book an appointment with the experts in the field boasting a 100% application success rate.

www.tpalegal.co.za