[Free] Videos

This book was designed to inspire, encourage, and motivate you to make positive changes in your financial life. Put God first in your finances because most times, we take care of the spiritual, and physical, then we only do something about the money after it is all gone. In this informative book, you will discover: The principles to get out of debt How to stay out of debt How to make a budget How to take control of your money

Forget what”they” have told you. False financial information spreads like a virus and engenders fear, which can take you down financially. With Living Debt Free, you gain empowerment and support as well as accurate knowledge of how to build economic stability. Take advantage of the one legitimate business strategy that can free you from debt and learn to add strategies that assert your power to remain debt-free. Then relax and watch your financial future become more secure everyday.

THE 4 LAWS OF FINANCIAL PROSPERITY (Formerly The Four Laws of Debt Free Prosperity)

Inspired by actual occurrences, this entertaining and captivating book shows that how much a person earns isn’t nearly as important in achieving financial security as most people think-that nearly anyone, on any income, can achieve debt-free prosperity by applying the four laws in the story.

Inspired by a true story . . . you will discover four basic laws that will change your life.

Simple principles . . . learn how to implement the powerful core principles that financially successful people understand and live by to eliminate debt and accumulate wealth.

Change your financial life . . . anyone on any income can become debt-free and achieve financial independence by applying the principles from this book.

Thousands have bought for family members and friends! Over one hundred thousand copies sold worldwide!

There is a desperate need for financial literacy in our hurting country. Faced with an unprecedented economic crisis, lives are being torn apart by huge mounds of personal and student loan debt. People are being destroyed by irresponsible spending and poor financial decision making. As discouraging as it all may seem, there are solutions to the fiscal problems that individuals face on a daily basis. Authors Norman and Olivia West were able to pay off $170,000 worth of debt in 8 years. They managed to eliminate off all of their student loan debt, credit card debt, car loans, personal loans, and will soon pay off their home, never making six figures, with no windfalls or handouts. In “Debt Free at 33: 33 Ways You Can Become Financially Free,” the authors combine their own monetary and life experiences with practical insight from renowned writers, pundits, and celebrities, and, of course, a wealth of financial teaching. The information presented equips readers with the tools necessary to assess and eliminate their debt. Readers will learn how to create and stick to a budget, shop for bargains, reduce outstanding debt, and much more. If you are tired of living paycheck to paycheck and struggling to make ends meet, this book is for you. “Debt Free at 33: 33 Ways You Can Become Financially Free” will help you to become a better money manager and obtain the financial freedom that has been so elusive to you in the past. So what are you waiting for? Get started on your debt free journey today!

Upcycle Your Life

Get ready to trade in headaches and hassles for life skills, exchange clutter for money, transform eyesores into beautiful focal points in your home, and say goodbye to over-consumption and hello to genuine experiences.

Cristin Frank, the original Reduction Rebel, shows you the freedom and fulfillment you can have when you simplify your life. You’ll learn how to use your talents, time, and space to combat stress, become more efficient, relieve money woes, open up opportunities, and provide unbelievable self-fulfillment.

Inside you’ll find:Simple techniques that eliminate clutter and keep it from returningA personalized plan to help you reclaim your timePractical (and profitable) ways to sell unused items in your homeTips to eliminate debt and curb consumptionStep-by-step upcycling projects that transform old, unwanted furniture into beautiful, customized organizing systemsDozens of exercises that help you identify and honor your talents, values, and goals As Cristin says, “success is getting what we want.” Let this book show you how to let go of what’s holding you back so you can put your energy into your dreams and interests and build your success.

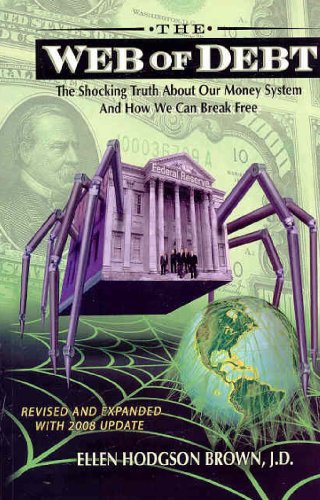

EXPLODING THE MYTHS ABOUT MONEY Our money system is not what we have been led to believe. The creation of money has been “privatized,” or taken over by a private money cartel. Except for coins, all of our money is now created as loans advanced by private banking institutions — including the private Federal Reserve. Banks create the principal but not the interest to service their loans. To find the interest, new loans must continually be taken out, expanding the money supply, inflating prices — and robbing you of the value of your money. Web of Debt unravels the deception and presents a crystal clear picture of the financial abyss towards which we are heading. Then it explores a workable alternative, one that was tested in colonial America and is grounded in the best of American economic thought, including the writings of Benjamin Franklin, Thomas Jefferson and Abraham Lincoln. If you care about financial security, your own or the nation’s, you should read this book.

Product Features

- Used Book in Good Condition

Do you ever feel TRAPPED by your DEBT?

If you’re looking for the FASTEST WAY OUT then the Debt Free Bible is your roadmap to freedom and here’s why; unlike other “get out of debt programs”

the Debt Free Bible doesn’t force you to use a single system or strategy. Why?

Because financial experts know there is no ONE SYSTEM to become debt free which will work best for everyone. So the Debt Free Bible gives you over

“19 Get Out of Debt Strategies” in ONE Manual (+4 Audio CD’s). It may be hard to believe, but we spent nearly 2 years and over $25,000

developing the Debt Free Bible.

