Most Viewed Videos

Noreena Hertz, one of the world’s leading experts on economic globalization, looks at the history of third-world debt and its crippling effects on people in developing countries.

Drawing from her impressive debt-relief campaign, fact-finding travels, and meetings with top-ranking officials, Hertz offers a probing analysis of the origins of this rampant burden and its evolution through the decades. With clear principles of justice, she uncovers the imbalance of power and misuse of corrupt dictators and reckless lenders.

How to consolidate credit card debt using three different methods.

LightStream Loans: http://bit.ly/LS_DebtConsolidation

(I may be compensated by LightStream through this link.)

Please subscribe: https://www.youtube.com/c/HonestFinance?sub_confirmation=1

If you want to know how to get rid of credit card debt, then you’re watching the right video. I’ll be covering why you’d want to consolidate credit card debt, which has to do with your credit utilization score and credit card interest.

I’ll also be covering 3 unique ways to consolidate credit card debt that I believe work the best. Getting a personal loan, balance transfer offers and cash-out refinancing are the three ways to consolidate credit card debt that I’ll be covering.

?????????????

— Resources and Recommendations —

DISCLAIMER: This video description contains affiliate links, which means if you click through the links, I can receive a small commission (at no cost to you). This helps support the channel and allows me to continue making in-depth content for you. Thanks for the support.

COURSES I RECOMMEND:

– How to Grow and Rank on YouTube: http://bit.ly/YTRankingAcdmy

BOOKS I RECOMMEND:

– Get 2 Free Audiobooks from Audible: http://bit.ly/AudibleFreeTrial_HF (Because leaders are readers 🙂

– The $3 Book that Changed my Life: http://amzn.to/2DuHmIy

– Best Book on Time Management: http://amzn.to/2Cj59hG

– Best Book on Investing/Stock Market: http://amzn.to/2DtEM5E

– Best Book on Budgeting/Debt: http://amzn.to/2Ekyszc

– Best Book on How Money Works: http://amzn.to/2Eaqdp5

INVESTING AND LOANS:

– Check out Betterment for automated, low-fee investing: http://bit.ly/Betterment_Investing

– Get a Free Stock for trying Robinhood: http://bit.ly/robinhood_hf

– Lightstream loans is who I recommend for any auto loans, personal loans or debt consolidation. They have the best rates and don’t charge any fees or pre-payment penalties. http://bit.ly/lightsteam_loans

?????????????

SOCIAL MEDIA:

Facebook: https://www.facebook.com/honestfinancechannel

Twitter: https://twitter.com/FinanceHonest

Linkdin: https://www.linkedin.com/in/honest-finance-1622a6171/

Pinterest: https://www.pinterest.com/honestfinance/

?????????????

Welcome to the Honest Finance Channel!

I’ll give you the honest truth about a variety of financial topics in a way that actually makes sense. I’m not a financial advisor and I’m not here to advertise a bunch of products. I simply want to share my financial advice with anyone who will listen.

Help me translate my videos: http://www.youtube.com/timedtext_cs_panel?c=UCNGiXK9ZsxIzY-3g_TPilBQ&tab=2

#honestfinance

Paying off your credit card debt can seem like a MONUMENTAL challenge. And getting rid of your credit card debt FAST is even harder. Here are the 4 steps I took to eliminate my $14,000 of credit card debt in just 7 months!

Please LIKE or COMMENT if you enjoyed the video! It helps a lot. ?

If you found any of this so INSANELY useful/helpful/inspiring, I wouldn’t mind waking up to a free coffee tomorrow morning. ? buymeacoff.ee/rapidweblaunch

More of a reader? Check out my full blog post: https://blog.rapidweblaunch.com/2016/08/29/pay-off-credit-card-debt-fast/

Americans as a whole view themselves as reasonably prudent and sober people when it comes to matters of money, reflecting the puritan roots of the earliest European settlers. Yet as a community, we also seem to believe that we are entitled to a lifestyle that is well-beyond our current income, a tendency that goes back to the earliest days of the United States and particularly to get rich quick experiences ranging from the Gold Rush of the 1840s to the real estate bubble of the early 21st Century.

