Recently Added Videos

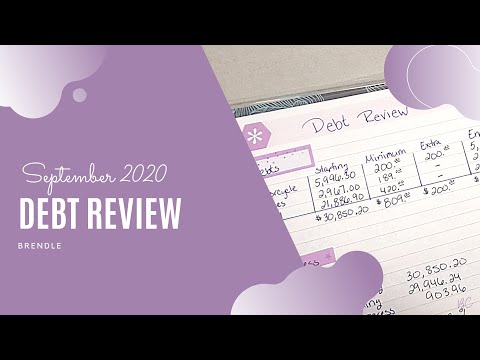

Hi! Today’s video shows our progress on our debt payments for September 2020. ?

Hope you enjoy the video!!

Answers to your burning questions:

What is your Instagram handle?

• its_brendle – https://www.instagram.com/its_brendle/

What planner do you use for your budget?

• Erin Condren – https://www.erincondren.com/referral/invite/brendacline/1

*If it is your first time buying & creating an account, you will get a $10 off coupon your first purchase and I will also receive a $10 coupon*

Where can I find this sticker kit?

• Caffeinated Cait’s Etsy page – https://www.etsy.com/shop/CaffeinatedCait

• This kit is called October Pumpkin Patch

• I do cut and modify them a little.

What pens do you use?

• Sharpie Gel pen 0.7

• TUL pens

• Pilot G-2 07

What camera do you use to film?

• GoPro Hero 8 Black

What free editing software do you use?

• Olive – https://www.olivevideoeditor.org/

What program do you use for my intro, outro, & thumbnails?

• Canva – https://www.canva.com/join/asking-backdrop-malaga

• I use the free version

*If you use this link, we will both receive Canva Credit towards premium elements, such as images, illustrations, icons, and music*

What color nail polish are you wearing?

• Au Naturel!

DISCLAIMER: The links included in this description might be affiliate/referral links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for your support!

How a cash out for debt consolidation works.

http://www.debtsage.co.za – At Debt Sage, our NCR registered and qualified Debt Counselors can assist you with the debt counseling program which is specially designed to help people who are struggling to service their monthly debt. You may apply for debt counseling if after deducting your living expenses from your net salary you have less cash left over than the installments on your debt.

Many people end up having their homes and their vehicles repossessed because at the first sign of trouble they are either too ashamed to act or they go into denial about the seriousness of the problem. The longer you wait to act, the fewer options you will have.

The debt counseling process came into effect on the 1st of June 2007, following the enactment into law of the National Credit Act no. 34 of 2005. This Act provides for consumers to go through debt counseling before filing for other debt relief measures such as debt administration and insolvency which have a devastating effect in terms of crippling future borrowing capacity and also carry large financial and legal costs. In this respect, debt counseling is your right to a financial fresh start.

Debt Sage is working with creditors so as to help individuals get out of debt without taking an additional loan. Money is not loaned, but a manageable repayment plan is achieved through loan modification which includes lowering the interest rate or extending the term of the loan among alternative techniques.

When you contact Debt Sage, professionally trained and certified debt counselors will help you evaluate:

• Your current financial situation;

• Provide you with a detailed review of your income and expenses;

• Develop a workable budget that you can live with; and

• Through our debt counseling program you will be able to pay off your debt within 5 years.

At the end of the counseling session you will feel good knowing that there are options available and that you are not alone. Debt Sage is here to help and provide you the best solution for you and your situation.

Debt Sage will solve your debt problem and halt collection activity from credit providers and lawyers demanding payment and help you eliminate debt and take control of your finances and your future. To discuss your particular needs, our debt counselors are available Monday –Friday 8:00 am to 5:30 pm and Saturday 8:00 am to 1:00 pm.

So, is debt consolidation a good idea? The truth about debt consolidation comes out! There are many views on debt management: some believe that it is a good approach to get out of debt, but I have another take on that. Of course, in some particular situations, consolidating debt may actually be a good thing, since a higher interest rate can be devastating to somebody trying to get out of the debt pile. However, it’s important to know which situations could be compatible with debt consolidation approach, and in which situations it is better idea to adjust your spending habits and think of the way to increase income. Let’s analyze this and understand why I believe that debt consolidation is not the best way towards being debt free.

Twitter: @RockingFinance

Instagram: https://www.instagram.com/RockingFinance

This Video: https://youtu.be/Bz6rzyvVNc8

Channel: https://www.youtube.com/channel/UCgyZc8B9MwtUzsKlp6_e54g

#debt #debtconsolidation #debtmanagement

At Credit Counselling Sudbury we’ve helped thousands of people who have found themselves in trouble with debt. Here are a few secrets for getting out of debt.

http://www.sudburycommunityservicecentre.ca/page/credit_counsel

Advantages and disadvantage of debt review

helpful tips about debt review

tandem debt solutions

helping you make an informed decision

In this episode, we are talking about debt review. What debt Review really means and the right tools you need before you can sign up for it or if you know someone who might need it.

