[Review] Videos

On this video, we explain the consequences of Reckless credit/lending and its implications for the credit providers. I also highlight the importance of keep a hands on your profile by monitoring your payment progress with your Debt counsellor.

I also explain the importance of choosing the right Debt counsellor (DC), as some Debt counsellors tend to prey or take advantage of ill-informed and vulnerable consumers, which is one of the reasons you need to SUBSCRIBE to my channel so that you do not fall prey to such individuals. I cannot stress enough the importance of staying informed.

Send me your comments and questions if you have any, and I will get back to you soonest.

Thank you for watching.

Sellina

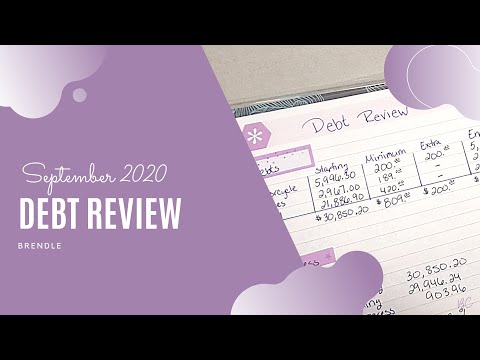

Hi! Today’s video shows our progress on our debt payments for September 2020. ?

Hope you enjoy the video!!

Answers to your burning questions:

What is your Instagram handle?

• its_brendle – https://www.instagram.com/its_brendle/

What planner do you use for your budget?

• Erin Condren – https://www.erincondren.com/referral/invite/brendacline/1

*If it is your first time buying & creating an account, you will get a $10 off coupon your first purchase and I will also receive a $10 coupon*

Where can I find this sticker kit?

• Caffeinated Cait’s Etsy page – https://www.etsy.com/shop/CaffeinatedCait

• This kit is called October Pumpkin Patch

• I do cut and modify them a little.

What pens do you use?

• Sharpie Gel pen 0.7

• TUL pens

• Pilot G-2 07

What camera do you use to film?

• GoPro Hero 8 Black

What free editing software do you use?

• Olive – https://www.olivevideoeditor.org/

What program do you use for my intro, outro, & thumbnails?

• Canva – https://www.canva.com/join/asking-backdrop-malaga

• I use the free version

*If you use this link, we will both receive Canva Credit towards premium elements, such as images, illustrations, icons, and music*

What color nail polish are you wearing?

• Au Naturel!

DISCLAIMER: The links included in this description might be affiliate/referral links. If you purchase a product or service with the links that I provide I may receive a small commission. There is no additional charge to you! Thank you for your support!

Advantages and disadvantage of debt review

helpful tips about debt review

tandem debt solutions

helping you make an informed decision

In this episode, we are talking about debt review. What debt Review really means and the right tools you need before you can sign up for it or if you know someone who might need it.

To check the registration of a Debt Counselor please click here:

https://ncr.org.za/register_of_registrants/registered_dc.php

The Credit Counselling Society is an accredited non-profit charity that helps Canadians with their money. We opened our doors in 1996 and have served over 700,000 Canadians through credit counselling and education.

Our mission is We Help, We Educate, We Give Hope. We do this by providing free credit counselling, low cost debt solutions, and education to Canadians.

We help any consumer who calls us. We can answer general questions about your credit, debt and budget. We can meet with you to discuss your specific situation and offer you information, unbiased advice, and resources to help you. No financial problem is too big or too small to get a fresh perspective on. And the best part is that it’s free and confidential.

https://www.nomoredebts.org/canada/manitoba/winnipeg/credit-counsellingutm_source=GMB&utm_medium=Organic&utm_campaign=winnipeg

1-888-527-8999 or 204-942-8789

A chat between industry experts as they discuss what distinguishes one Debt Counsellor from another and what it is that makes a “good” Debt Counsellor? The discussion also covers the way forward for the industry given Covid-19.

Each year at the Annual Debt Review Awards over 50 different Debt Counsellors are recognised for their efforts in the debt review industry. For more information head over to: www.debtreviewawards.co.za

The numbers are in for the month of September.

My Etsy Shop:

https://www.etsy.com/shop/TheUrbanScavenger?ref=search_shop_redirect

My Ebay Shop:

https://www.ebay.com/sch/hannah_jeanie/m.html?_nkw=&_armrs=1&_ipg=&_from=

13 Benefits of Debt Counselling or Debt Review.

1. All of your debt repayments will be consolidated into one reduced monthly repayment plan.

The great thing about debt counselling is that instead of paying numerous accounts, which you can easily lose track of, The National Debt Review Center will work out an amount that covers all of your repayments.

This includes all your legal fees and debt review costs, with lower interest rates.

2. Your assets, including your home and car, will be protected from repossession.

If you’re fearing that your home and car will be repossessed because you’re in too deep, you’re not alone. Debt counselling will protect your assets from being repossessed as a result of defaulting on repayments.

3. You will no longer get calls from your creditors demanding payment.

Once placed under debt review, you will no longer be at risk of getting deeper into debt.

The National Credit Regulator will flag your credit profile, barring you from taking out more credit. This flag will be removed from your credit profile once you have settled all your debt.

4. You do not pay any money upfront.

Alarm bells should go off if the Debt Counsellor makes such a request. Asking for money upfront is not part of the Debt Review process and indicates that the Debt Review company is untrustworthy.

All Debt Review fees are strictly prescribed by the Nation Credit Regulator (NCR) and are pretty much the same for all South African Debt Counsellors.

There are no up-front fees because the fee structure is created in such a way that all the fees form part of your reduced monthly repayment plan. Each client’s fee will differ because it is worked out as a percentage of the monthly debt you owe.

5. There is no permanent record of having undergone debt counselling.

6. There is only one monthly repayment to be made.

7. Your budget will meet your basic needs first before provision is made for debts.

8. You will never pay more money than you can reasonably afford.

9. A debt counsellor will suggest ways of cutting costs and saving money.

10. Gives you Peace of Mind that your debt is being paid.

11. Help You Live Comfortably with all living expenses covered.

12. Help You Reach Your Goal of settling the debt.

13. Helps you Change your financial spending behaviour.

In light of this, always be sure to contact The National Debt Review Center here or at info@ndrc.org.za as soon as you begin to struggle with your payments, so that all of your instalments can be reduced immediately.

Contact us here – https://ndrc.org.za/contact

Article – https://ndrc.org.za/what-are-the-benefits-of-debt-review

For more news, visit sabcnews.com and also #SABCNews #Coronavirus #COVID19News on Social Media.

The numbers are in for the month of August.

My Etsy Shop:

https://www.etsy.com/shop/TheUrbanScavenger?ref=search_shop_redirect

My Ebay Shop:

https://www.ebay.com/sch/hannah_jeanie/m.html?_nkw=&_armrs=1&_ipg=&_from=