Here’s just a little of what you’ll discover in the 287 pg Manual (+4 Audio CD’s):

• 43 places you can find UNCLAIMED MONEY to get out of debt fast! (page 253)

• Use the “Method Matrix” to compare 19 get out of debt methods and pick the best one (page 222)

• Discover how to get one bank pay off another bank with the “IR Method” (page 163)

• How to use the “Overflow Method” pay off any debt faster (page 159)

• How to pay off your bills FASTER with no extra money using the “RR Strategy” (page 167)

• Why the “LBF Technique” gives you a psychological advantage to become debt free (page 169)

• Why the “HIF Method” should be used FIRST on debts over 24% interest (page 171)

• How the “Division Method” and a calculator can get you debt free 8 YEARS SOONER (page 173)

• Pay off your mortgage in only 6 YEARS with the “AP Strategy” (page 191)

• A clever way to use your debt like a checking account with the “Deposit Method” (page 193)

• Use the “Float Technique” to loan yourself money to get out of debt FAST (page 197)

• And much more!

Product Features

- 287 Page Manual

- Four Interactive One Hour Audio CD’s

- NOTE: The “Debt Free Bible” is only a small part of the more expensive “Debt Free Bible System” which covers Debt Negotiation Strategies

How ANY student–including YOU!–can win scholarships and earn free money for college!

On the first day of high school, Kristina Ellis’s mom–a single, working mother who lost her husband to cancer–informed her that she could not financially support her after graduation. Kristina would need to find her own way to pay for college.

As an average student with less-than-impressive test scores, Kristina realized she would have to sell herself to scholarship committees if she wanted to stand out. That’s when she devised the plan that led to her receiving over $500,000 in scholarships–enough to pay for her full education at a top- 20 university, all the way through her doctoral degree, and make her dreams come true.

How she made it happen–and how you can too!–is the focus of this book. In Confessions of a Scholarship Winner, Kristina shares not just her little-known secrets for scholarship success but her incredibly inspiring story.

Together, you’ll explore how to:

Find the best scholarships for you Uncover the secrets behind paying for college Make a great impression in a scholarship interview Overcome the personal obstacles that stand in your way Craft a strategy that highlights your strengths, no matter your challenges or your financial status

You don’t have to be a star athlete, a top student, or a recognized leader to live your dreams! Here are the tools you need to catch a vision for your future and make your dreams a reality!

Endorsements

“Kristina Ellis’s story is absolutely inspiring. And the ‘insider’ information she presents in this book is just as motivating. If you’re looking for great ideas and easy-to-follow advice from somebody who has already blazed the scholarship trail, Kristina Ellis is the choice. Confessions of a Scholarship Winner is the only book you’ll need for creating your own path to success.”

–Curt Jones, Founder CEO, Dippin’ Dots Ice Cream

“I wish I had been given a copy of this book in high school– what an incredible resource for young people! Now everyone will understand that going to college really doesn’t have to leave you or your family in debt for years. Students and parents alike need to read Confessions of a Scholarship Winner!

–Brenna Mader, Miss Tennessee USA

“Confessions of a Scholarship Winner is a fantastic resource for anyone who wants to learn more about the college financial-aid and scholarship process for attending a college or university. Kristina’s personal story is both compelling and accessible, and her clear, thoughtful writing helps makes this an indispensable resource for the college-bound student.”

–Dr. Thomas Burns, Provost, Belmont University

“I love this easy-to-follow guide for finding and winning scholarships. Confessions of a Scholarship Winner is packed with information, yet it is presented so well that it’s not intimidating. It’s a fast read and easy to implement. Homeschool.com highly recommends it.”

–Rebecca Kochenderfer, Senior Editor and Co-Founder, Homeschool.com, Inc.

EXPLODING THE MYTHS ABOUT MONEY. Our money system is not what we have been led to believe. The creation of money has been privatized, or taken over by a private money cartel. Except for coins, all of our money is now created as loans advanced by private banking institutions — including the Federal Reserve, the branches of which are 100% privately owned. Banks create the principal but not the interest to service their loans. To find the interest, new loans must continually be taken out, expanding the money supply, inflating prices — and robbing you of the value of your money. Web of Debt unravels the deception and presents a crystal clear picture of the financial abyss towards which we are heading. Then it explores a workable alternative, one that was tested in colonial America and is grounded in the best of American economic thought, including the writings of Benjamin Franklin, Thomas Jefferson and Abraham Lincoln. If you care about financial security, your own or the nation’s, you should read this book.

Product Features

- Used Book in Good Condition

Struggling with debt? Get realistic help that’s actually useful, from Liz Weston, one of the most popular and respected personal finance experts! Today, people struggling with debt have far fewer options: lenders are stingier, which makes it harder to avert disaster, or to recover from setbacks like foreclosure, short sales, or bankruptcy. (Meanwhile, people with good credit have more options than ever, including some of the lowest interest rates in decades.) You need an up-to-date guide that can help you assess options, find help, discover opportunities, and take action that works. Liz Weston’s Deal with Your Debt, Updated and Revised Edition is that guide. Weston reveals why most “conventional wisdom” about debt is just dead wrong. For most people, it’s simply impractical to pay off every dime of debt, and live forever debt free. In fact, doing that can leave you a lot poorer in the long run. You’re more likely to give up, or pay off the wrong debts. You could leave yourself too little flexibility to survive a financial crisis. You could neglect saving for retirement. You might even wind up in bankruptcy — just what you’re trying to avoid! For most people, it’s smarter to control and manage debt effectively. In this extensively updated guide, Weston shows how to do that. You’ll learn which debts can actually help build wealth over time, and which are simply toxic. You’ll find up-to-date, real-world strategies for assessing and paying off debt, money-saving insights on which debts to tackle first, and crucial information about everything from debt consolidation loans to credit scores and credit counseling. Weston offers practical guidelines for assessing how much debt is safe — and compassionate, realistic guidance if you’ve gone beyond the safety zone. If you’ve ever worried about debt, you’ll find the new edition of Deal with Your Debt absolutely indispensable.