Debt

If you will live like no one else, later you can live like no one else.

Build up your money muscles with America’s favorite finance coach.

Okay, folks, do you want to turn those fat and flabby expenses into a well-toned budget? Do you want to transform your sad and skinny little bank account into a bulked-up cash machine? Then get with the program, people. There’s one sure way to whip your finances into shape, and that’s with The Total Money Makeover: Classic Edition.

By now, you’ve heard all the nutty get-rich-quick schemes, the fiscal diet fads that leave you with a lot of kooky ideas but not a penny in your pocket. Hey, if you’re tired of the lies and sick of the false promises, take a look at this—it’s the simplest, most straightforward game plan for completely making over your money habits. And it’s based on results, not pie-in-the-sky fantasies. With The Total Money Makeover: Classic Edition, you’ll be able to:

Design a sure-fire plan for paying off all debt—meaning cars, houses, everything Recognize the 10 most dangerous money myths (these will kill you) Secure a big, fat nest egg for emergencies and retirement!The success stories speak for themselves in this book from money maestro Dave Ramsey. Instead of promising the normal dose of quick fixes, Ramsey offers a bold, no-nonsense approach to money matters, providing not only the how-to but also a grounded and uplifting hope for getting out of debt and achieving total financial health.

Ramsey debunks the many myths of money (exposing the dangers of cash advance, rent-to-own, debt consolidation) and attacks the illusions and downright deceptions of the American dream, which encourages nothing but overspending and massive amounts of debt. “Don’t even consider keeping up with the Joneses,” Ramsey declares in his typically candid style. “They’re broke!”

The Total Money Makeover isn’t theory. It works every single time. It works because it is simple. It works because it gets to the heart of the money problems: you.

Product Features

- a guide to getting out of debt

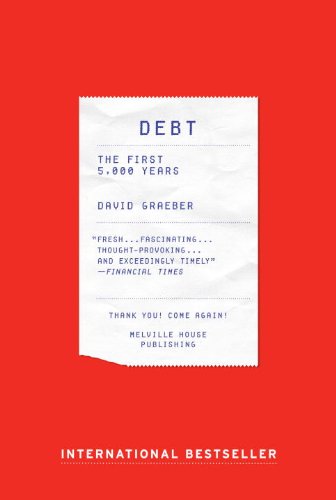

Now in paperback: David Graeber’s “fresh .?.?. fascinating .?.?. thought-provoking .?.?. and exceedingly timely” (Financial Times) history of debt

Here anthropologist David Graeber presents a stunning reversal of conventional wisdom: he shows that before there was money, there was debt. For more than 5,000 years, since the beginnings of the first agrarian empires, humans have used elaborate credit systems to buy and sell goods—that is, long before the invention of coins or cash. It is in this era, Graeber argues, that we also first encounter a society divided into debtors and creditors.

Graeber shows that arguments about debt and debt forgiveness have been at the center of political debates from Italy to China, as well as sparking innumerable insurrections. He also brilliantly demonstrates that the language of the ancient works of law and religion (words like “guilt,” “sin,” and “redemption”) derive in large part from ancient debates about debt, and shape even our most basic ideas of right and wrong. We are still fighting these battles today without knowing it.

Buffett became a billionaire on paper when Berkshire Hathaway began selling class A shares on May 29, 1990, when the market closed at $7175 a share. In 1998…

Sarah Palin talks to CNN’s Jake Tapper about comparing the national debt to slavery, saying the term “fits the bill.”

On this episode of Breaking the Set, Abby Martin remarks on news that Wal-Mart workers will be expected to work on Thanksgiving, and calls attention to the a…

Do you want to make easy money online? I have been making money doing nothing consistently for over 1 year. Contact me to find out more or go here; http://ww…

For more, visit: http://HiddenSecretsOfMoney.com You are about to learn one of the biggest secrets in the history of the world… it’s a secret that has huge…

Welcome to WordPress. This is your first post. Edit or delete it, then start blogging!

![[275] Mass Wal-Mart Arrests, Obama’s ‘Killing Machine’, Occupying the Debt [275] Mass Wal-Mart Arrests, Obama’s ‘Killing Machine’, Occupying the Debt](http://img.youtube.com/vi/in7xOSZldK0/0.jpg)