Inflated examines this apparent conflict and makes the argument that such a world view is so ingrained in us that to expect the United States to live in a “deflated” world is simply unrealistic. It skillfully seeks to tell the story of, money inflation and public debt as enduring (and perhaps endearing) features of American life, rather than something we can one day overcome as our policy makers constantly promise.Features interviews with today’s top financial industry leaders and insiders.Offer a glimpse into the future of the Federal Reserve and the role it will play in the coming yearsExamines what the future may hold for the value of the U.S. dollar and the real incomes of future generations of Americans

The gradual result of the situation we find ourselves in will inevitably lead to inflation, loss of economic opportunity, and a decline in the value of the dollar. This book will show you why, and reveal how we might be able to deal with it.

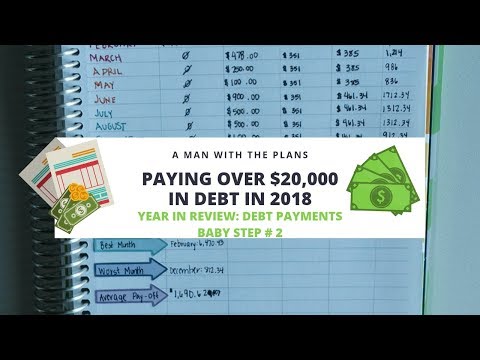

As I’m closing out my 2018 Year in Review, I wanted to take a look at home much money I put to debt this entire year. I went through each of my current debts from 2018 (4 in total: 1 credit card, 2 student loans and 1 car loan) and looked at how much I paid. These payments are both principal and interest, but it’s crazy how much I did this year and how much room for improvement I still have on my debt free journey. What are you doing in 2019 to tighten your budget to hit your financial goals?

Links for products used down below! (Note: some may be affiliate links!)

Connect with me!

AManWithThePlans on Instagram

A Man with the Plans on Facebook

www.amanwiththeplans.com

Looking to make your first EC purchase? Use my code below to get a $10 coupon code emailed to you! Lucky for me, I’ll also get a $10 off coupon code (at no cost to you), so that I can keep sharing all of my favorite goodies! Thanks!

Erin Condren Colorful Hourly Life Planner:

https://www.erincondren.com/referral/invite/ryanselock0323/1

Dave Ramseys: Total Money Makeover:

https://amzn.to/2J78Nwr

Capital One 360 (Interest Bearing Checking Accounts!):

https://capital.one/2KRdg7b

The Miracle Morning by Hal Elrod

https://amzn.to/2xpmUYk

Papermate Flair

https://amzn.to/2NmJoUV

Camera I use: Canon G7X:

https://amzn.to/2Pc2U7j

SWAG Bucks (Take Surveys to Earn Gift Cards):

http://www.swagbucks.com/p/register?rb=47837497

I PAID OFF $10,000 IN CREDIT CARD DEBT IN SIX MONTHS GJFREKJGHRJFEGK I’m too excited WOW. Here’s a very detailed video of my debt payoff process!! #personalfinance #debtpayoff #creditcarddebt

TIME STAMPS:

0:00 – intro

2:01 – how I got into 10k of credit card debt

5:30 – get serious and commit to a debt payoff plan

6:30 – balance transfers

7:23 – track your income and expenses & create a budget

7:59 – pay more than minimum payments (debt snowball vs debt avalanche)

9:04 – find extra money to use toward debt (cut your spending and/or make more money!)

11:18 – I have definitely increased my income (+ my estimated total income for 2019)

12:50 – what percentage of my income goes toward debt?

14:35 – how much did I pay each month?

16:40 – my debt payoff hype song lmfao

17:36 – how do you resist lifestyle inflation / spending more as you earn more?

