[counselling] Videos

Credit counseling services in North Bay is considered to be very popular. Along with that, the credit counseling in Sault Ste Marie is also equally important. There is a definite way in which credit counseling can preferably help to resolve your financial challenges. Also, there are a lot of people who are struggling to pay their bills and for them, these particular services are considered to be very important. If you want affordable credit counseling services in North Bay from a reputed debt relief Company, visit the website https://www.reynoldshelp.ca/

Search Tags: Credit Card Debt Counselling Sudbury, Debt Help North Bay, Credit Help Sault Ste Marie

Is debt counseling for me?

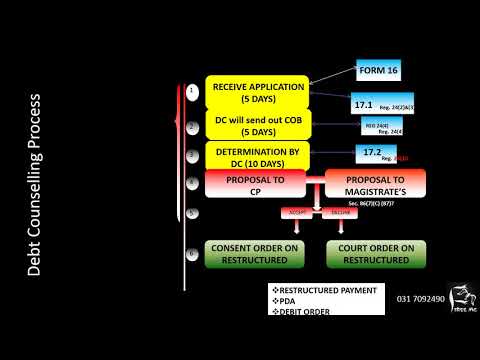

Debt Counseling is a formal legal process that provides for a consumer to be declared over indebted and for the Debt Counselor to negotiate a restructured payment plan and obtain a court order confirming the new repayment plan. The Debt Counselor must be registered with the National Credit Regulator and have an NCRDC number. The NDMA uses the services of a registered debt counselor.

More info and debt help can be found at http://www.debtcounsellinghelp.co.za

Today’s questions:

I have received a Summons, can you help me?

The biggest mistake that most people make is to leave debt counselling to late. As soon as you have received a summons from your creditor we cannot stop repossession. You can however still ask your creditor to stop the repossession.

You will have to negotiate a new repayment plan with your creditor. As soon as we have detail of your new payment plan and your creditor has agreed that you can place the payments under debt counselling we can continue with debt counselling.

The attorney of the creditor will normally send you a Section 129 final warning before the issue of a summons. You will have 10 working days to apply for debt counselling after the issue of this notice. If you don’t apply in this time you will not be able to include this debt under debt counselling.

Do not ignore a Section 129 Notice or summons. It will not go away by itself. We will help you. Doing nothing is the worst thing you can do.

Contact as soon as you can when you get the Section 129 Notice.

Debt Sage Can Help You – Debt Counseling & Debt Counseling Services South Africa, Johannesburg, Cape Town

This service helps you identify the best solution for your needs: https://www.consolidatedcredit.ca/credit-counselling/

Getting out of debt on your own isn’t easy. There are so many solutions you can use and they deliver very different results depending on your financial situation. What worked for your neighbor may not work for you because you have a different amount of debt, a different credit score, and a different budget. But there’s a free service that can help you identify the best solution for your needs. This video explains how it works.

For more information visit our website:

https://www.consolidatedcredit.ca

Or follow us on Social Media:

Facebook: https://www.facebook.com/consolidatedcreditcanada

Twitter: https://twitter.com/ConsolidatedCA

Instagram: https://www.instagram.com/consolidatedcreditca/

LinkedIn: https://www.linkedin.com/company/consolidated-credit-counseling-services-of-canada/

Pinterest:https://www.pinterest.ca/consolidatedcan/

https://www.g.page/richard-killen-toronto This 2-minute video offers a quick overview of debt counselling in Toronto and bordering areas regarding what debt counselling is plus your alternatives to debt counselling in the GTA.

Credit and Debt Counselling in Toronto and the GTA.

Lots of individuals have a hard time repaying their credit debt, whether it’s charge card or almost any additional type of debt.

Are you one of them?

Are you likewise struggling taking care of your debts for several weeks or perhaps quite a few years?

Are you one of the men and women who also ignore the problem or delay and allow it to build up, or maybe stubbornly hang on in dread of filing for bankruptcy?

One way to find the very best option could well be obtaining guidance through a financial debt professional, but not all of them can offer you all the alternatives that may be the most beneficial option for you.

Personal debt counselling is a good alternative to personal bankruptcy, wherein quite a lot of men and women who usually do not desire personal bankruptcy as a solution to their debt troubles.

Talking with a Licensed Insolvency Trustee will direct you through every one of the choices which might be appropriate for you, in order to make the most beneficial choice for your circumstance.

Consulting a trustee doesn’t suggest you are filing for bankruptcy, instead they’ll review your circumstances and give you all your options to find the most suitable choice to your debt problems, such as credit and debt management, a consolidation loan, a consumer proposal and bankruptcy.