To check the registration of a Debt Counselor please click here:

https://ncr.org.za/register_of_registrants/registered_dc.php

How to Get What you Want in Divorce Mediation | Ask a Divorce Mediator // When couples decide to proceed with separation or divorce, they often feel unprepared and alone. In therapy, Parallel Wellness works with couples contemplating “Is my marriage over?”, “Should I get divorced?” and “Can i save my marriage?” In this video, we interview Paul Sweatman of Dignified Divorce Vancouver, a divorce mediator to gain insight into the mediation process, how to avoid mediation conflict, and his advice on divorce and separation. Before divorce, couples may seek couples counselling or even attend counselling for divorce and separation throughout their medication experience.

In this video, Paul covers his top divorce advice, divorce mediation tips and divorce tips for couples getting divorced, how to amicably divorce with kids, managing spousal and child support agreements, and his divorce legal advice. He also shares about supporting clients when they choose to stop divorce.

Paul Sweatman – Dignified Divorce Vancouver

www.dignifieddivorcevancouver.com

BLOG POST: Marriage as a Flight: https://www.parallelwellness.ca/marriage-divorce-mediator/

WATCH NEXT:

Stay Connected as a Couple | Gottman Seven Principles: https://youtu.be/fzEG8dUbUlg

Survive Quarantine with Your Partner: https://youtu.be/m30x7SiNbsM

Coping with Social Distancing During COVID-19: https://youtu.be/yQK-yfPQ5Ko

Gottman’s Four Horsemen of the Apocolypse: https://youtu.be/HO6kz6iyVg0

How to Make Relationships Work: https://youtu.be/ave0Kuhrxzo

SAY HELLO! ON SOCIAL MEDIA:

Twitter: https://twitter.com/parallelwellnes/

Instagram: http://instagram.com/parallelwellness/

Facebook: https://www.facebook.com/parallelwell…

#beparallelwell

CAMERA GEAR USED:

My camera – https://amzn.to/2VYCoi6

Microphone – https://amzn.to/2zwF0wt

SD card – https://amzn.to/2zml3Im

Tripod – https://amzn.to/2S5amjT

Studio lights – https://amzn.to/3eQuJLG

MUSIC: Mama’s Whisper by The 126ers

DISCLAIMER: Links included in this description might be affiliate links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for supporting Parallel Wellness so I can continue to provide you with free content each week!

The advice and opinions expressed in this video are not a substitute for therapy or medical treatment. The information contained in this video is intended to provide general information on matters of interest for the personal use of the viewer. While every effort has been made to ensure the information shared in this video has been obtained from reliable sources, we do not hold responsibility for any errors or omissions, or for the results obtained from the use of this information.

Any comments expressed are the opinions of individual viewers and do not necessarily reflect the view of Parallel Wellness or their associated partners.

We encourage seeking professional help if you would like support for specific concerns. If you or someone you know is in crisis and needs emergency support, please contact the local crisis centre in your area. For Canadian and BC residents, please refer to the following for crisis support:

Crisis Services Canada

24/7 Toll Free Phone: 1 833 456 4566

Texting: 45645

Kids Help Phone

Text Services: Text “CONNECT” to 686868 (also serving adults)

Chat Services: (6pm-2am ET): kidshelpphone.ca

Youthspace.ca (NEED2 Suicide Prevention, Education & Support)

Youth Text (6pm-12am PT): (778) 783-0177

Youth Chat (6pm-12am PT): www.youthspace.ca

British Columbia:

Vancouver Crisis Centre

Crisis Chat: crisiscentrechat.ca

Northern BC

Prince George Crisis Line

Youth Support: (250) 564-8336

Crisis Chat: www.northernyouthonline.ca

Vancouver Island:

Vancouver Island Crisis Line & Chat

Crisis Text: (250) 800-3806

Crisis Chat: www.vicrisis.ca

Is debt counselling a scam – or does it really work?

From households to governments to big businesses – global debt has increased by 50 per cent since the crash ten years ago. Are we inviting another financial crisis?

GUESTS:

Garrick Hileman

Head of Research, Blockchain.com

Osmond Plummer

London Institute of Banking & Finance

David Belle

UK Growth Director, Trading View

Beverley Budsworth

Managing Director, The Debt Advisor

LOCATOR: MANCHESTER, UK

Subscribe: http://trt.world/Roundtable

Livestream: http://trt.world/ytlive

Facebook: http://trt.world/facebook

Twitter: http://trt.world/twitter

Instagram: http://trt.world/instagram

Visit our website: http://trt.world