18:43 – how do you stay motivated during debt payoff?

19:57 – what was the most helpful way to think about the process of paying off debt?

20:33 – are you saving while paying off debt?

21:13 – what’s next? Pay off my student loans! + my current total loan balance

22:49 – how has your credit score changed?

23:24 – did you still use credit cards while paying them down?

24:46 – what do you recommend for young people regarding credit cards and student loans?

SOURCES & REFERENCES:

Opening Up About My Student Loans and Credit Card Debt – https://youtu.be/tku2C-DgA6s

Finances of a Full-Time YouTuber (taxes, budgeting, etc) – https://youtu.be/3NMQyrvp7o8

Debt Snowball Vs Debt Avalanche | Which is the Best Debt Payoff Strategy? – https://youtu.be/jtgnRJKSJlw

What is a balance transfer? – https://www.creditkarma.com/credit-cards/i/what-is-balance-transfer/

The Financial Diet – https://www.youtube.com/channel/UCSPYNpQ2fHv9HJ-q6MIMaPw

Aja Dang – https://www.youtube.com/user/ajabdang

Sarah Nourse – https://www.youtube.com/channel/UCDbGw5fdxTLjRsNnD7_Jwvw

? Instagram: https://www.instagram.com/tferg__/

? Twitter: https://twitter.com/tiffanytheprez

? My Podcast, Previously Gifted: http://bit.ly/previouslygifted

? Vlog Channel: http://bit.ly/tfergvlogs

? Political Channel: http://bit.ly/sociallyunacceptable

??? Use my affiliate links to support my channel 🙂 ???

* My go-to eyeshadow palette (vegan and cruelty free!) https://amzn.to/2WnU5tX

* 10% off Glossier (for first time customers). I use the Perfecting Skin Tint, “Cake” and “Zip” Generation Z lipstick

– https://re.glossier.com/72ff5ffa

*Sign up for my fav travel site, Airbnb, for a $40 credit! http://www.airbnb.com/c/tferguson42

*Here’s an Amazon list with all of the equipment I use to film my videos, including my camera, mic, ring light, and more! http://bit.ly/filmingequipment

Hello my dudes! My name is Tiffany Ferguson. I’m a 24 year old sharing my thoughts and life experiences. Here on Tiffanyferg, recently I’ve been working on my Internet Analysis series, where I research and discuss topics related to social issues and media. I also occasionally talk about my experiences with college, traveling, study abroad, veganism, and more.

Business Inquiries: tiffanyferguson@select.co

FTC: This video is not sponsored. Links with * are affiliate, meaning I am compensated monetarily if you join or make a purchase.

The high-yield leveraged bond and loan market (“junk bonds”) is now valued at $3+ trillion in North America, €1 trillion in Europe, and another $1 trillion in emerging markets. What’s more, based on the maturity schedules of current debt, it’s poised for massive growth. To successfully issue, evaluate, and invest in high-yield debt, however, financial professionals need credit and bond analysis skills specific to these instruments. Now, for the first time, there’s a complete, practical, and expert tutorial and workbook covering all facets of modern leveraged finance analysis. In A Pragmatist’s Guide to Leveraged Finance, Credit Suisse managing director Bob Kricheff explains why conventional analysis techniques are inadequate for leveraged instruments, clearly defines the unique challenges sellers and buyers face, walks step-by-step through deriving essential data for pricing and decision-making, and demonstrates how to apply it. Using practical examples, sample documents, Excel worksheets, and graphs, Kricheff covers all this, and much more: yields, spreads, and total return; ratio analysis of liquidity and asset value; business trend analysis; modeling and scenarios; potential interest rate impacts; evaluating and potentially escaping leveraged finance covenants; how to assess equity (and why it matters); investing on news and events; early stage credit; and creating accurate credit snapshots. This book is an indispensable resource for all investment and underwriting professionals, money managers, consultants, accountants, advisors, and lawyers working in leveraged finance. In fact, it teaches credit analysis skills that will be valuable in analyzing a wide variety of higher-risk investments, including growth stocks.