Richard Killen and Associates have been offering debt and credit counselling for over 25 years. We utilize a combination of tools to help you get out of debt but not simply that, we provide basic credit education with regards to budgeting and money management skills to help you to reach your financial goals.

“This Could Be The Most Stress Relieving Phone call You’ll Ever Make!”

Call +1 647-699-3916

We have offices over the GTA. Visit https://rkillen.ca/debt-counselling-toronto-an-alternative-debt-relief/ for more information.

Richard Killen & Associates Ltd Toronto on Danforth

2600 Danforth Avenue,

Toronto, ON M4C 1L3, Canada

Tel: +1 647-699-3916

Follow us on Social Media:

https://www.instagram.com/killen_trustee/

https://twitter.com/Killen_Trustee

https://www.facebook.com/rkillenassociates

https://www.linkedin.com/company/richard-killen-&-associates/

https://www.linkedin.com/in/richard-killen-020aaaba/

Follow our Podcast at https://rkillen.ca/podcasts/

What can you do when you realise that the minimum payments required on all your credit card accounts have become too much to bear? Watch this video to find out how YOU can take the first step to address a growing debt problem.

Language: Mandarin

Presented by Credit Counselling Singapore.

________________________________

Visit Credit Counselling Singapore – https://www.ccs.org.sg

Take our Online Debt Management Course – https://www.ccs.org.sg/get-help/odmc/

Address a Debt Problem – https://www.ccs.org.sg/debt-management/

Arrange for Financial Counselling – https://www.ccs.org.sg/get-help/appointment-documents/

Download Counselling Request Package – https://www.ccs.org.sg/sdm_downloads/crf/

https://www.g.page/richard-killen-brampton This 2-minute video provides you with an overview of debt counselling found in Brampton and neighbouring areas regarding what personal debt counselling is plus your alternative options to debt counselling in the Greater Toronto Area.

Debt Counselling in Brampton.

So many men and women are experiencing trouble repaying their financial debt, whether it’s a charge card or most other debts.

Are you among them?

Are you also finding it difficult coping with your own personal debts for a few months or quite a few years?

Are you among the list of people today who also ignore the issue or delay and let it pile up, or maybe stubbornly hang on in fear of filing for bankruptcy?

The best way to acquire the most effective option could well be getting guidance through a personal debt professional, although not debt counsellors can offer all the alternatives that may be the most beneficial option for you.

Personal debt counselling is a good option to personal bankruptcy, where lots of men and women who do not desire personal bankruptcy as a fix to their debt troubles.

Speaking with a Licensed Insolvency Trustee will help you through all the choices that could be appropriate for you, so you can make the most suitable choice for your situation.

Consulting with a trustee doesn’t signify you are filing personal bankruptcy, instead, they will review your situation and give you all your options to obtain the suitable remedy to your debt worries, that include credit and debt management, a consolidation loan, a consumer proposal and individual bankruptcy.

Richard Killen and Associates have been providing debt and credit counselling for more than 25 years. We make use of a combination of tools to ensure you get out of debt however not simply that, we provide basic credit education about budgeting and money management skills that will help you to reach your financial goals.

“This Could Be The Most Stress Relieving Phone call You’ll Ever Make!”

Call +1 905-456-3311

We have offices over the GTA. Visit https://rkillen.ca/debt-counselling-toronto-an-alternative-debt-relief/ for more information.

Richard Killen & Associates Ltd Brampton

284 Queen St. East, Suite 224,

Brampton, ON L6V 1C2, Canada

Tel: +1 905-456-3311

Follow us on Social Media:

https://www.instagram.com/killen_trustee/

https://twitter.com/Killen_Trustee

https://www.facebook.com/rkillenassociates

https://www.linkedin.com/company/richard-killen-&-associates/

https://www.linkedin.com/in/richard-killen-020aaaba/

Follow our Podcast at https://rkillen.ca/podcasts/

Professional debt advice is free from Licensed Insolvency Trustees. They will explain all your options so you can decide the best solution for your situation. For more information about debt help services in Ontario, please call 519-310-JOHN (5646) or contact us via:

Website: https://www.adamsontrustee.com/

Facebook: https://www.facebook.com/adamsontrustee

Twitter: https://twitter.com/310johnadamson

Instagram: https://www.instagram.com/adamsontrustee/

Adamson & Associates offer bankruptcy, consumer proposal, credit counselling, and other debt help services in London, St. Thomas, Windsor, Kitchener / Waterloo and Chatham, Ontario.