“The book teems with eccentric characters and scenes that made my skin crawl…. Explained simply, read easily, Bad Paper defies expectations. It should also raise quite a few alarms.”-Colin Dwyer, NPR

The Federal Trade Commission receives more complaints about rogue debt collecting than it does about any activity besides identity theft. In Bad Paper, journalist Jake Halpern reveals why. He tells the story of Aaron Siegel, a former banking executive, and Brandon Wilson, a former armed robber, who become partners and go in quest of “paper”-the uncollected debts that are sold off by banks for pennies on the dollar. As Aaron and Brandon learn, the world of consumer debt collection is an unregulated shadowland, where operators often make unwarranted threats and even collect debts that are not theirs.

Introducing an unforgettable cast of characters, Halpern chronicles Aaron and Brandon’s lives as they manage high-pressure call centers, hunt for paper in Las Vegas casinos, and meet in parked cars to sell the social security numbers and account information of unsuspecting consumers. The result is a vital exposé on the cost of a system that compounds the troubles of hardworking Americans and an astonishing feat of storytelling.

An Amazon Best Book of the Month, October 2014: Everyone knows about collections agencies, but how they actually operate is much more interesting than you probably think. Falling somewhere between Glengarry Glen Ross and Mean Streets, Jake Halpern’s Bad Paper introduces us to an economy spanning many shades of gray. Halpern’s book tracks the descent of “paper” (spreadsheets containing the information of millions of debtors and their debts) as it’s sold for pennies on the dollar by banks and credit companies and passed through a network of collectors. Files are often bought and sold multiple times, each transaction stripping away the best remaining prospects as collectors wring paper dry through all manners of persuasion and coercion. Along the way, Halpern encounters first-hand the game’s players, from the financiers at the top of the pyramid to mid-level “brokers” and the ground-level phone-jockeys; these are all hard men within their contexts, as one tale of a Tarantino-grade stand-off over stolen information attests. This book is unexpected, and unexpectedly fun. –Jon Foro

Most books on this subject will teach you to first pay off your debt before doing anything else. In this book, Curt Whipple explains how FOCUSING on paying off your debt can be the key to your downfall and total frustration.

Curt Whipple teaches you the keys to becoming FINANCIALLY FREE and in the process you will also become debt free.

KEYS like:

-How to become Financially Free, on your current income, without changing jobs,and regardless of your debt.

-Why focusing on debt can keep you broke forever!

-What Financially Free people do, that Broke people do not.

-How to find $300-$600 of extra cash each month. (money you never knew you had!)

-How $8,000 invested can secure a comfortable retirement.

-How to generate over $105,000 with pocket change.

Founder of MyDebtFreeCollege.com, Kevin Y. Brown, author of 10 Ways Anyone Can Graduate from College DEBT-FREE: A Guide to Post Graduate Freedom reflects back on his college experience…”If I have to take out a loan for college, I’m dropping out!” is what he said to his dormitory hall director, a few days in to college. With zero knowledge of the college, financing system Kevin took it upon himself to be proactive and take control of his college finances. Upon graduation, Kevin proved to have kept his promise to himself and today he is free of any college debt. With approximately 37 million student loan borrowers having outstanding student loans and people in the 18 to 24–age bracket spending nearly 30% of their monthly income on student loan debt repayment there is a need for a guide to help students navigate the financial aspects of college life and avoid the pitfalls of student loans and related college debt. 10 Ways Anyone Can Graduate From College DEBT-FREE provides: • 10 proven strategies that can help students avoid student loan debt • Personal stories of the authors experience with each strategy • A list of over 100 scholarships valued at over $10 million dollars • Consequences of defaulting on student loans • An understanding of the various types of financial aid • Up-to-date data on life-time earnings vs. education levels • Current data on and the state of the student loan debt crisis